Polarized Fractal Efficiency

This lesson will cover the following

- Explanation and calculation

- How to interpret this indicator

- Trading signals generated by the indicator

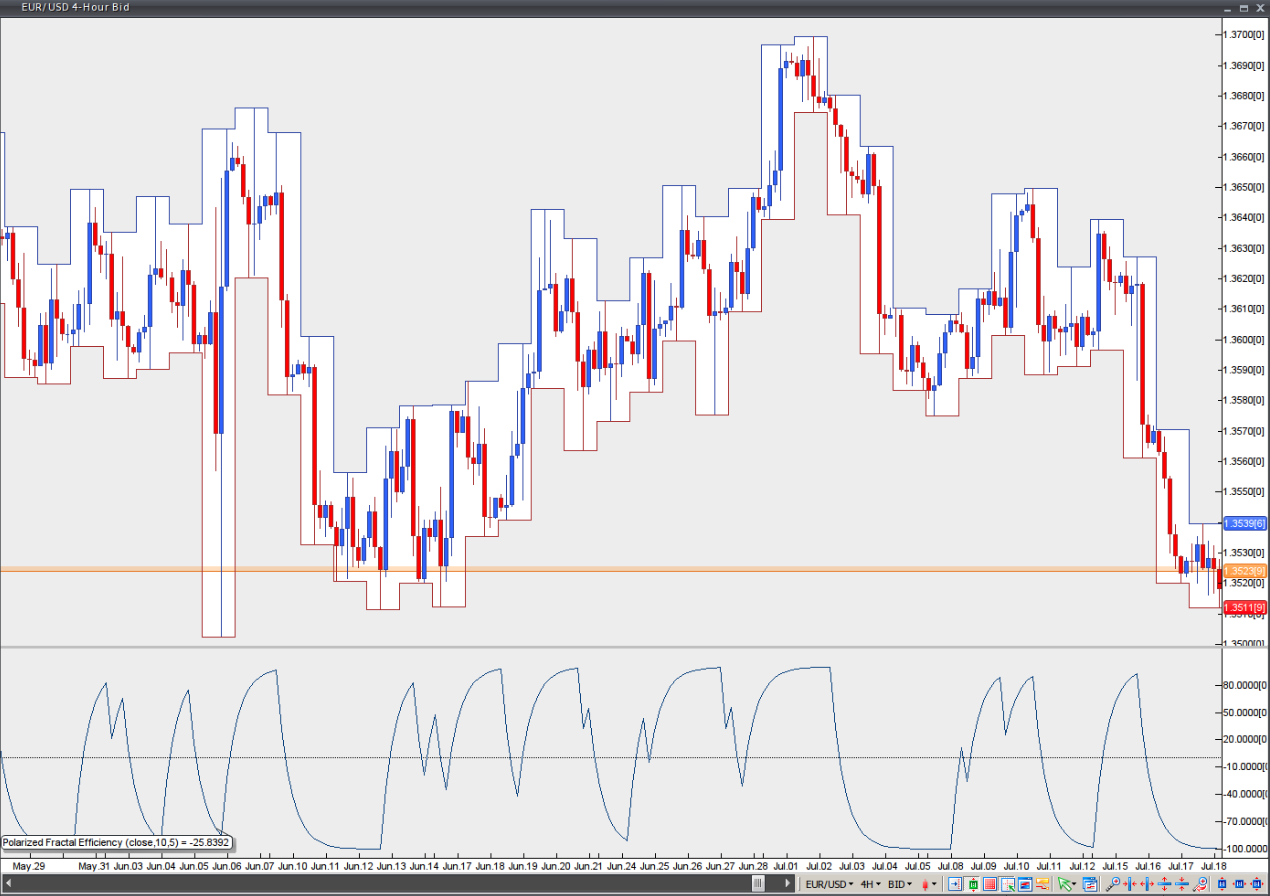

Developed by Hans Hannula, the Polarized Fractal Efficiency (PFE) indicator was described in the January 1994 issue of Technical Analysis of Stocks & Commodities magazine. The PFE generally indicates how trending or overextended a market is. If the PFE reading is below zero, this suggests a bear trend, while a reading above zero suggests a bull trend. The higher the value, the more efficient – or ‘trendier’ – the movement to the upside. A reading close to zero indicates that price action is choppy and less efficient.

Traders usually enter at maximum efficiency – that is, when the PFE appears to have reached an extreme in either direction – and keep their positions open until the indicator reaches the opposite extreme. An exception arises when the PFE slows near the zero line; in that case, the trader should exit the trade and wait for a new entry at the next ‘maximum efficiency’ level.

Chart Source: VT Trader