Spike plus channel trends – illustrations part I

This lesson will cover the following

- Parabolic nature of channels

- A case involving a gap plus channel trend

- A case involving a typical spike plus channel trend

Parabolic nature of channels

On the 10-minute chart of AAPL above, we can see what a parabolic-shaped channel looks like. The move to the upside from bar 5 to bar 6 was in the form of a steep micro channel, but the price managed to break above this channel. Moreover, it created an even steeper bull channel from bar 7 to bar 8. These two channels led to a parabolic increase in the slope, which can be considered a type of climax. In many cases, a climax lasts longer than a trader can sustain their account. Therefore, it is better not to attempt to go short during an uptrend as strong as that shown on the chart.

If ten or more strongly trending bars with short wicks and little overlap appear, this implies an exceptionally strong uptrend. Traders will usually buy into this trend at market and not wait for a pullback. They do so because they are confident that the price will climb to higher levels soon, but they are not certain whether a pullback will occur at all. If, however, one occurs, it may be shallow, lasting for several bars, after which the market usually forms a new high.

The move from bar 1 to bar 2 was a spike-plus-climax trend. Bar 1 was the spike, while instead of a channel, the market formed another spike at bar 2. Successive climaxes are usually followed by a larger pullback that reaches the low of the second climax, as was, to a certain extent, evident on the chart (the bar 4 low tested the bar 2 low). This scenario was also a double-bottom bull flag. spike plus channel trends usually lead to the same situation, so spike-plus-climax trends can be considered a variation of the first.

Gap plus channel during a trading day

At times, a gap can appear instead of a spike, creating a gap plus channel trading day. This is visualised on the 10-minute chart of AAPL above. The move from bar 1 to bar 2 formed a bull flag, which led to a channel from bar 2 to bar 3.

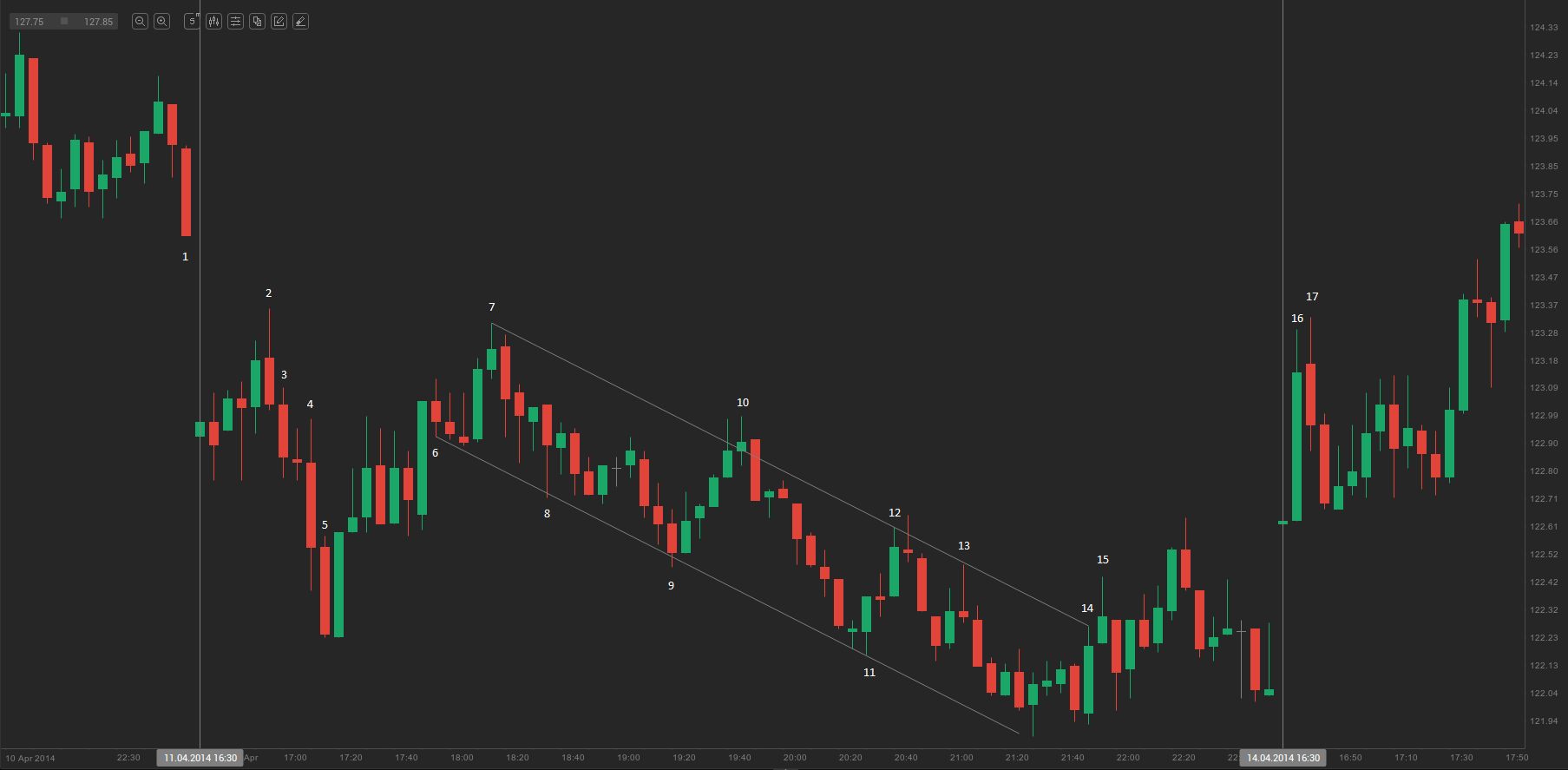

Spike plus channel trends are common to observe

On the 5-minute chart of Boeing Co. (BA) above, we can see what a spike plus channel trend looks like. The trading day on 11 April began with a gap (as stated above, gap plus channel trends are a variant of spike plus channel trends). Bars 2, 3, 4 and 5 were consecutive sell climaxes that were followed by a pullback, which tested the highs of bars 4 and 3. The market then created a bear channel, which lasted for most of the trading day. Bars 1 and 2 also formed a bear flag.

- Trade Forex

- Trade Crypto

- Trade Stocks

- Regulation: NFA

- Leverage: Day Margin

- Min Deposit: $100

Bar 15 broke above the bear channel. As prices tend to test the starting point of channels, traders may now look for long setups. However, the test of bar 7’s high did not occur until the next trading day (14 April). The beginning of the bear channel was tested by the high of bar 16 and exceeded by bar 17.

Within the bear channel, bears might have scaled into their short positions and scalped for a number of reasons. They might have sold above the high of the prior bar, such as above bar 9 or above the highs of the three bars that followed it. They might also have sold at the bear trend line (bars 12 and 13) or at any small break of this trend line (bar 10). Other sellers might have decided to go short a fixed amount below each test of the upper area of the channel (for example, 1 point below the test), because they supposed that further price action to the downside was likely. As this bearish move was seen on smaller time frames and other types of charts, market players trading off these charts might also have gone short.

Buyers following a more aggressive strategy might have gone long in the same bear channel. One group of them might have scalped, buying at every test of the trend channel line (at the lows of bars 8 and 11). Another group might have scaled into their long positions, hoping that the price would test the highs of bars 12 and 13 during the current trading day or the one following it. Some buyers might even have scaled in with larger positions (for instance, twice the size of their previous position). Others might have been trading based on larger or smaller time frames, tick charts, or volume charts. There would also have been traders buying and selling, scaling in and out for any conceivable reason, and they might still have been successful.

However, the majority of traders would consider scaling into long positions in a bear channel during the final few hours of the day to be highly risky. Often, a trader may end up holding a large losing position and will need to exit at a loss before the close. It is more probable to make a profit when looking for short setups in a bear channel than when scaling into long positions.