Ehlers MESA adaptive moving average

This lesson will cover the following

- Definition

- Interpretation

Developed by John Ehlers, the MESA adaptive moving average is a technical trend-following indicator which, according to its creator, adapts to price movement ‘based on the rate change of phase as measured by the Hilbert Transform Discriminator’. This method of adaptation features a fast and a slow-moving average, so that the composite moving average swiftly responds to price changes and holds the average value until the next bar’s close. Ehlers states that because the averages’ fallback is slow, you can create trading systems with almost whipsaw-free trades.

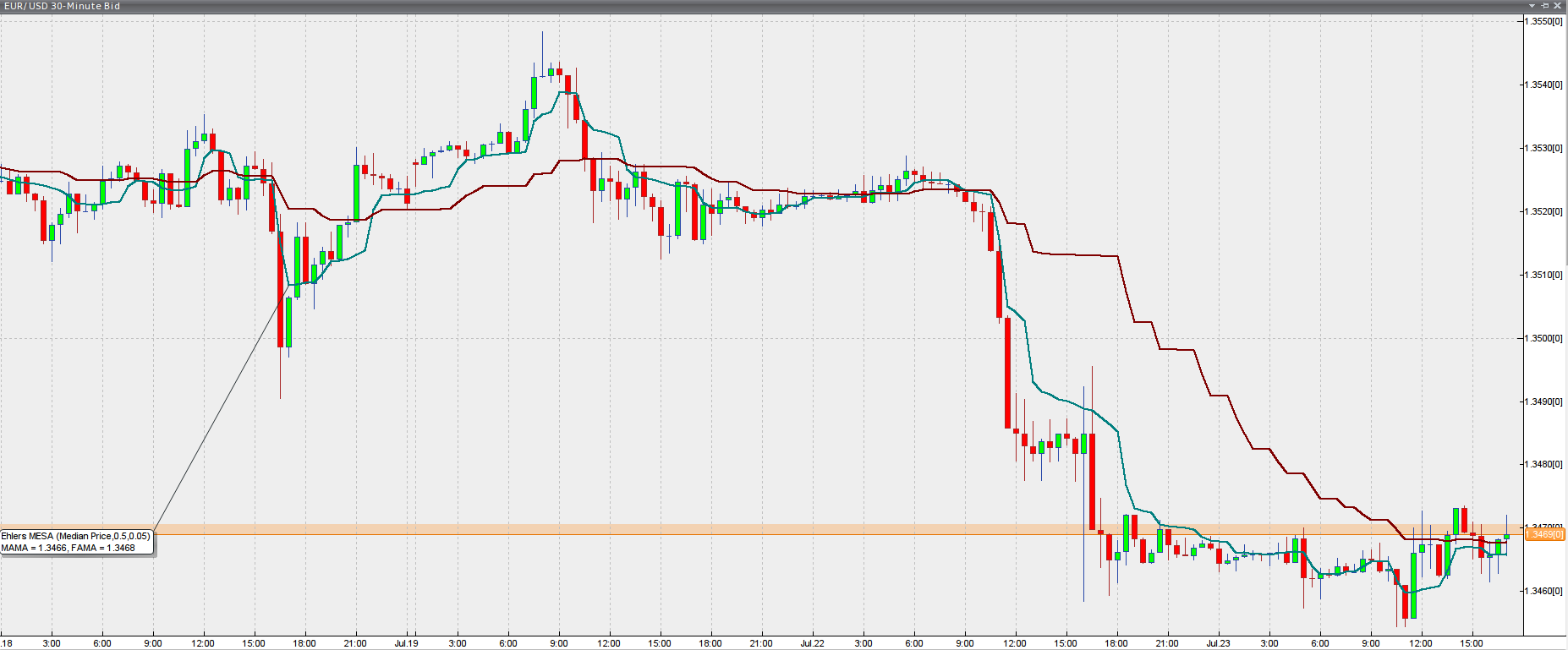

Below you can see the indicator plotted on a trading platform.

Chart source: VT Trader

Basically the indicator looks like two moving averages, but instead of curving around the price action, the MESA adaptive MA moves in a staircase manner as the price ratchets. It produces two outputs: MAMA and FAMA. FAMA (following adaptive moving average) is the result of MAMA being applied to the first MAMA line. The FAMA is synchronised in time with MAMA, but its vertical movement comes with a lag. Thus, the two don’t cross unless a major change in market direction occurs, resulting in a moving average crossover system which is ‘virtually free of whipsaw trades’, according to Ehlers.

- Trade Forex

- Trade Crypto

- Trade Stocks

- Regulation: NFA

- Leverage: Day Margin

- Min Deposit: $100

The MESA adaptive moving average is used as a replacement for traditional moving averages. As such, the MAMA and FAMA can be traded just like ordinary moving averages.

First, they act as strong support and resistance areas, and the price will tend to rebound from them upon contact. This makes pullbacks to the MAMA and FAMA suitable with-trend entry areas.

Second, crossovers between the MAMA and FAMA, resembling a golden or death cross, are also widely traded. When the MAMA crosses the FAMA from below and edges higher, it indicates that the market will likely continue to move up, generating a buy signal. Conversely, when the MAMA crosses the FAMA from above and edges lower, it implies that the market is edging lower and will most likely continue to do so, thus generating a short entry signal.

The MESA adaptive moving average, just like traditional moving averages, can be used as a stand-alone indicator, but also in conjunction with other indicators, which are typically combined with SMAs and EMAs in order to improve your decision-making.