How to reduce Forex risk in trading. Protective stops

This lesson will cover the following

-

The protective stop is a predetermined point which marks

- Why risk reduction is important

- What protective stops are

- Ways to place stop-loss orders

As we have already explained in the previous article, one of the most important concepts you need to master at the beginning of your trading career is money management, or the means of preventing financial ruin. One of the most popular and important money-management tools traders use to safeguard their capital is the protective stop.

Protective stops

The protective stop is a predetermined point which marks the maximum loss a trader is willing to sustain on a single position. It is intended to control trading losses, and some refer to it as a “money-management stop” because it prevents the complete loss of capital. It relates to the risk-to-reward ratio, or the level of risk a trader is willing to accept when entering a position.

Protective stops are placed by using a stop-loss order on the trading platform. This is an order that automatically closes your position if the price of the asset moves in the opposite direction and crosses a predetermined level that you do not want it to exceed. Therefore, stop-loss orders are vital in protecting the money you have invested, and most professional traders agree that every entry must have an inviolate protective stop under all circumstances.

One of the most difficult tasks when trading currencies and other assets is determining where to place your stop-loss order. A high level of discipline is also required so as not to move your stop and take additional risk when the trade does not work out for you. For example, if you have entered a long position and the price begins to fall, you should not lower your stop in an attempt to give the market time to recover, thereby exposing yourself to a risk greater than the one you originally accepted. By doing that, you allow your emotions to get the better of you, which is why stops must be set when the position is opened and must remain unchanged, even as prices are about to trigger them.

- Trade Forex

- Trade Crypto

- Trade Stocks

- Regulation: NFA

- Leverage: Day Margin

- Min Deposit: $100

Vital for new traders

Protective stops are vital, especially for new traders. While professionals have the experience to trade for profit using advanced systems tested over time, people who are new to currency trading have one principal goal – to survive and gain experience. The longer they stay in the game, the more they will learn and improve their skills. This makes stop-loss orders an indispensable tool in the toolkit of novice traders.

Apart from allowing you to minimise losses and remain in the game longer, stops also reduce the stress associated with trading. Holding a losing position without a protective stop significantly increases stress levels, which leads to irrational thinking, especially for inexperienced traders. Moreover, the further the price moves against you, the more the stress escalates and begins to dominate your mind.

The bottom line is that, by using stop-loss protection, you can exit losing positions swiftly with minimal loss and recoup it quickly by pursuing other opportunities instead of focusing on a losing trade for days and praying for the price to recover.

Placing stops

Each trader has a different method for determining where to place his or her protective stops. Traders who favour technical analysis use levels such as support and resistance to find the most suitable point for a stop-loss order, while others rely solely on the amount of time a trade has been open. There are also traders who do not use technical levels or time frames and instead choose to risk a fixed absolute amount of money, a practice often used in stock trading.

Technical levels

Support and resistance

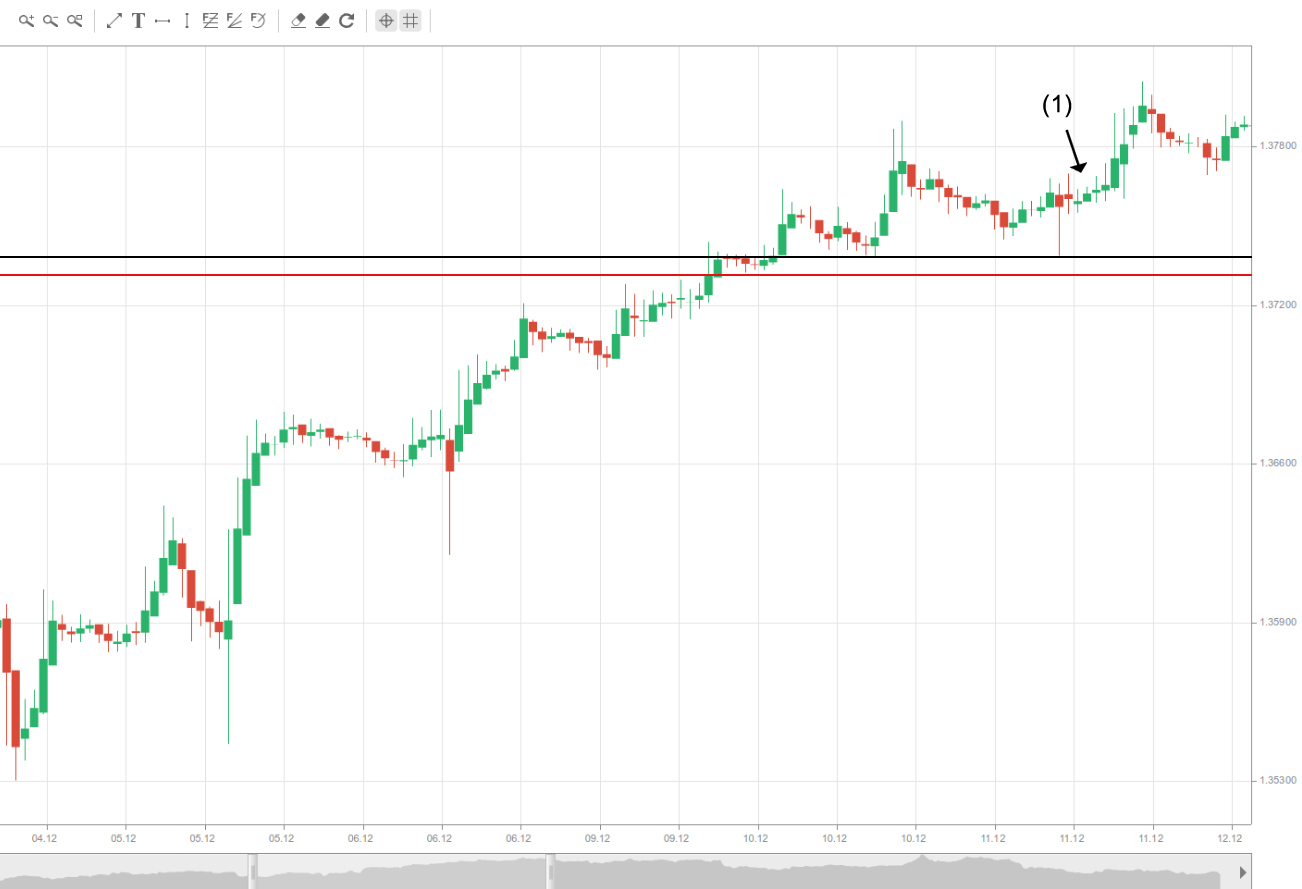

Market players very often take supports and resistances into consideration when placing stops. These levels indicate when a price reversal is likely to occur. The chart below illustrates how a protective stop should be placed below support levels when we have entered a long position.

Since a support will likely cause a declining price to rebound and advance, a protective stop should be placed below it. In our case, as shown in the screenshot, we enter a long position at (1) and the most recent swing low acts as a support level (marked by the black line), thereby giving us a clue as to where to place our protective stop. Remember to put the stop a certain number of pips beneath the support level so that it is not triggered by failed attempts to break the support or by random noise. The red line marks an appropriate price level for the stop.

The same logic applies to the opposite price movement. If price levels are moving downward and you have entered a short position, you need to place a protective stop several pips above the resistance level.

It is also worth mentioning that round numbers, such as EUR/USD 1.3000, 1.3200, 1.3500, etc., are widely regarded as support and resistance levels. Consequently, placing protective stops just below or above those prices is very useful and is employed frequently. Bear in mind that a break through these levels can trigger many market players’ stop-loss orders and cause price fluctuations.

Moving averages

Many traders use moving averages (MAs) as support and resistance levels and trade moving-average crossovers. It therefore seems logical to place protective stops on the other side of the moving average. The following screenshot illustrates such placement.

Generally, when prices touch a moving average and rebound, this generates a buy signal if the price movement is upward, and vice versa. Having entered a long position after the signal had been generated, you would want to place a protective stop several pips below the moving average, just as you would when placing it below the basic support level discussed earlier.

In the example, we entered a long position at (1), immediately after the rebound generated a buy signal, and placed a stop-loss order several pips below the moving average so that it would not be triggered by random movement. As we can see, there was later an attempt to break through the moving average, which failed, and the price subsequently moved higher. Had we placed our protective stop too close to, or at, the moving average, it would have been hit and we would have exited the position at a loss.

Of course, the same logic applies to the opposite price movement. If the current price is below the moving average and touches the MA from below before rebounding downward, you would enter a short position and place a protective stop several pips above the moving average.

Using channels

Market players also use various trading ranges, such as channels, bands or envelopes, whose boundaries act as support and resistance levels. Prices usually rebound when hitting one of the two boundaries, keeping them within the channel or band. However, this does not exclude the possibility of a breakout. To protect yourself, you should place a protective stop below the lower band or above the upper band, depending on whether your position is long or short.

In the screenshot above you can see a price rebound from the lower boundary of the SMA envelope, which provided a signal for a long entry at (1). When entering the trade, you can protect your position by placing a protective stop below the lower boundary, which will limit your losses if prices unexpectedly decline and break through the channel or band. As in the previous cases, the same logic applies when entering the opposite position. Remember to leave a certain number of pips between the boundaries and the protective stops so that failed breakout attempts or random noise do not trigger them.

A general rule when deciding where to place stop-loss protection is to look for a certain point characterised by the following:

– the market has reached a level which has invalidated your initial planning and reasoning

– there is a greater probability that the market will continue moving against your position and it is therefore wiser to exit the trade.

There are several factors which must be taken into account when placing a protective stop, but their interpretation is highly individual and varies according to everyone’s personal style of trading. Such guidelines are:

– Risk – defines how much a person is willing to lose in a trade. Most professional traders advise novice traders not to risk more than 1-2% of their capital in a single position.

– Risk-to-reward ratio – depends on the trading style a trader uses and on market conditions. Favourable conditions allow you to give your position more room, while riskier assets require tighter stops.

– Volatility – measures the price range within which an asset fluctuates. Stop-loss protection is used to minimise losses, but if you place your stop too close to the current price, especially at times of increased volatility, it may be triggered by random noise. There is also the risk of slippage, an event which was thoroughly explained in the article “What to Look for in a Trading Platform”.

– Position size – if the amount of money you have invested in a position is too large, then each pip of movement will be fairly significant compared with the total money in your trading account. This increases risk exposure. A tighter stop is suggested in this case, but, as logic dictates, it could be triggered more easily, even by random movement.

– Trading capital – the position size is linked to the amount of trading capital you own. If your trading account is under-capitalised, you will be forced to use tighter stop-loss protection to avoid losing a large part of your funds in a single trade. This means that traders who want to enter larger positions need to start with a well-capitalised account.