Double stochastic oscillator

This lesson will cover the following

- Explanation and calculation

- How to interpret this indicator

- Trading signals generated by the indicator

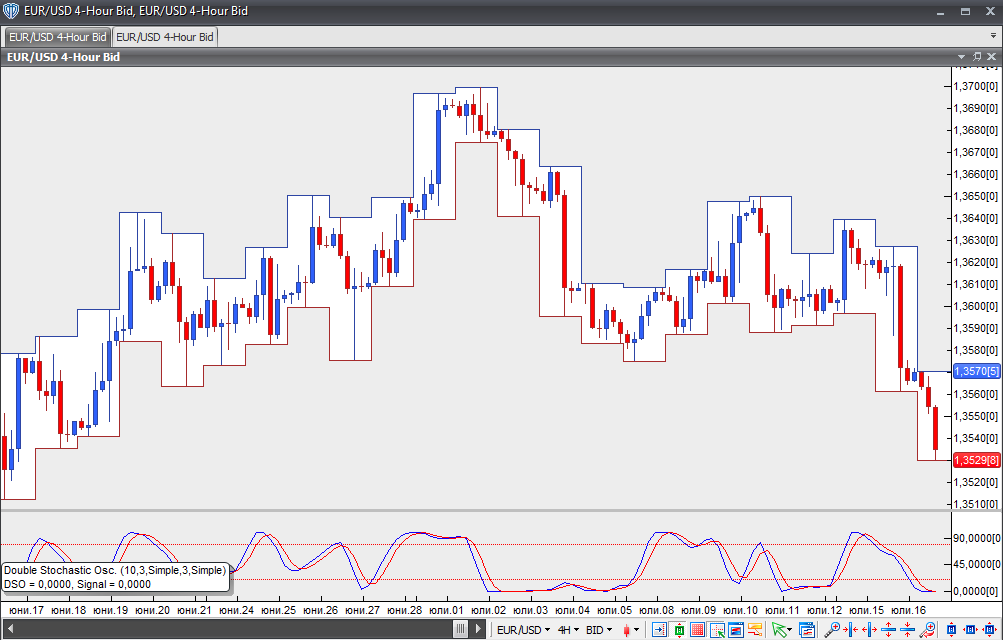

The Double Stochastic Oscillator is a variation of the stochastic oscillators developed by George Lane. Like the original stochastic oscillators, it is a momentum-based indicator, reflecting the current closing price in relation to the high-low range over a specified period. It oscillates between 0 and 100. The indicator assumes that, during an uptrend, the price will close near the top of the range and, during a downtrend, it will close near the bottom of the range.

The Double Stochastic Oscillator is composed of two lines – %K, the main (fast) line, and %D, the signal (slow) line.

Fast %K = ((Today’s Close – Lowest Low in %K Periods) / (Highest High in %K Periods – Lowest Low in %K Periods)) x 100

Slowing %K = n-period moving average of Fast %K

Double %K = ((Today’s Slowing %K – Lowest Low Slowing %K in %K Periods) / (Highest High Slowing %K in %K Periods – Lowest Low Slowing %K in %K Periods)) x 100

- Trade Forex

- Trade Crypto

- Trade Stocks

- Regulation: NFA

- Leverage: Day Margin

- Min Deposit: $100

Double Slowing %K = n-period moving average of Double %K

%D = 3-period simple moving average of Double Slowing %K

The Double Stochastic can generate several types of trading signals:

First, crossovers between the %K and %D lines. A trader may buy when the %K line crosses above the %D line and sell when it crosses below.

Second, traders may use another type of crossover. One can go long when the %K line crosses above the 50 level and go short when the %D line crosses below the 50 level.

Third, traders look for divergences between price and the Double Stochastic to identify potential trend-reversal or trend-continuation set-ups. There are two types of divergence – regular and hidden. Regular divergence signals trend reversals, while hidden divergence signals trend continuation.

A regular bullish divergence occurs when the market forms lower lows while the indicator forms higher lows.

A regular bearish divergence occurs when the market forms higher highs while the indicator forms lower highs.

A hidden bullish divergence occurs when the market forms higher lows while the indicator forms lower lows.

A hidden bearish divergence occurs when the market forms lower highs while the indicator forms higher highs.

Fourth, traders can take advantage of overbought and oversold conditions. The market is considered overbought when the Double Stochastic is at or above the 80 level and oversold when it is at or below the 20 level. A buy signal is generated when the oscillator falls below 20 and then moves back above it, while a sell signal is generated when the oscillator rises above 80 and then moves back below it.

Chart source: VT Trader