Why Is Using an Economic Calendar Important?

This lesson will cover the following

- What to look for in an economic calendar?

- Types of indicators

- How to deal with data?

One key tool for success when trading Forex is the economic calendar. By using the calendar, a trader gains a better understanding of why the market is moving in a certain way and, at the same time, will be able to anticipate these moves. As a rule, the largest market-moving events tend to be the release of key economic data such as the GDP or the US non-farm payroll number. While not all market reactions to these announcements can be predicted, they nevertheless present excellent trading opportunities.

What to Look for in an Economic Calendar?

Experienced traders examine future economic events on a daily basis in an attempt to predict the movement of a particular currency pair. They usually stay well ahead of crucial announcements and act accordingly, so that by the time a certain announcement is made, they will have already estimated the value of the currency pair they are interested in. A simple but effective way for traders to keep track of information from events, news, or statements is to have an economic calendar at their disposal. By using such a vital trading tool, traders can follow key economic and non-economic indicators, which may provide clues about the market’s direction, and remain aware of all the events expected to influence the movement of a particular currency.

There are several ways to keep an economic calendar. The most common is to use an online calendar platform that updates data automatically and immediately presents all the information to users.

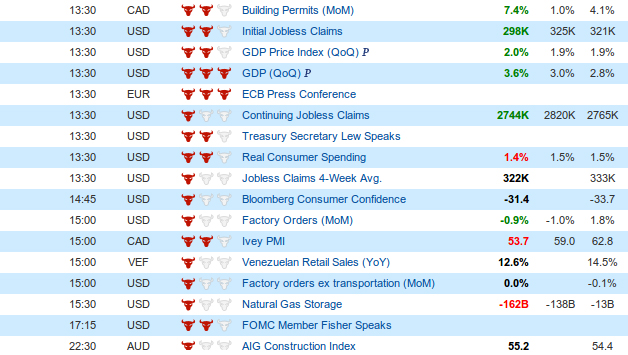

When looking at such a calendar, a beginner trader will most likely notice that all the available information is arranged in several columns: country, name of the indicator and its influence (or importance), the current period value, the forecast value, and the value for the previous period.

We should note that different countries exert varying degrees of influence on global markets. For example, during the past decade almost two-thirds of total allocated foreign exchange reserves worldwide have been denominated in US dollars, giving the currency its reserve-currency status. Because the United States accounts for a large proportion of global currency trades, major economic events and statements from the U.S. usually have the greatest impact on the currency market, often even on currency pairs that do not include the US dollar.

- Trade Forex

- Trade Crypto

- Trade Stocks

- Regulation: NFA

- Leverage: Day Margin

- Min Deposit: $100

Types of indicators

There are two types of indicators, classified according to the time aspect they reflect, that every trader needs to be aware of: leading indicators, which often change prior to large economic adjustments and can therefore be used to predict future trends; and lagging indicators, which reflect the economy’s past performance, with changes that are identifiable only after an economic tendency or pattern has already formed.

An example of a leading indicator is Retail Sales, while lagging indicators include the Unemployment Rate.

Furthermore, indicators are usually classified into three groups according to their impact on the economy and, consequently, the volatility they may cause. Each economic calendar platform has its own method for grading economic indicators. Investing.com, for instance, structures its economic calendar by rating indicators according to the volatility they might generate in the market.

An indicator of utmost relevance is a nation’s GDP (Gross Domestic Product), as it gauges the value of all goods and services produced in that country. PMI (Purchasing Managers’ Index) monitors manufacturing activity and is also regarded as a highly influential indicator. Other closely watched indicators include Initial Jobless Claims, the Unemployment Rate, the Consumer Confidence Index, Home Sales, Durable Goods Orders, and more. We shall discuss them all in the next chapter of our guide.

Less significant, yet still influential, data are provided by indicators such as Housing Starts, the Beige Book report, Business Inventories, Factory Orders, Average Hourly Earnings, the Federal Budget Balance, and so on.

Another two keenly anticipated indicators for Forex market analysis are the Producer Price Index (PPI) and the Consumer Price Index (CPI), which reflect the average price levels faced by producers and consumers of goods and services. These are considered the most suitable measures of a country’s inflation rate.

How to deal with data?

Traders usually compare the current period’s figures with those of the preceding period while also taking analysts’ estimates for the specific data into account. By juxtaposing these three figures, traders can determine whether new data disappoints or exceeds expectations, which in turn informs their next move in the market.

Economic announcements and political news can also change the direction of a particular currency pair, sometimes within a matter of seconds. By using the economic calendar, a trader may become aware of a potential change sooner and act more quickly than other participants in the market.

When a trader knows that the release of a particular report is imminent, the first decision should be whether this release will trigger volatility and, if so, how high that volatility might be. A trader’s response to an announcement depends greatly on where they have positioned themselves and where they have placed protective stops. This explains why leading indicators are so important for decision-making. Traders can profit when they have information in advance, because this enables them to project the possible direction of a currency pair they are interested in.

Once you have gained a solid understanding of the Forex trading basics, you will be ready to move to the next level and examine in detail each of the most important economic releases published every trading day. The guide will take you through each indicator closely watched by analysts, explaining how it fits into the broader picture.