R-squared method

This lesson will cover the following

- Explanation and calculation

- How to interpret this indicator

- Trading signals generated by the indicator

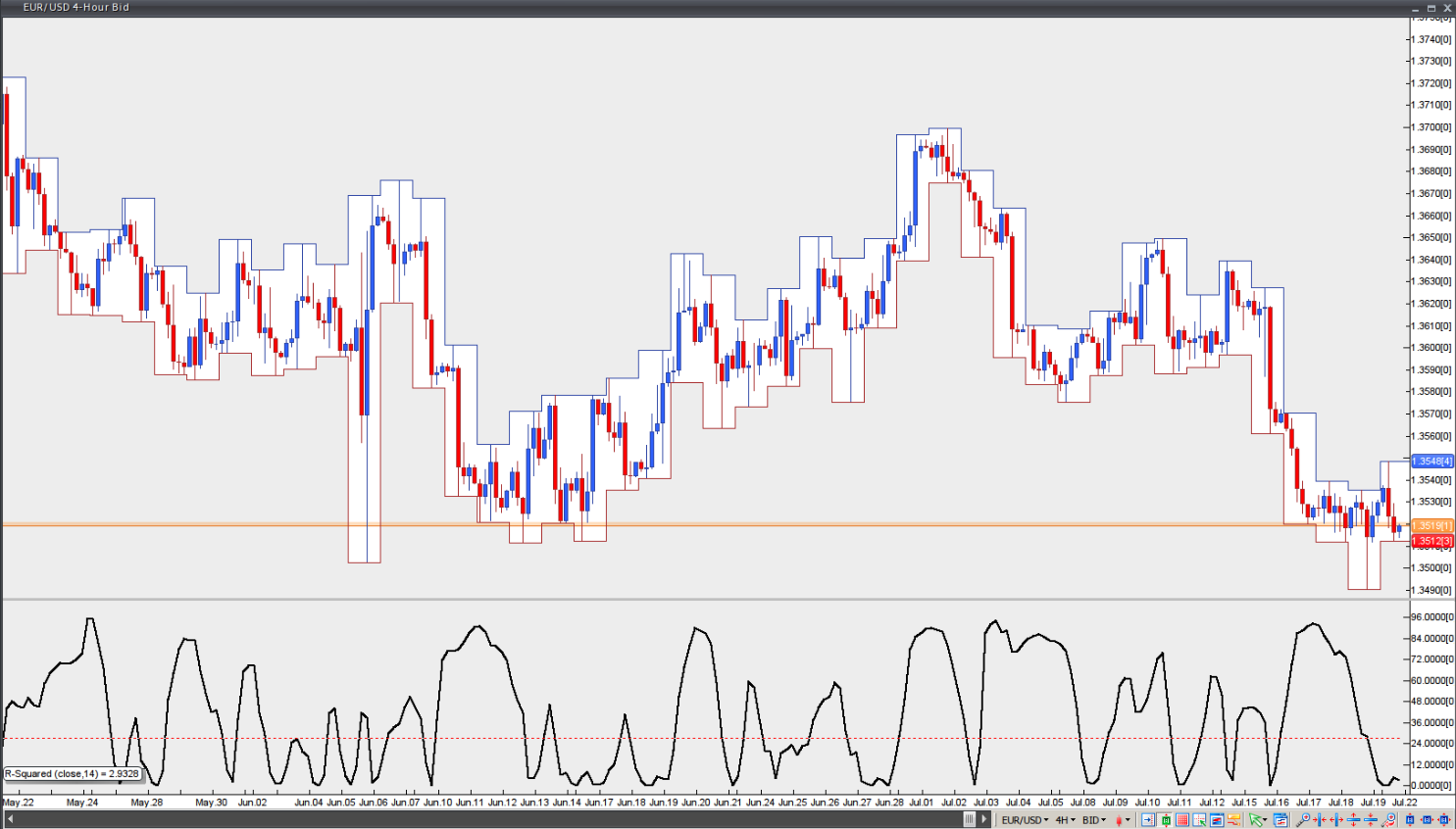

This is a linear regression method that attempts to determine the strength of trends. If prices move more closely in a straight line over a certain period, this suggests that the trend is stronger. R-squared readings reflect the percentage of price movement explained by linear regression. If the R-squared reading over 14 periods is 60%, it indicates that 60% of the price movement can be explained by linear regression. The remaining 40% is considered random noise.

A trend is statistically significant for a linear regression line of a given period if we have a 95% confidence level. If the R-squared reading is below the 95% confidence level for a particular period, there is no statistically significant trend.

The recommended number of R-squared periods and the corresponding 95% confidence levels are shown below.

Number of periods / R-squared critical value at 95% confidence:

5 / 77

10 / 40

14 / 27

20 / 20

25 / 16

30 / 13

50 / 8

60 / 6

120 / 3

Linear regression and R-squared can be used in several ways to generate trading signals. One approach combines R-squared with the linear regression slope. R-squared determines how strong the underlying trend is, while the linear regression slope indicates the direction of the trend – whether it is positive or negative. Signals are generated in line with the direction of the linear regression slope, while R-squared should remain above its 95% confidence level.

Another approach combines R-squared with an oscillator. In this case, signals are generated according to the oscillator’s readings between the overbought and oversold levels, while R-squared should remain low (significantly below the 95% confidence level, which suggests that market behaviour is ‘less trendy’).

Chart source: VT Trader