Supply and Demand in Trading

This lesson will cover the following

- What is supply and what defines it

- What is demand and what defines it

- The three main states of markets

According to the law of supply and demand, it is obvious.

Supply & Demand Explained

The Forex, stock, commodity or any other freely traded market in the world is driven by supply and demand. Understanding these principles is of the utmost importance, as they are the main forces that move the price of an instrument up or down.

In addition, having a solid grasp of supply and demand will make all the difference when you have to sift through the barrage of news that comes out each day and select the events you consider the most relevant.

What is Supply?

Supply represents the extent to which a particular commodity is available in the market at any given time. If the supply of a specific currency rises, the currency will tend to lose value. Conversely, if the supply of that currency falls, it will usually appreciate because it is rare or absent.

People tend to value assets that are in low supply, such as diamonds. However, if we consider rocks, the conclusion is obvious. Rocks have very little value because they can be found almost everywhere. Thus, we can say that the supply of rocks is quite high on a global scale. As one walks down the street, they can choose from a vast variety of rocks.

By contrast, diamonds are usually highly valued because they are rare and not commonly found in circulation. It is a simple example, but it illustrates market logic well.

- Trade Forex

- Trade Crypto

- Trade Stocks

- Regulation: NFA

- Leverage: Day Margin

- Min Deposit: $100

What is Demand?

Demand represents the extent to which a particular asset is wanted by market participants at any given time. In currency trading, demand usually has the opposite effect on value compared with supply. If the demand for a currency increases, the currency will gain value. Conversely, if demand falls, the currency will usually lose some of its value.

S&D conditions

Several key assumptions are required for this concept to be reliable: First, product differentiation does not exist – there is only one type of product sold at one price to each consumer. Second, in this closed scenario, the item of interest is a basic want rather than an essential human necessity such as food or water. The final assumption is that the good has no substitutes and consumers expect prices to remain stable in the future.

Three states

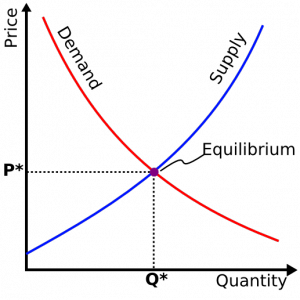

A market is always in one of three states.

First, demand exceeds supply, which implies that participants are competing to buy, and this competition pushes prices higher.

Second, the market can be in a state where supply exceeds demand, which means participants are competing to sell, and this competition drives prices lower.

Third, the market can be in a state of equilibrium, where there is no competition to buy or sell because the price allows everyone to transact as much as they wish. This scenario presents the optimal economic condition, in which both consumers and producers of goods and services are satisfied.

However, as the market moves away from equilibrium, competition increases and pushes prices back towards balance. In other words, competition eliminates itself by forcing markets back to equilibrium. Even though equilibrium is where the majority of candlesticks form, investors are not always willing to trade in that area.

Japan example

Let us use oil prices to illustrate how supply and demand work together and affect the global economy. If demand for crude oil rises, or if supply falls, the price of oil futures will generally surge. As crude oil prices increase, petrol prices respond almost immediately and rise as well. When petrol becomes more expensive, consumers must spend more money simply to travel from, say, point A to point B. As they devote a larger share of their budgets to oil-based products, they are left with less disposable income than before the surge. These same factors that influence individual budgets also affect the bottom lines of the world’s largest corporations and the most influential governments worldwide.

Let us take Japan, which suffers from high oil prices because it imports almost all of its oil. Every barrel the country needs to power its industry must be purchased at the prevailing market price. Moreover, the Japanese economy depends on the country’s ability to export the goods it produces to key trading partners such as the United States and China. Every car, smartphone and computer produced in Japan becomes increasingly expensive to deliver to consumers as oil prices rise. In this case, the country experiences a double blow. First, it needs to import all of its oil at inflated prices and then it must pay inflated prices to ship 100 per cent of the goods it produces.

According to the law of supply and demand, it is clear how a sustained increase in oil prices would influence the value of the Japanese currency. Oil is always priced and sold in US dollars, so as prices rise, purchasers in Japan have to convert larger amounts of Japanese yen into US dollars to pay for it. This increases the supply of yen on the market and causes the currency to lose value.

As a result of all this, Japanese goods appear more expensive and fewer people can afford them. Demand for the Japanese yen decreases because the fewer goods people purchase, the fewer yen they need. The combination of increasing supply and decreasing demand leads to the devaluation of the Japanese currency.

This example of oil impacting the yen illustrates how supply and demand can affect currency markets.