Failed breakouts from trend channel lines

This lesson will cover the following

- Trend channel line overshoots as signals

- An example

It is worth noting that the trend channel line may not be apparent when the reversal takes place. As soon as the move begins to show a more parabolic shape, price action traders will usually redraw trend channel lines in search of an overshoot and a reversal. The most reliable reversal setups feature huge reversal bars and provide opportunities for second entries. The first leg of a reversal will very often move through a trend line. If it fails to do so, an actual reversal may not occur, and a trading range or trend continuation becomes more likely. If the second entry in the reversal fails, the original trend is very likely to continue for at least two legs.

- Trade Forex

- Trade Crypto

- Trade Stocks

- Regulation: NFA

- Leverage: Day Margin

- Min Deposit: $100

Counter-trend traders will almost always draw trend channel lines in anticipation of an overshoot followed by a reversal, allowing them to scalp. Ideally, they also look for a two-legged move opposite to the prevailing trend.

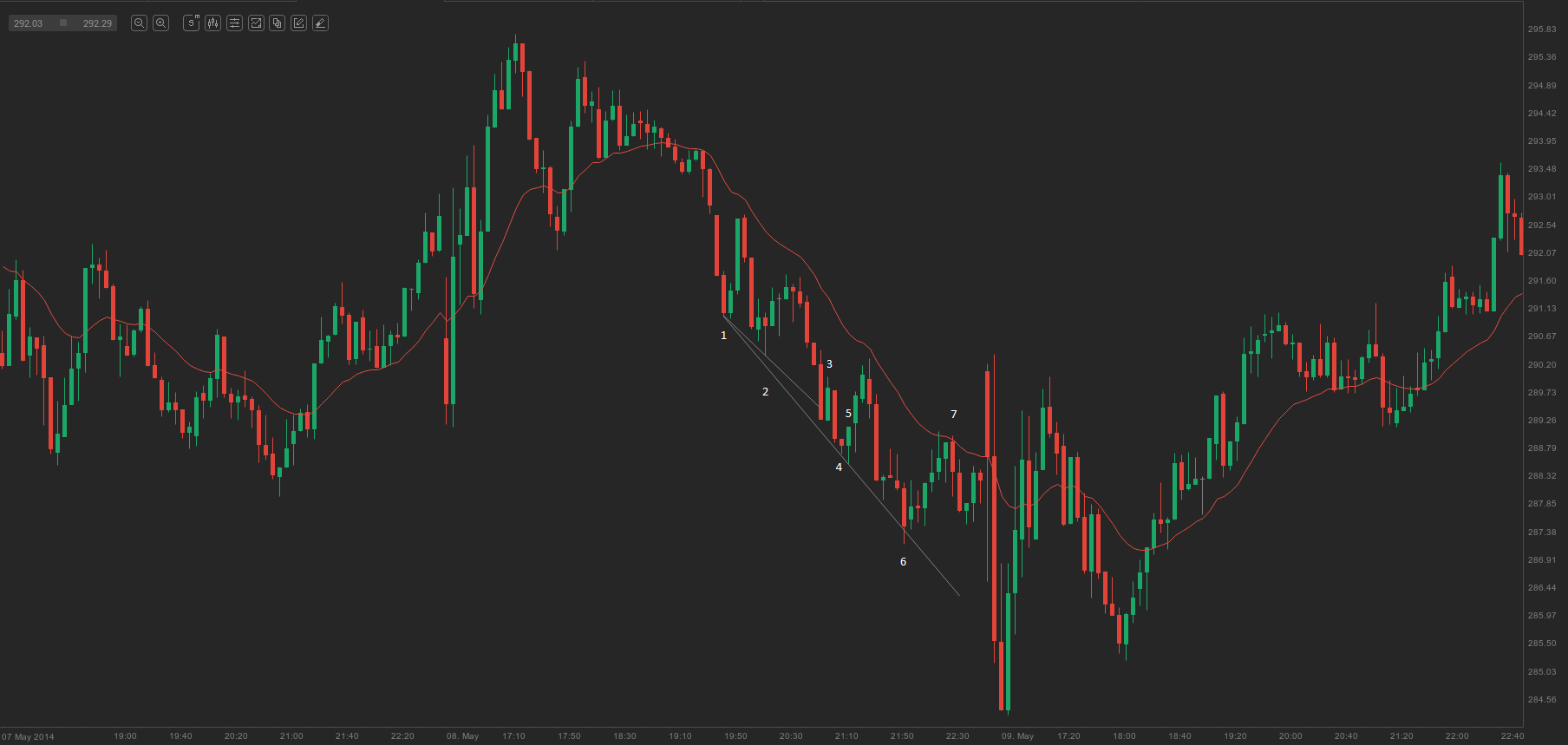

On the 5-minute chart of AMZN above, bar 3 breached a short trend channel line within the downtrend, but there had been no prior counter-trend strength. In this situation, astute price action traders would have waited for a secondary entry; if one did not appear, they would have treated it as a setup to enter in the direction of the trend (which proved to be the case). Bar 6 overshot a larger trend channel line. The signal bar for an entry against the trend was an inside bull trend bar with a good-sized body; therefore, many traders would have viewed this setup as an opportunity for a successful counter-trend scalp. Bar 7 was a good M2S setup, offering an opportunity for a with-trend entry.