Inertia Indicator

This lesson will cover the following

- Definition

- Interpretation

Developed by Donald Dorsey, the Inertia Indicator is an extension of Dorseys Relative Volatility Index and is used to define the long-term trend and how far it has extended. Its name refers to the physics term and its reference to direction and mass of motion.

Dorsey states that a trend is simply the “outward result of inertia” and as such, the market will require much more energy to reverse its direction than to extend the ongoing move.

Determining the direction of motion is easily achievable using technical analysis. However, defining mass is more complicated and Dorsey argued that volatility is the most simple and accurate gauge of inertia. For these purposes he used the aforementioned Relative Volatility Index and smoothed it via a linear-regression indicator.

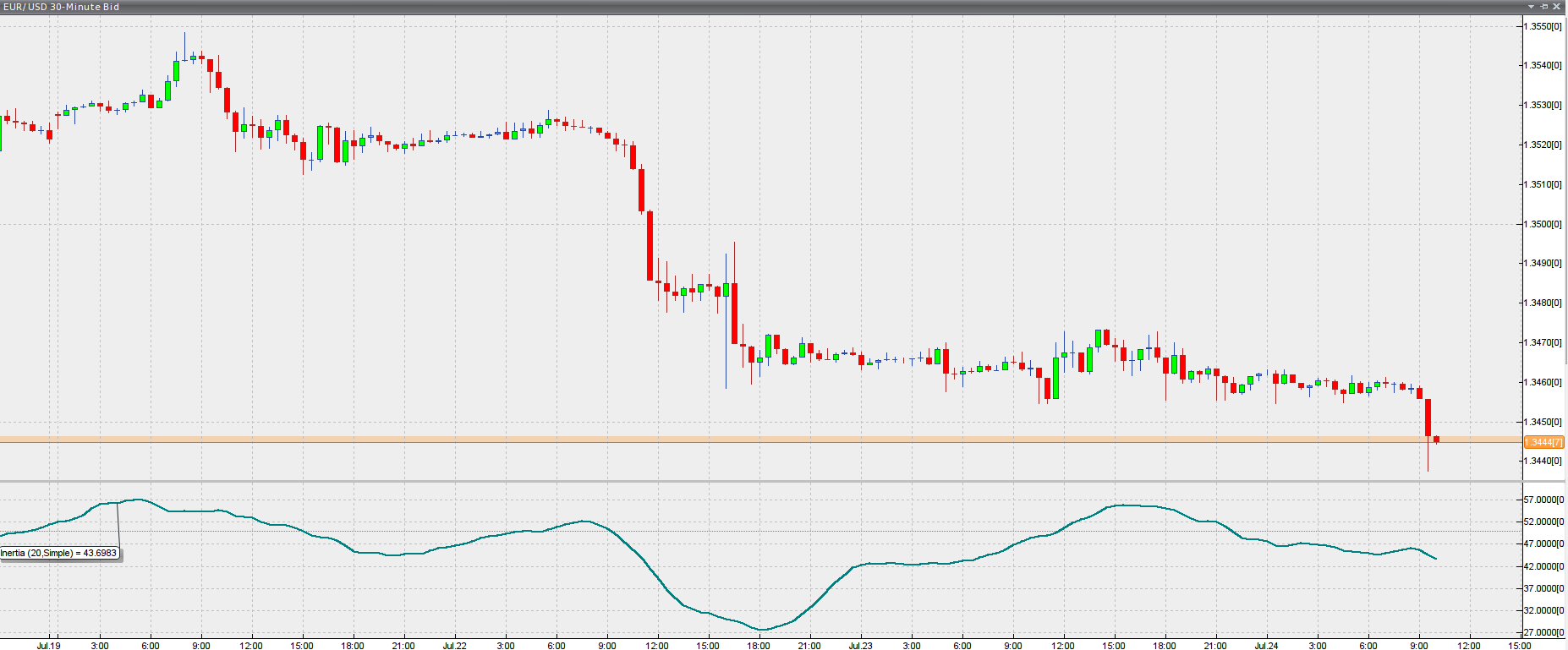

The Inertia indicator is plotted on a scale of 0 to 100 and its middle level of 50 acts as a threshold separating uptrends from downtrends. Thus, crossings beneath or above the line suggests a trend reversal is most likely in process, which generates entry signals or exits out of current with-trend positions. Here is what the indicator looks like in a trading platform.

Chart source: VT Trader

For example, if Inertia is below the middle level but edges higher past 50, a buy signal will be generated as soon as the upward cross is confirmed by a bar closing above it. When the uptrend later ends and Inertia drops back below 50, the trader should close his long position. The opposite is in force for a bear trend. The Inertia indicator however shouldnt be used solely as a base for decision-making, rather be combined with other indicators, for example the Parabolic SAR, to achieve a more elaborate trading strategy.