Hull Moving Average

This lesson will cover the following

- Explanation and calculation

- How to interpret this indicator

- Trading signals, generated by the indicator

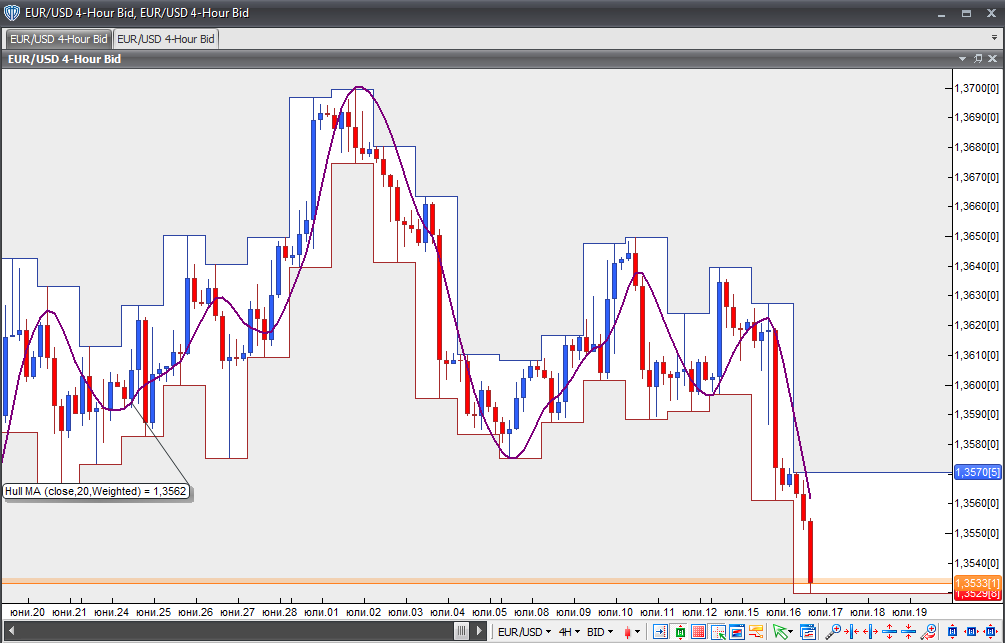

Developed by Alan Hull, the indicator addresses the problem of making a moving average more reactive to current price action. The Hull Moving Average almost eliminates lag while improving smoothing.

The HMA is able to keep up with rapid changes in price action, providing better smoothing than a Simple Moving Average of the same period. The HMA employs Weighted Moving Averages (WMA) and attenuates the smoothing effect. It can be calculated as follows:

HMA(n) = WMA(2*WMA(n/2) – WMA(n), sqrt(n))

First, take the WMA of the last n/2 data points and multiply it by 2. Then subtract the WMA of the last n data points from this value. Next, apply a WMA to the result using a period equal to the square root of n. As the square root truncates values, choose an n that is a perfect square, such as 4, 9, 16, etc.

- Trade Forex

- Trade Crypto

- Trade Stocks

- Regulation: NFA

- Leverage: Day Margin

- Min Deposit: $100

This indicator can be used in all the ways traditional moving averages are employed, with the exception of crossover signals, because the latter depend on lag.

Chart Source: VT Trader