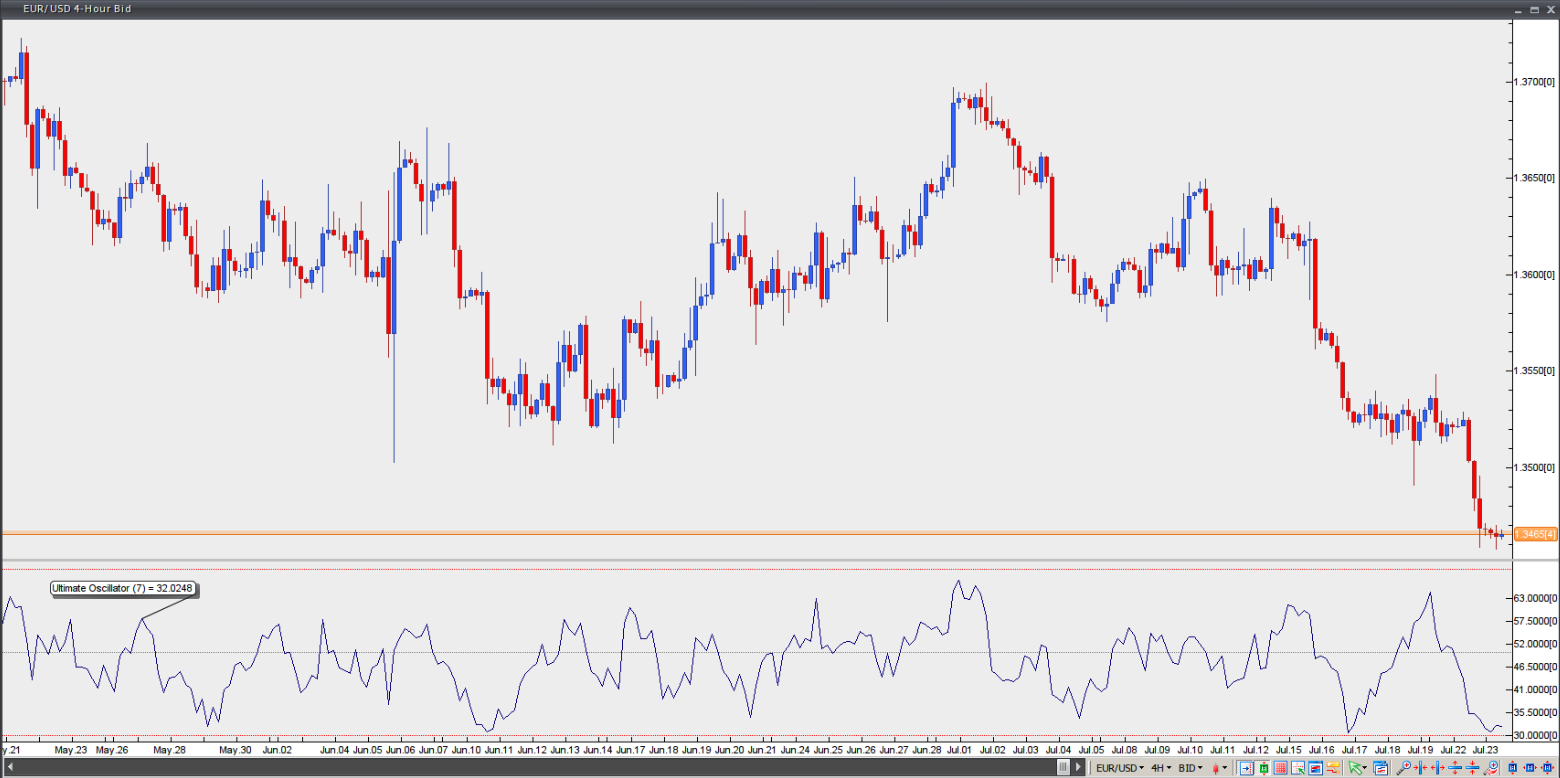

Ultimate Oscillator

This lesson will cover the following

- Explanation and calculation

- How to interpret this indicator

- Trading signals generated by the indicator

Developed by Larry Williams in 1976 and introduced in Stocks & Commodities Magazine in 1985, the Ultimate Oscillator attempts to capture momentum across three different time periods, aiming to avoid the drawbacks of other oscillators. Many momentum-based oscillators rise at the start of a strong upward move and then generate bearish divergence as the price advance continues, because they track only a single time frame.

The time frames used for the Ultimate Oscillator are as follows: short-term (7 periods), medium-term (14 periods) and long-term (28 periods). These time frames overlap, with the long-term frame encompassing both the medium-term and short-term frames.

The Ultimate Oscillator (UO) is calculated using the following steps:

First, calculate Buying Pressure to identify the direction of price action;

Second, measure Buying Pressure relative to the True Range to determine the magnitude of profit or loss;

Third, calculate averages using the three time frames mentioned above;

Fourth, calculate a weighted average based on those three averages (this is the oscillator itself).

The calculations are as follows:

1. Buying Pressure = Close – Minimum (Low Price or Previous Close),

2. True Range = Maximum (High Price or Previous Close) – Minimum (Low Price or Previous Close),

3. Average (7-period) = (7-period Buying Pressure Sum) / (7-period True Range Sum)

Average (14-period) = (14-period Buying Pressure Sum) / (14-period True Range Sum)

Average (28-period) = (28-period Buying Pressure Sum) / (28-period True Range Sum)

4. UO = 100 x [(4 x Average7) + (2 x Average14) + Average28] / (4+2+1)

Buying Pressure and its relation to the True Range are the core of the UO. According to Williams, the best way to estimate Buying Pressure is simply to subtract the lower of the Low Price and the Previous Closing Price from the Closing Price. The UO usually surges when Buying Pressure is strong and declines when Buying Pressure is weak.

According to the criteria defined by Larry Williams, a buy signal is generated when:

1. A bullish divergence is created between prices and the Ultimate Oscillator. This occurs when the market forms lower lows, while the oscillator forms higher lows.

2. During the divergence the UO has dropped below 30, ensuring that prices are oversold.

3. The UO has risen above the high formed during the bullish divergence.

A long position should be closed when the oscillator rises above 70, or climbs above 50 and then falls back below 45.

A sell signal is generated when:

1. A bearish divergence is created between prices and the Ultimate Oscillator. This occurs when the market forms higher highs, while the indicator forms lower highs.

2. During the divergence the UO has climbed above 70, ensuring that prices are overbought.

3. The UO has dropped below the low formed during the bearish divergence.

A short position should be closed when the oscillator falls below 30, or surges again above 55 after falling below 50.

Chart Source: VT Trader