Types of Orders in the Forex Market

This lesson will cover the following

- Which orders an investor can submit to trade in the market

- Market orders

- Limit orders

- Stop orders

- Others

Let us imagine an investor who intends to start trading currency pairs but has not yet opened an account with a brokerage company. He or she should first make up their mind about what type of financial intermediary services they need, as the usual choices include opening an account with a full-service brokerage firm or with a ‘discount brokerage firm’. Some investors may decide that they require the services offered by both types of firms.

If the investor requires advice or broad analysis, he or she would probably seek assistance from a brokerage company offering a full range of services. If the investor has already decided to purchase a particular financial instrument, he or she would probably use the buying and selling services of a brokerage firm specialised in this area. Whatever the case, investors should bear in mind that full-service brokerage firms charge higher fees for their intermediary services.

The procedure for opening an account is usually as follows. The brokerage firm will require the completion of a specific form, similar to that used when opening a bank account. The form should be completed and returned to the brokerage company along with a cheque. After it has been processed by the company’s administration, it will be returned to the investor within a few weeks, together with the account details, including the account number. Once this has been done, the investor may call a representative of the brokerage firm and place purchase orders.

Regarding the types of orders, the most commonly used are market orders, limit orders and stop orders.

- Trade Forex

- Trade Crypto

- Trade Stocks

- Regulation: NFA

- Leverage: Day Margin

- Min Deposit: $100

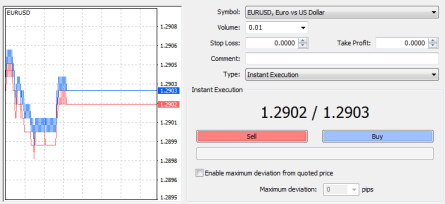

Market Order

First, and probably the most popular, is the market order. If the investor submits a market order, he or she instructs the broker to buy or sell currency pairs at the best available price at that moment. Market orders are always executed; however, they are unlikely to be filled at the exact price the investor prefers or expects.

Let us provide an example. An investor wishes to purchase a certain number of units of the EUR/USD pair. He or she simply calls the brokerage firm, and the representative on the phone states that EUR/USD is currently trading at a bid price of 1.3471 and an ask price of 1.3474. The investor places a purchase order for 1,000 units of this pair. A little later the broker calls back and informs the investor that the 1,000 units have been bought at 1.3477. It appears that the pair’s value increased during the interval between the submission and the execution of the market order. Of course, investors should also bear in mind that the order could have been executed at a lower price—1.3470, for example—if sellers had outnumbered buyers at that moment.

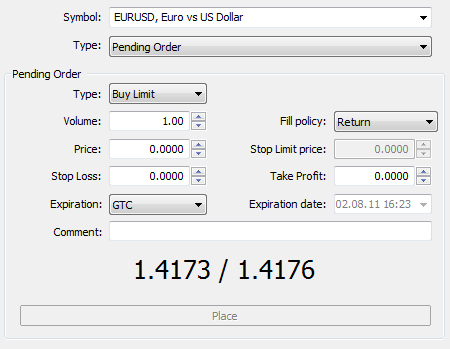

Limit Order

The limit order is another frequently used type of order. When submitted, this means the broker will buy or sell a specified number of units of a given currency pair at the stated price or better. If this price is outside the current market range, then it is usually considered ‘away from the market’ and will be registered in the so-called order book beneath the other active orders. This means that other investors submitted their limit orders earlier, and all registered orders will be filled in that sequence.

This is not uncommon, so investors should note that there is no guarantee that limit orders will ever be executed. Before deciding whether to use a market or a limit order, every investor should weigh the advantages and disadvantages: the ‘guaranteed’ execution of a market order, which may occur at an unexpected price, versus the possibility of getting the preferred price with a limit order but not knowing whether the trade will ever be completed.

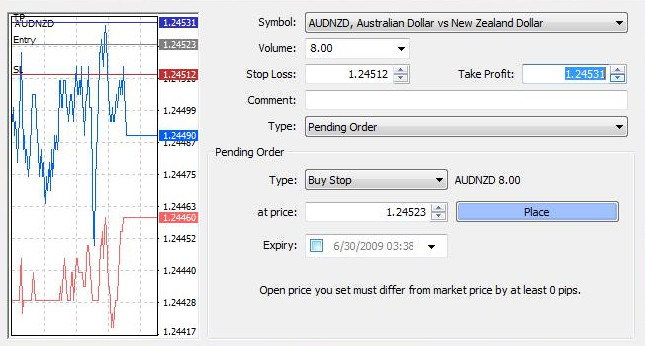

Stop Order

A stop order is a conditional market order that is activated once the market reaches a price predefined by the investor.

Stop order to buy is converted into a market order to buy when other investors are trading at the predefined stop price or higher. Stop order to sell is converted into a market order to sell when other investors are trading at the predefined stop price or lower.

Alongside the three types of orders mentioned above, there are also stop-limit orders. A stop-limit order to buy means that, the moment the market reaches the predefined price, the order is transformed into a limit order to buy. Similarly, a stop-limit order to sell means that, the moment the market reaches the predefined price, the order is transformed into a limit order to sell.

Lastly, investors can submit so-called ”Fill or Kill” orders. They are usually used to trade futures and options contracts, but are also valid in stock trading. These orders are limited in time. For instance, if an investor submits a 25-minute ”Fill or Kill” order, it will be cancelled unless it is executed within the next 25 minutes.

It is also worth mentioning that stock trading recognises two additional types of orders defined by their time period: a Day order and the so-called ”Good Till Cancelled” order.

A Day order is valid only for the trading session in which it was submitted. “Good Till Cancelled” orders, however, are more specific. They remain active until the investor cancels them and can be executed at any time. “Good Till Cancelled” orders need to be reaffirmed twice a year—every six months. Stock-exchange regulations stipulate that this reaffirmation should take place on the last working days of April and October.

Next, we will discuss the different derivative instruments through which currency pairs can be traded.