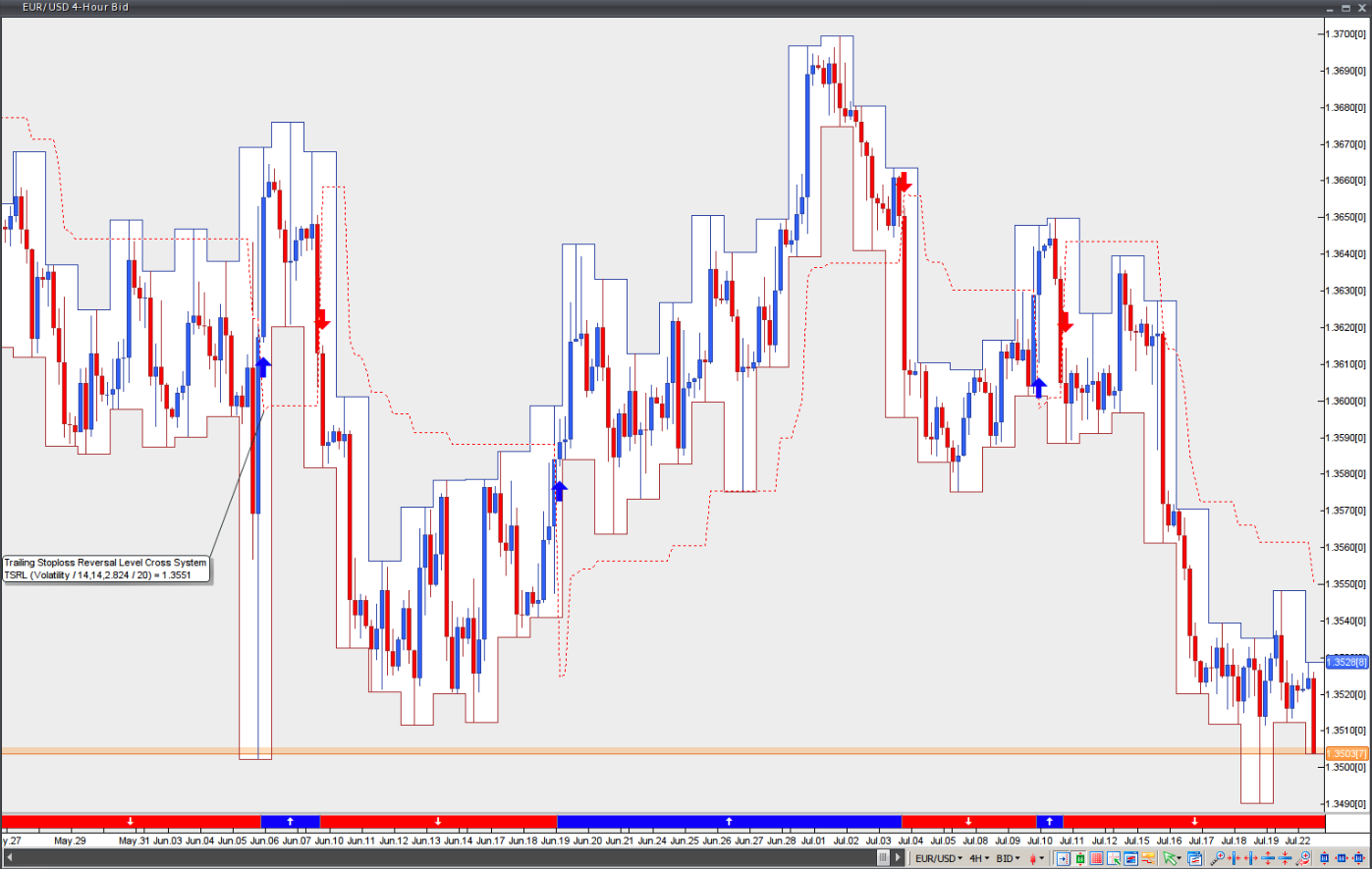

Trailing stop-loss reversal level

This lesson will cover the following

- Explanation and calculation

- How to interpret this indicator

- Trading signals generated by the indicator

This indicator trails below or above the price, depending on its position relative to the price. A trader may set the indicator to follow the price based on volatility or on a predefined number of pips.

Trailing stop-loss levels have recently become a popular way to exit trades without emotional involvement. Therefore, the indicator is helpful for controlling risk.

When a long trade is active, the trailing stop-loss level indicator sits below the price and ratchets higher as the price rises. When a short trade is active, the trailing stop-loss level indicator sits above the price and ratchets lower as the price falls.

If the price returns to the trailing stop-loss level, the latter will remain at its previous level and will never move away from the price. In this way, potential gains are preserved while losses are limited.

A long position should be closed when the price moves back below the trailing stop-loss level. A short position should be closed when the price moves back above the trailing stop-loss level.

Chart source: VT Trader