Quantitative Qualitative Estimation

This lesson covers the following

- Explanation and calculation

- How to interpret this indicator

- Trading signals generated by the indicator

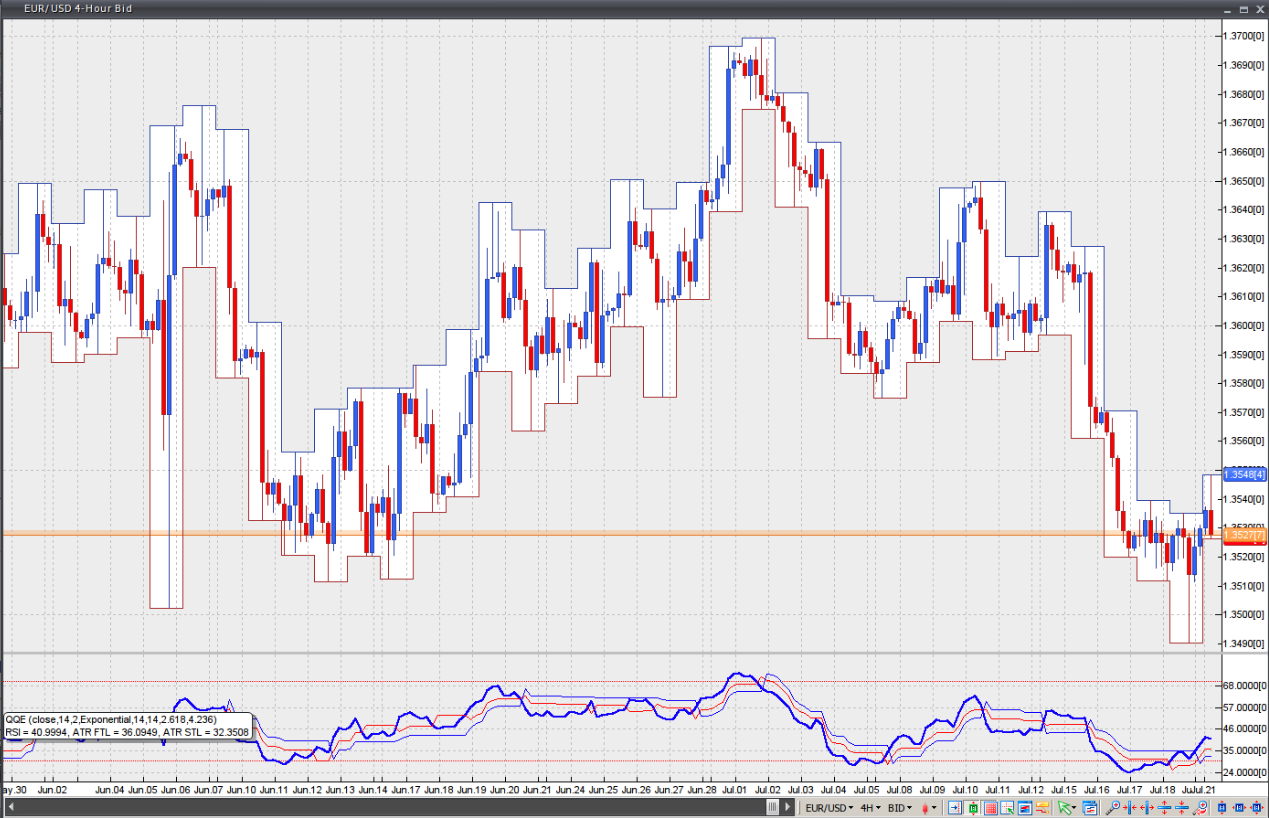

This indicator comprises a smoothed Relative Strength Index and two trailing levels, based on volatility – the Fast Trailing Level (Fast TL – the thin red line on the chart below) and the Slow Trailing Level (Slow TL – the thin blue line on the chart below). These levels are determined by calculating the Average True Range (ATR) of the smoothed RSI over a specified number of periods, after which the ATR is further smoothed using an additional n-period Wilder’s smoothing function. Ultimately, the RSI’s smoothed ATR is multiplied by the Fast and Slow ATR multipliers to determine the final Fast and Slow Trailing Levels.

There are several ways in which the QQE generates trading signals:

First, look for crossovers between the RSI and the Fast ATR TL or the Slow ATR TL. If the RSI crosses above either trailing level, a buy signal is generated. If it crosses below, a sell signal is generated.

Second, monitor the RSI’s 50 level. If the RSI moves above 50, a buy signal is generated; if it falls below 50, a sell signal is generated.

Third, consider crossovers between the Fast ATR TL and the Slow ATR TL. If the Fast ATR TL crosses above the Slow ATR TL, a buy signal is generated. If it crosses below, a sell signal is generated.

Fourth, search for divergences between price and the QQE to identify a potential trend reversal or trend continuation. There are two types of divergence: regular and hidden. Regular divergences signal trend reversals, while hidden divergences signal trend continuation.

A regular bullish divergence occurs when the market forms lower lows while the indicator forms higher lows.

A regular bearish divergence occurs when the market forms higher highs while the indicator forms lower highs.

A hidden bullish divergence occurs when the market forms higher lows while the indicator forms lower lows.

A hidden bearish divergence occurs when the market forms lower highs while the indicator forms higher highs.

Fifth, take advantage of overbought and oversold conditions. An overbought condition occurs when the QQE is at or above its 70 level, while an oversold condition occurs when it is at or below its 30 level. Signals are generated when any QQE component crosses these extremes. If the RSI, the Fast ATR TL or the Slow ATR TL crosses below 30 and then moves back above it, a buy signal is generated. If the RSI, the Fast ATR TL or the Slow ATR TL crosses above 70 and then moves back below it, a sell signal is generated.

Chart source: VT Trader