Scaling in and out of trades in Forex

This lesson will cover the following

- Scaling out of a trade is used to achieve similar goals

- What is scaling?

- How to scale into trades

- How to scale out of trades

- What to avoid when using this technique

In the previous sections of the chapter we’ve talked about what money management is, what makes it so vital, and we’ve explained some of the most popular ways to reduce risk in trading. Now it is time to turn our attention to the so-called scaling in and out of trades.

Scaling is a method of money management that allows you to limit potential losses and maximise potential profits, despite the fact that future price movement is uncertain. Scaling means gradually increasing or decreasing the size of your position while trading. This enables you to increase your profits, reduce risk and limit losses when the market turns against you. Of course, scaling in and out of trades requires proper money management, discipline and sound reasoning; otherwise you can lose, just as with any other strategy.

There are two types of scaling – scaling in and scaling out of trades. As with every other trading strategy and money-management method, scaling has not only advantages but also drawbacks, which we will discuss later. Let us begin by explaining each of the two types.

Scaling in

Scaling into a trade means opening a position with just a fraction of the capital you initially intended to commit, and then entering more positions if price levels move in your favour. Scaling in is optional; you can choose not to use it if you don’t want to, but it has several considerable advantages, which make it worthwhile.

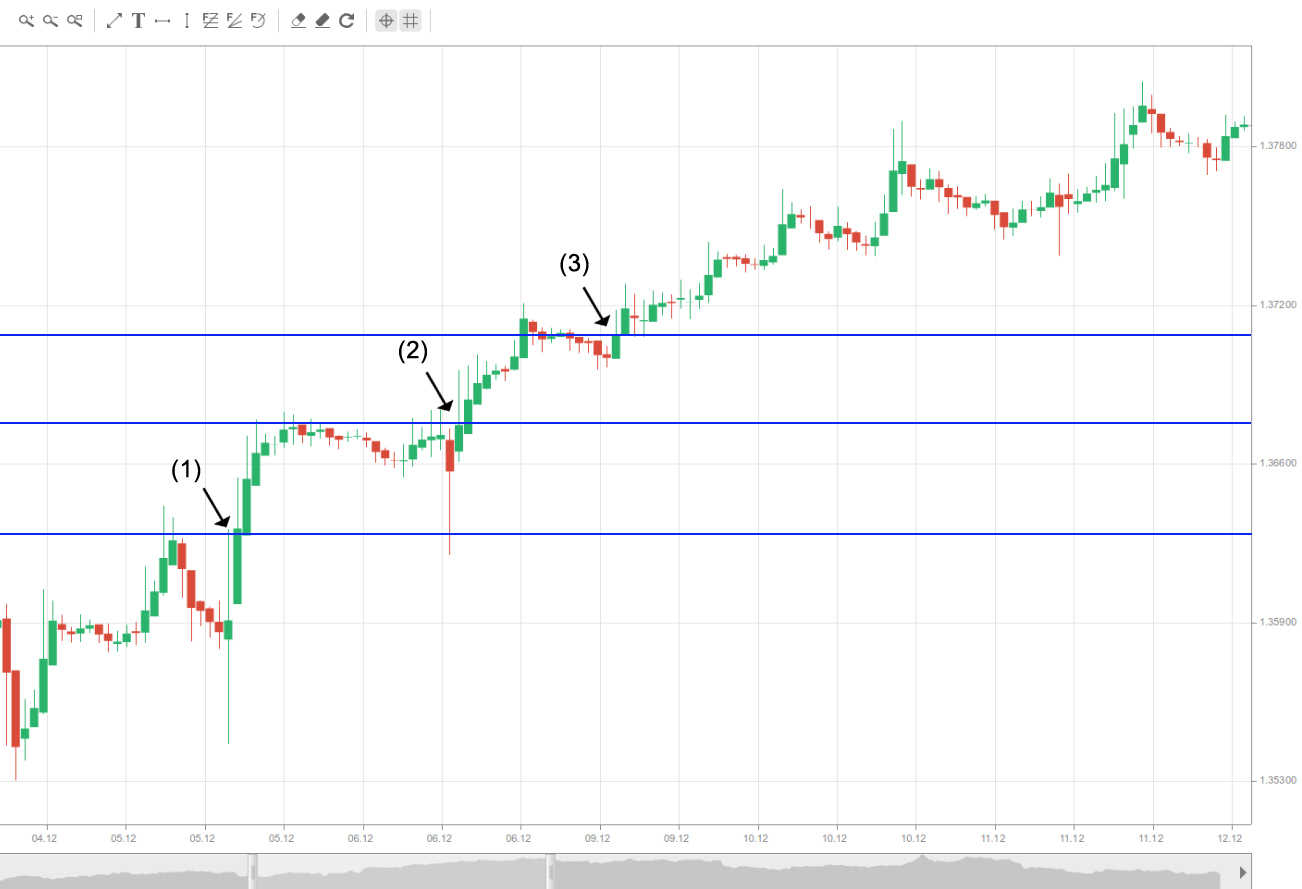

First, you reduce the total risk of your trade. By scaling in, you commit only a fraction of your funds upon entry into the long position. In the example provided with the screenshot below, instead of going long with one standard lot, you could enter a position by committing a fifth of it, or two mini lots, in our case at (1) (we’ve explained what a lot is and what the advantages of the lot system are in the article “Advantages of Using a Demo Account“). By doing so, you risk losing far less money if the price turns against you at the beginning.

If the trade, however, moves in the desired direction, you can add to the position – let’s say another four mini lots – after a pullback has ended, in our case at (2), bringing the total amount to six mini lots. If the trade continues to go well, you can add the last four mini lots after the next pullback, at (3), thus reaching your initial goal of investing one standard lot in the position. This, of course, means that you would profit less compared with entering with the full standard lot, but it also means you would have lost less if prices had turned against you.

If the trade continues to go in your favour after entering the standard lot, you could add more funds to the position than initially intended once you are in profit. This move should, however, be backed by raising your protective stop to the initial entry point, thereby removing any risk of loss from the market.

Second, scaling in allows you to choose the best entry point for your trade. It is quite possible that your analysis of the current market situation is correct, but you haven’t chosen the most suitable level at which to enter. Scaling in gives you more time to assess the situation. Very often you will have two or three favourable entry levels, and sometimes the area is not a precise price but rather a range, especially on hourly and larger time frames. This is why scaling in allows you to enter a trade even if you’ve missed the perfect entry level and still manage to make a profit.

- Trade Forex

- Trade Crypto

- Trade Stocks

- Regulation: NFA

- Leverage: Day Margin

- Min Deposit: $100

Disadvantages of scaling into trades

However, it is worth noting that scaling into a trade also has certain disadvantages, which is why not everyone uses it. The main downside of this strategy is that poor money management can lead to an increase in overall risk exposure, which could be devastating for your account if a sudden price reversal occurs and you haven’t limited losses through protective stops.

As the current price moves further in your favour and your confidence grows, it becomes much easier to exceed the amount of money initially intended for the trade. Distracted by their temporary success, some traders keep adding more and more mini lots to their positions over time, to the point where the amount invested exceeds the general rule of risking no more than 1-2% of your total capital on a single trade.

This, of course, carries a big risk, especially for novice traders, as the danger of a sudden price reversal always lurks, and the greater the risk exposure, the more money you can lose. Such a reversal is illustrated in the screenshot below.

In our example, the trader enters a long position at (1) with a fraction of the total amount he intends to invest. Seeing the market move in the desired direction, the trader adds another fraction at (2). After a significant rise and the subsequent pullback, the trader further adds to his position at (3), expecting prices to regain strength, which they do. Shortly afterwards, however, a significant price reversal occurs, wiping out the whole position and turning it into a loss.

Another drawback of scaling in, illustrated in the example above, is that when you enter a trend that has already been established for some time, the later positions you add (the later mini-lot additions, in our case) are exposed to a higher degree of risk because the trend may be nearing its end. That is why you should be cautious when scaling into trades within a trend that has existed for a while.

Scaling out

Scaling out of a trade is used to achieve similar goals to scaling in – reducing risk, locking in profits and limiting losses. Scaling out means selling a fraction of your total exposure after your position has become profitable, thus locking in some profit while leaving other positions open in order to benefit if prices continue to advance.

The screenshot below illustrates how scaling out can protect you from the sudden price reversal that wiped out our entire profit in the previous example when we scaled into the trade.

For scaling out to work, the market must be trending. The main goal of using this technique is to retain the profit and avoid a loss situation as much as possible. In order to begin scaling out of a trade, you must first reach the breakeven point as soon as reasonably possible, and after you are on the winning side you can begin exiting positions and locking in profits.

As illustrated on the screenshot above, our long entry point is at (1). After the initial downward movement had ended and we were on the winning side, the first exit was taken at (2), thereby securing some profit. Leaving the two other positions still open allows us to take advantage if prices advance further. At the same time, an unexpected price reversal, which would otherwise affect our whole trade, would have a much less significant impact on our session, as we have already reduced our risk exposure and locked in some profit. As the price continues to advance, we exit another position at (3), thus further securing our trading success. The following pullback is of little significance to us, and after prices rebound we close our last remaining position at (4). Even if we had left it open, the upcoming sudden price reversal would have had a greatly diminished impact on our trading account, given the low risk exposure.

Disadvantage

One negative aspect of scaling out, which novice traders often find disturbing, is a market that continues to move in your direction and even accelerates significantly after your initial exit. This might be frustrating, but it shouldn’t really bother you if you have followed your trading plan, as in many other cases the technique will protect you from a price reversal.

This money-management method, just like scaling into trades, reduces your overall profit. Logically, you would end up winning more if your entire position benefitted from the full duration of the upward move, not just a fraction of it, but the risk reduction you obtain offsets that loss. The scaling technique is especially suitable for novice traders as it will allow them to stay in the game for longer, but it is vital that it be combined with proper discipline and appropriate money management.