What does Forex stand for?

This lesson will cover the following

- What the Foreign Exchange Market is

- What determines the value of currencies

- Statistical facts illustrating how big the Forex market really is

Many people have heard the term “Forex”, but far fewer actually know what it means. Forex stands for foreign exchange and basically means trading one currency for another. For example, when you visit a foreign country as a tourist, or wish to invest there, you will need to acquire a certain amount of local currency to make payments. The conversion of your home country’s currency into that of another country makes you a participant in the Forex market.

The foreign exchange market is the biggest and most liquid market, reaching daily volumes of over $5 trillion. Unlike other markets, there is no central marketplace and currency trading is conducted over-the-counter. Decentralisation enables the spot currency market to remain open twenty-four hours per day, closing only at weekends.

Another indisputable advantage of the Forex market is the huge variety of factors that affect and determine exchange rates, making the possibilities for speculation and the strategies employed practically infinite. This is why the currency market is regarded as the closest thing to the ideal of perfect competition, despite increasingly frequent interventions by central banks as they try to keep their currencies within a less extreme range.

Participants in the Forex market, ranging from individuals to financial institutions and governments, are also attracted by the ability to use leverage to amplify profits and by the relatively low transaction costs compared with fixed-income markets.

However, to understand how the Forex market works and how to profit from it, you first need to learn the basics. And what is more important than understanding what makes a currency valuable?

- Trade Forex

- Trade Crypto

- Trade Stocks

- Regulation: NFA

- Leverage: Day Margin

- Min Deposit: $100

How is a currency’s value determined?

In every free economy, the nation’s currency is valued through market forces, which determine its supply and demand. The stronger the demand for a currency, the higher its price will be. Factors such as tourism, investment, trade and geopolitical risk increase or decrease the need to buy local currency. For example, when a foreign company seeks to do business with a local one, it typically pays with the domestic currency. The more developed a country’s tourism sector is, the more tourists it will attract, thus increasing the need for people to buy local currency in order to pay for the goods and services they consume.

Foreign investments are typically made in the local currency as well. Also, if a geopolitical risk such as war or mass protests occurs, demand for the local currency usually decreases as fewer people seek to visit the country and more locals want to leave it, thus selling domestic currency for foreign. Because almost every country in the world has a free economy, and the factors noted apply to all of them, currency trading has become the most essential and active market. When you add speculators, who attempt to profit from price movements and account for a large share of global volume, it is easy to understand why the Forex market is so large and continues to expand.

Forex statistics and how significant the market is

Let us speak in numbers. As noted above, the Forex market is the largest and most liquid market, and it includes all of the world’s currencies. But how big is it exactly, you may ask?

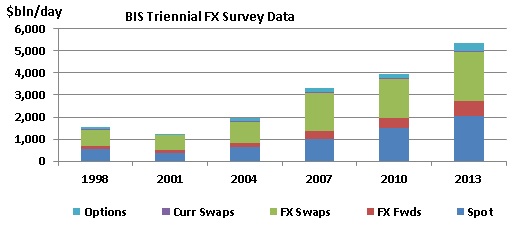

According to the latest Triennial Central Bank Survey by the Bank for International Settlements, global foreign exchange markets recorded an average daily turnover of $5.3 trillion in April 2013. That’s an impressive 33% increase on three years earlier, when daily turnover was $4.0 trillion, and well above the $3.3 trillion recorded in April 2007.

The growth over the last three years outstripped the 19% rise recorded between 2007 and 2010, but trailed the record 72% surge seen between 2004 and 2007.

The expansion of Forex trading was mainly driven by financial institutions other than reporting dealers. Smaller banks accounted for 24% of the turnover, while institutional investors such as insurance companies and pension funds made up 11%, and hedge funds and proprietary trading firms a further 11%. Trading with non-financial customers, mainly corporations, contracted to 9% of global turnover.

Foreign exchange activity is concentrating increasingly in the largest financial centres. Sales desks in the U.K., U.S., Singapore and Japan facilitated 71% of Forex trading in 2013, up from 66% in April 2010.

Most popular pairs

The most actively traded instruments in April that year were FX swaps, at $2.2 trillion per day, followed by spot trading at $2.0 trillion.

As expected, the most popular currency remained the U.S. dollar, also called the “greenback”, “long green”, “buck” and many other names. With the greenback standing on one side of 87% of all trades as of April 2013, it remains firmly the dominant currency vehicle, followed by the euro, whose share, however, fell to 33% that year from 39% in April 2010.

The Japanese yen was the third most popular currency, with its share jumping by 4% to 23% in 2013, while the British pound, which ranked fourth, lost 1.1% to 11.8%.

Observing the three most popular pairs, which are constructed from the top four currencies, confirms the growing significance of the Japanese yen. Trading in the EUR/USD accounted for 24.1% of total turnover, down from 27.7% three years earlier, while the USD/JPY share surged to 18.3% from 14.3%. The GBP/USD cross recorded a modest retreat of 0.3% to 8.8%.

Emerging market currencies

The 2013 Triennial Survey also revealed some other interesting facts that hint at the direction the Forex market may be moving in the near future.

Apart from the rising market share of the yen, there is distinct growth in interest in several emerging market currencies. They were led by the Mexican peso and the Chinese renminbi, which entered the list of the top ten most traded currencies.

The Mexican peso ranked eighth and accounted for 2.5% of global Forex market turnover, up from 1.3% in the 2007-2010 period, while the renminbi jumped by an impressive 1.3% to 2.2% and took ninth place. The Russian rouble also recorded a significant increase, making it the 12th most actively traded currency, up 0.7% to 1.6% in April 2013.