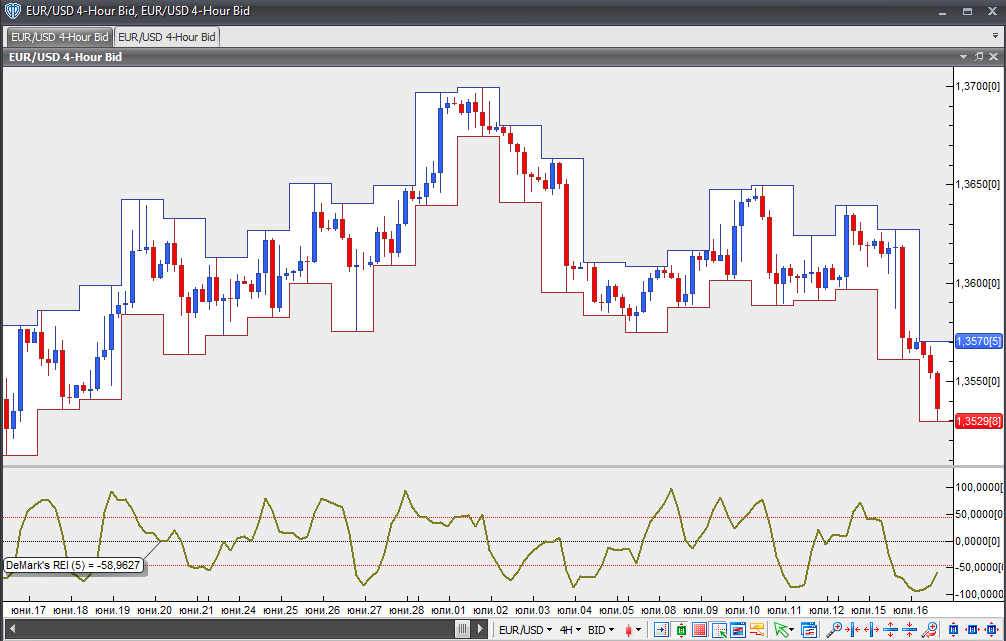

DeMark’s Range Expansion Index

This lesson will cover the following

- Explanation and calculation

- How to interpret this indicator

- Trading signals generated by the indicator

Developed and introduced by Thomas DeMark in the book ‘DeMark on Day Trading Options’, the Range Expansion Index (REI) is a market-timing oscillator designed to address the problems encountered by exponentially calculated oscillators, such as the Moving Average Convergence Divergence. The REI is calculated arithmetically.

The oscillator fluctuates between -100 and +100. Its default setting uses a period of 8. Traders who want fewer but more reliable signals may choose a longer period, while those seeking more frequent but less reliable signals may opt for a shorter period. Thomas DeMark recommends sticking to the default setting.

If the indicator value rises above +60 and then falls back below it, a sell signal is generated. If the indicator value drops below -60 and then climbs back above it, a buy signal is generated.

- Trade Forex

- Trade Crypto

- Trade Stocks

- Regulation: NFA

- Leverage: Day Margin

- Min Deposit: $100

Thomas DeMark advises against trading in extreme overbought or oversold conditions, indicated by six or more bars above or below the thresholds.

Chart source: VT Trader