Hello there, this is tradingpedia.com and in this video we introduce one popular oscillator, an oscillator that exists on any trading platform, including on the MetaTrader. It is called the Commodity Channel Index and, like the name suggests, it is one of the oldest indicators that exist. It survived the test of time and works on any market, including the currency one.

How To Use CCI In Trading

Therefore, it deserves a place in any trading academy, and here we are talking about how to trade with the CCI. As an indicator, we can apply it on any timeframe and market, by choosing Insert/Indcators/Oscillators and we choose the CCI. If the trading platform does not offer the CCI, you can easily find it over the Internet and import it – it is not that complicated. However, if your trading platform does not offer the CCI then you have a big question mark regarding the broker.

Because it is an oscillator, it considers more periods than the current level and the default number of periods is 14 and appears at the bottom of the chart. You can play with the window as you want.

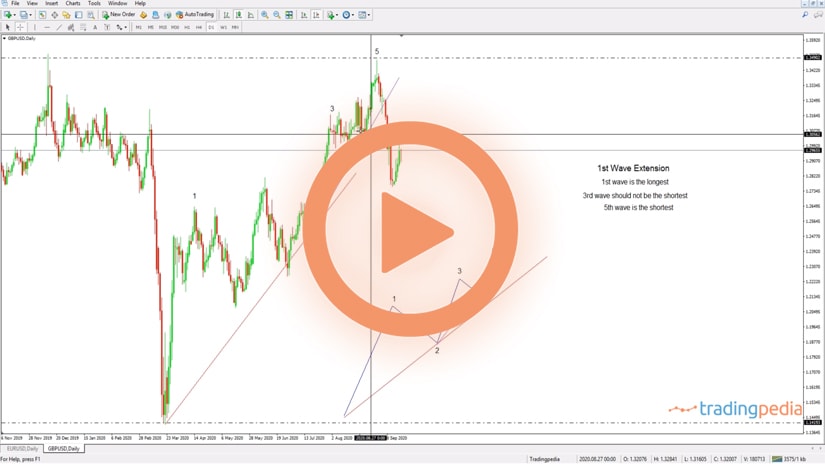

It comes with two levels: 100 and -100. Whenever you have extreme levels, the first thing to consider is overbought and oversold territory. This is true in the case of the RSI, and of all oscillators that are bounded. But the CCI is unbounded, as we can have much lower or higher values. How do we know how to trade it and where to use the overbought and oversold territory?

Use The Overbought And Oversold Level

The first thing to consider when trading with the CCI is to use the overbought and oversold level. The EURUSD consolidated all this time, and whenever you expect a consolidation, then you can trade it with oscillators. For instance, we go short here, we buy here, and so on – if you play this game all the way until here you will see that the oscillator follows what the price did. But the problem with this approach is that it works well in a range but doesn’t when there is no range anymore.

Imagine here. The EURUSD traveled here and if you tried to sell it you had an issue as it traveled multiple big figures (a big figure means a hundred pips) and then the oscillator did not help. It is usually an approach that works on the Asian market as most Asian sessions are slow and you can apply the oscillator on the lower timeframes. Or, when you expect a big market event. For instance, this market seems to expect the U.S. election six weeks from now.

Look For Divergences

Another way to trade with the CCI is to look for divergences, even though they do not appear that often. The reason for that is that the CCI is very sensible as it moves from positive to negative territory on little or nothing. Therefore, we should treat them as more powerful than other ones. For instance, the EURUSD here, while rising, it formed a bearish divergence. That is a nice place to go for a short trade, even though that short may be taken only from here. Still, a good trade.

When the CCI diverges from the price it is doing so usually during trending markets. And then, during ranges, one can trade overbought and oversold territory.

Related Videos

Set Bigger Levels

Last but not least, we can alter the CCI to find even more extreme levels. If the CCI has the power to come to positive and negative territory so easily, why not making it a bit more difficult of it? Therefore, we can edit the oscillator and replace the original levels with bigger ones. In other words, we are interested to trade overbought and oversold only when the CCI reaches this area. Therefore, we have limited our entries to the downside or upside like shown here, and when the market dropped to -250, we go long.

So this is another approach to use the CCI and you have to do some research to find out what are the extreme levels the CCI typically reaches and you can use them in your trading.

Out of the three possibilities, the original interpretation of the CCI works best, if you are able to spot the difference between trending and ranging markets.

Thank you for being here. Bye, bye.