Elder-Ray bear and bull power indicators

This lesson will cover the following

- Explanation and calculation

- How to interpret the indicator

- Trading signals generated by the indicator

Developed by Dr Alexander Elder in 1989 and introduced in his book ‘Trading for a Living’, the Elder-Ray indicator comprises three elements – Bear Power, Bull Power and a 13-period exponential moving average.

As the high price of any candle shows the maximum power of buyers, and the low price shows the maximum power of sellers, Elder uses the 13-period EMA to present the average consensus of value. Bull Power shows whether buyers are capable of pushing prices above this average consensus, while Bear Power shows whether sellers can push prices below it. Bull Power is calculated by subtracting the 13-period EMA from the day’s high price. Bear Power is calculated by subtracting the 13-period EMA from the day’s low price.

According to Alexander Elder, Bull Power should normally remain positive, while Bear Power should normally remain negative. If the Bull Power indicator moves into negative territory, this implies that sellers have overcome buyers and control the market. If the Bear Power indicator moves into positive territory, this indicates that buyers have overcome sellers and control the market. A trader should not go long when the Bear Power indicator is positive, nor should they go short when the Bull Power indicator is negative.

- Trade Forex

- Trade Crypto

- Trade Stocks

- Regulation: NFA

- Leverage: Day Margin

- Min Deposit: $100

The slope of the 13-period EMA can be used to identify the direction of the major trend. According to Elder, the most reliable buy signals are generated when there is a bullish divergence between the Bear Power indicator and the price (Bear Power forms higher lows, while the market forms lower lows). The most reliable sell signals are generated when there is a bearish divergence between the Bull Power indicator and the price (Bull Power forms lower highs, while the market forms higher highs).

There are four basic conditions required to go long or short using the Elder-Ray method alone. Alexander Elder recommends using this method in combination with the Triple Screen method.

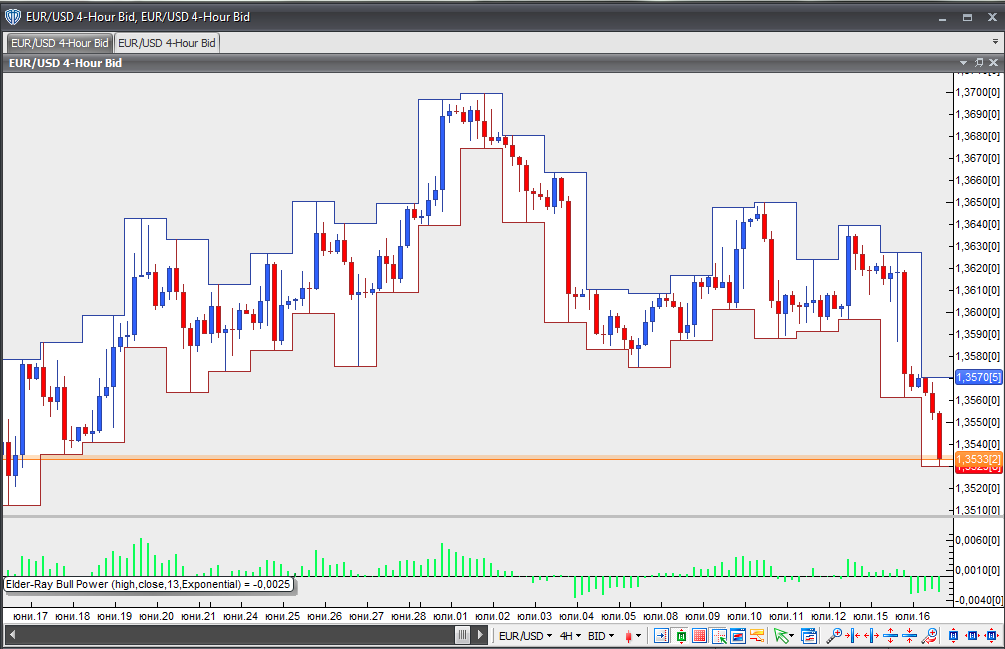

In order to go long:

1. The market is in a bullish trend, as indicated by the 13-period EMA

2. Bear Power is in negative territory but increasing

3. The most recent Bull Power top is higher than its previous top

4. Bear Power is rising from a bullish divergence

The last two conditions are optional.

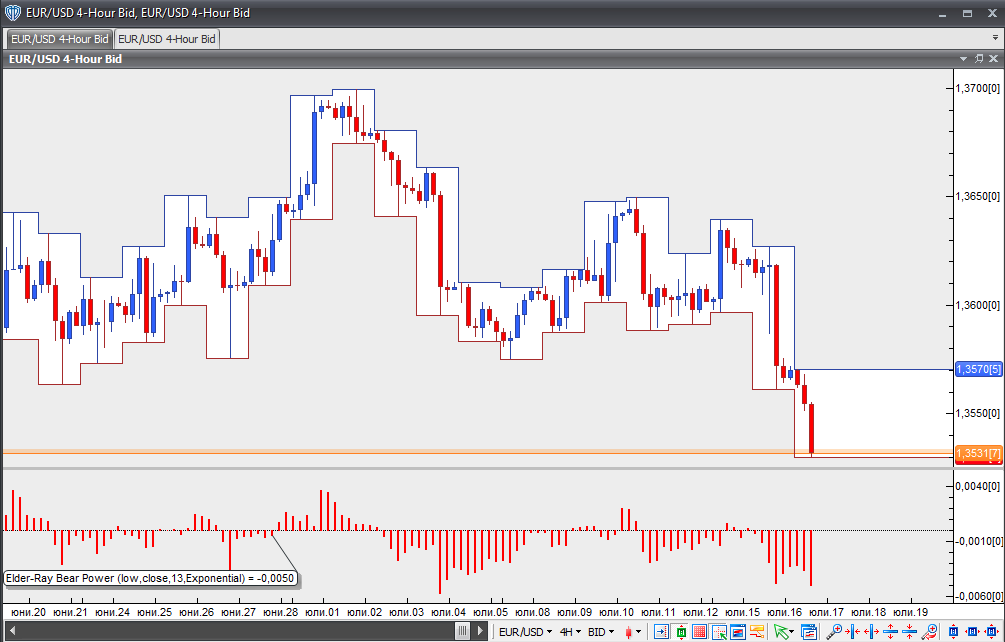

In order to go short:

1. The market is in a bearish trend, as indicated by the 13-period EMA

2. Bull Power is in positive territory but falling

3. The most recent Bear Power bottom is lower than its previous bottom

4. Bull Power is falling from a bearish divergence

The last two conditions are optional.

If a trader wishes to add to their position, they need to:

1. add to their long position when Bear Power falls below zero and then climbs back into positive territory

2. add to their short position when Bull Power rises above zero and then drops back into negative territory.

Chart Source: VT Trader

According to Elder’s Triple Screen method, the market trend should be identified on a higher time-frame chart (1-week, for example), while the Elder-Ray indicators should be applied on a lower time-frame chart (1-day). Signals should be taken according to the Elder-Ray, but only in the direction of the trend identified on the higher time-frame chart.