Further talk on pullbacks

This lesson will cover the following

- Additional discussion on pullbacks

- Types of pullbacks according to their extent

- Minor pullbacks

- Major pullbacks

- Three-legged pullbacks

Pullbacks can be classified by their extent, and they generally occur in sequence from the shallowest to the deepest as the trend progressively weakens. You can have a one-bar pullback, a pullback to a minor trend line, a pullback to the moving average, and a pullback to the major trend line. There can be more than one of each type, but they tend to occur according to the decisiveness of the market movement; i.e., in a very strong trend, especially in its early, unexhausted stage, it is not typical to see pullbacks to the major trend line, while one-bar pullbacks are common.

When a pullback occurs for the first time, it is the initial one for that type. Most initial pullbacks are small and part of the trend’s first leg, but each subsequent pullback generally becomes deeper. Subsequent pullbacks are typically followed by a test of the old extreme, which is most often exceeded. Moreover, once a smaller type of pullback occurs, it is usually followed by the larger varieties, because sentiment among counter-trend traders improves, while with-trend traders begin to lock in profits instead of scaling into their positions.

- Trade Forex

- Trade Crypto

- Trade Stocks

- Regulation: NFA

- Leverage: Day Margin

- Min Deposit: $100

After a trend has begun, the first pullback is most often a one- or two-bar pullback, which is commonly followed by a rally to a new high (or a plunge to a new low in a bear trend). The next pullback may also be a one- or two-bar pullback, but it is usually deeper. As the trend progresses, larger pullbacks develop and, at some point, the price will break a minor trend line and then accelerate back to a new trend extreme. You can see an example below.

As you can see in the screenshot above, the market entered a strong bearish trend after a climactic exhaustion of the previous bull trend. There was a small pullback to a minor trend line, after which the price broke the most recent swing low. A prolonged pullback then followed to the next minor trend line. As we know, pullbacks are not necessarily counter-trend moves; they can also be simple trading ranges. Upon reaching the minor trend line, the market fell to a session low.

Strong trends will inevitably pull back

It is possible for the price not to touch the moving average for more than 15 bars during a strong trend, but once it pulls back to the MA, it will commonly provide a good with-trend setup that will lead to a test of the trend’s extreme and may even penetrate it. Sometimes the price will not only break the moving average but also form a gap bar (a bar whose high is below the moving average in a bull trend, or whose low is above the moving average in a bear trend). Usually, such a pullback is followed by a rally to a new trend extreme.

At some point, the market will make a strong counter-trend move that will break the major trend line (in many cases it is the same move that formed an MA gap bar), which will then be followed by a test of the latest trend extreme. However, because this is the most significant type of pullback and indicates that counter-trend traders are becoming increasingly powerful, it is very likely that the test of the old extreme, even if successful, will be followed by a strong two-legged counter-trend move or even a reversal. Each pullback before this reversal should be considered a with-trend entry signal, because it is expected to test the previous extreme and even exceed it. This is exactly what happened at the end of the trend shown above. Take a look.

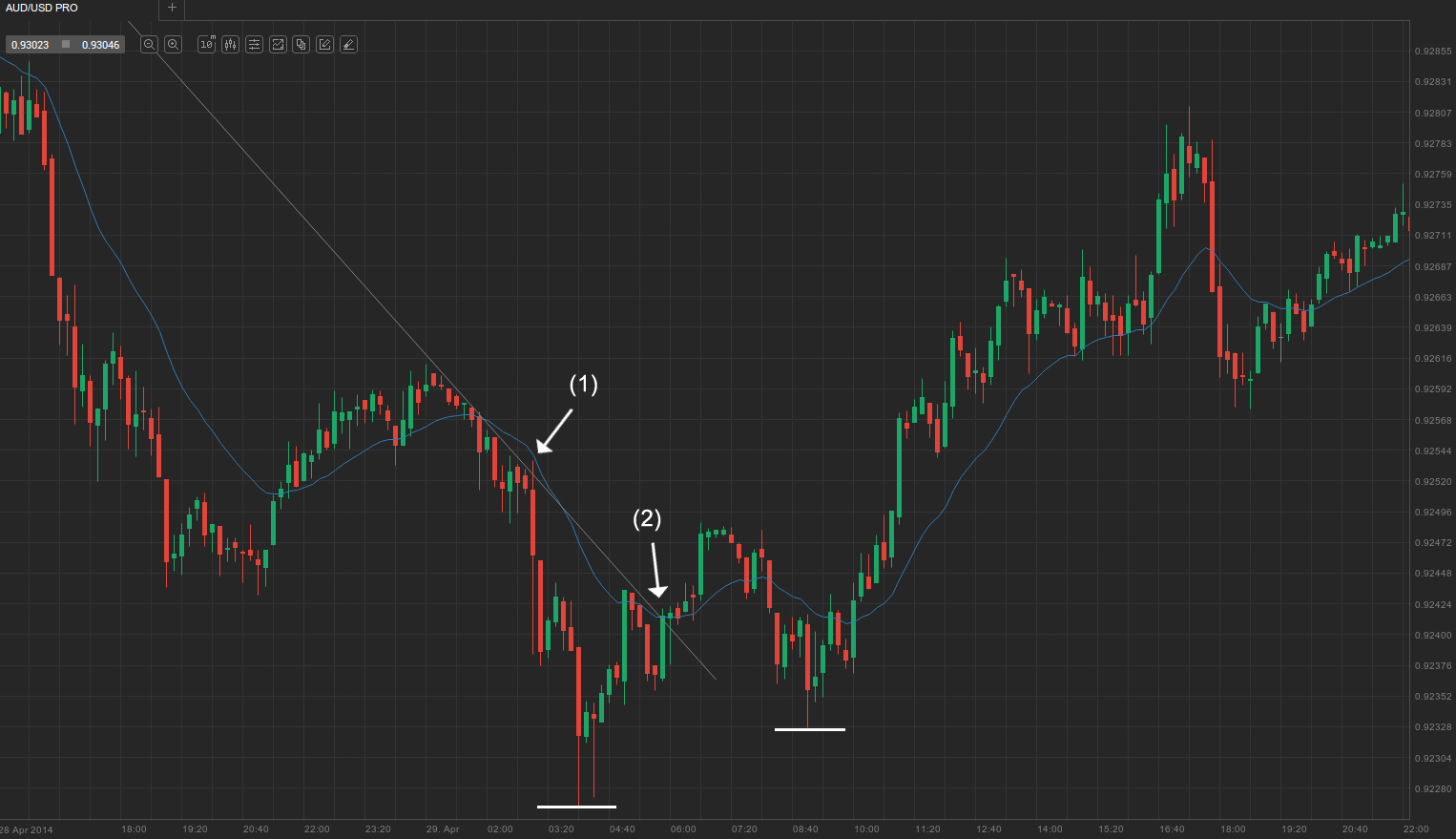

You can see that the market pulled back to the major trend line and repeatedly retested it. After it finally managed to overshoot the line at bar (1), it fell to a new session low, with a small two-bar pullback in between. The price then pulled back to the major trend line and the 20-day EMA and managed to penetrate both of them at bar (2). The move continued and formed five consecutive gap bars. Usually, after this, the market is expected to accelerate to a new trend extreme (in our case, the session low), after which it typically enters a trading range, or a two-legged correction or reversal follows. In our case, it fell short of breaking the previous session low but nevertheless reversed upwards afterwards.

Careful at the top

Moreover, if the market has already formed several pullbacks and entered a late, small trading range within the trend, you should proceed with caution. These trading ranges have the potential to trap with-trend traders because they occasionally accelerate towards a final extreme, followed by a trend reversal. Generally, when such a trading range is present – in a bullish trend, for example – you can go long at its bottom, provided there is a suitable entry signal. However, you should avoid placing buy orders on an upward breakout, because other bulls might decide to take profits at the new high while bears may short, thus leading to a trend reversal after the final extreme. Check the screenshot below.

You can see that a strong, protracted trend, which had already pulled back several times over more than a day, entered a ‘barbed wire’ trading range shortly after marking a new extreme. As you already know from the article ‘How to avoid one of the biggest wallet drainers’, barbed wire is very tricky to trade and is best avoided. Nevertheless, in our case, if a trader wanted to trade it, the only decent entry would be to go long at the bottom of the trading range and avoid going long on a with-trend breakout, because that might be too close to a possible trend reversal, or at least a two-legged correction, after a trend extreme is hit.

Three-legged pullbacks

Sometimes, pullbacks might not have two counter-trend moves but rather three, which can trap counter-trend traders because they expect the third leg to be a new trend. Although this happens most of the time, there are of course exceptions. In some cases, strong trends have three-legged pullbacks which, however, lack strong momentum, and traders take advantage of this. As the price pulls back, market participants typically place with-trend entries at each new low in a bullish trend, or each new high in a bearish trend. Check the screenshot below.

In the example above you can see that the market fell to a session low, followed by a three-legged pullback. The price corrected with three pushes up – (1), (2) and (3) – and the respective minor with-trend legs between them, before the bear trend resumed after testing the session high and fell to a new extreme. As soon as the third leg began, counter-trend traders were trapped, thinking that the second minor with-trend leg would mark the end of the pullback and that the next move would be the beginning of a new trend, which it usually is, but not this time.