Hello there, this is tradingpedia.com and in this video deals with how to trade the oil market and things to know from a retail trader’s perspective regarding oil. As you are about to find out in this trading series of five or six videos here on tradingpedia.com, trading oil differs from a retail perspective and a professional investor or trader’s perspective.

Link Between Price of Oil and Inflation

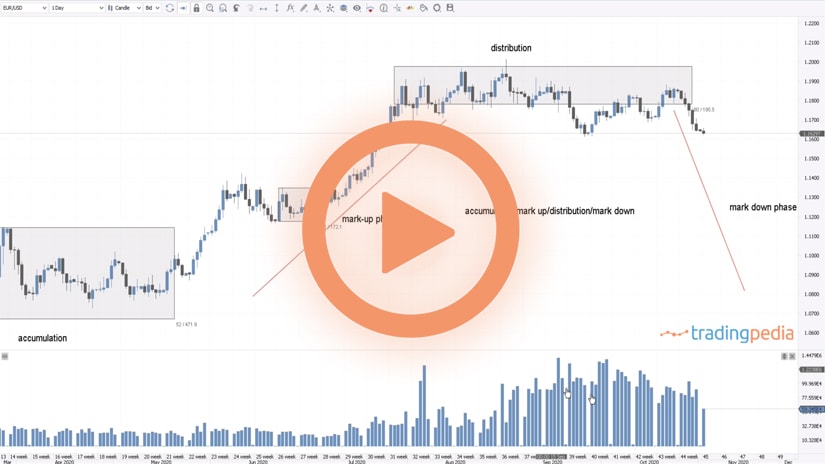

This is a commodity, perhaps the one commodity that is responsible for most of the developments in the last hundred years as everything we know and surrounds us, depends on the oil market and the price of oil. For instance, the price of oil is responsible for inflation – there is an important relationship between the two, because the price of oil dictates inflation and inflation dictates the monetary policy in the developed world.

Oil, since its discovery, changed the balance of powers around the world. Countries with no geopolitical influence on the world stage, suddenly became important. Oil producing countries organized in cartels and the way they influence the supply and demand influence the price of oil.

Oil Supply and Demand

Oil is a commodity, and because of that, supply and demand are important. From a single barrel of oil there are so many things that are produced, starting with gasoline, kerosene, asphalt for the roads, or plastic for the chemical industry, and so on. It is absolutely amazing how this product changed the world and influences the way we live our lives.

Related Videos

What to Expect From Our Oil Series

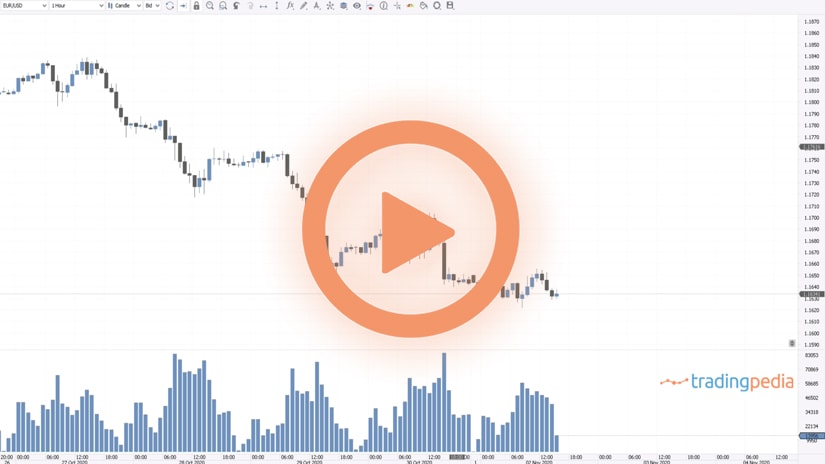

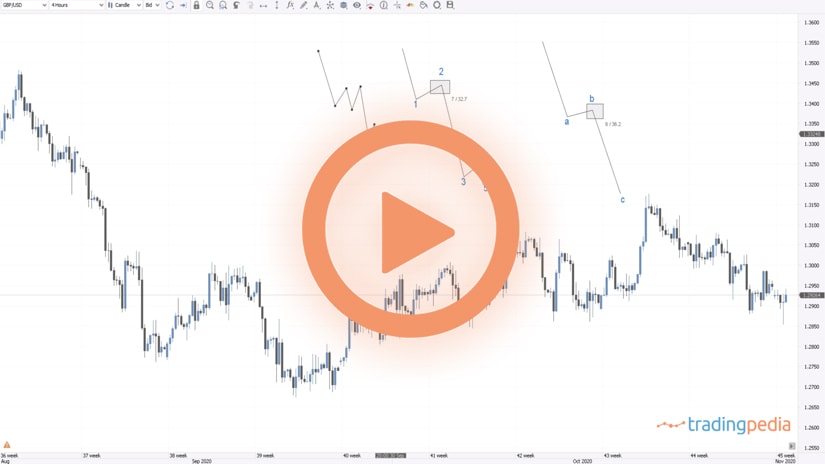

In this series we will look at some economic releases to consider when trading oil, but also at the difference between various oil products and oil derivatives and how they influence the price of oil. For example, in April this year, the futures contracts for oil delivery in May dropped below zero for the first time in history.

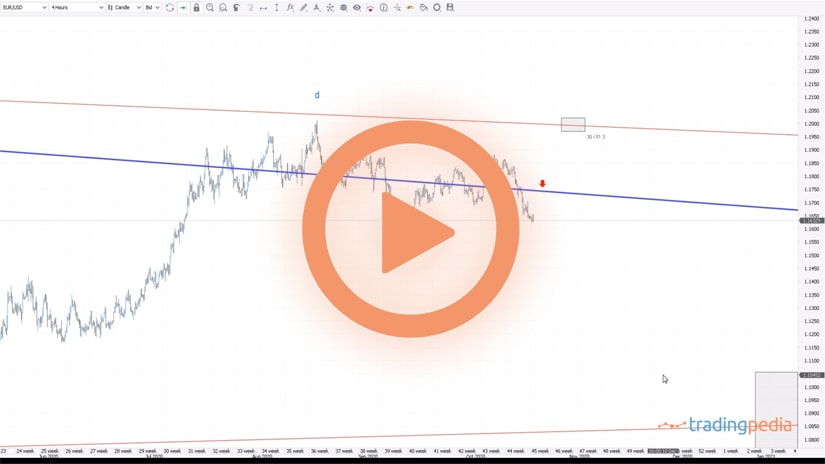

We will also look at the correlation between oil and some currencies in various oil-producing countries in the world. In this case, we will use the direct correlation between oil and CAD. Also, we will check what CFDs are when compared to derivatives like futures and forwards. Oil as an investment is a very interesting thesis for the future of humanity because major oil companies in the world started to downsize their explorations and investments because of a rising trend toward environmental policies around the world, especially in the European Union.

Therefore, we will cover all these aspects but also at fracking and the shale oil industry and how it changed the playing field between the United States and the rest of the world. Oils as a commodity is an alternative investment, having the purpose to offer a hedge in a portfolio. For instance, investors add oil to a portfolio to hedge against inflation. On the other hand, the price of oil is a direct determinant of inflation. Higher oil prices will lead to higher inflation, lower oil prices to lower inflation.

This year, in 2020, the price of oil fell well below the zero level. It created a deflationary wave all over the world, as inflation dropped below zero in many countries. Because of that, central banks have a problem raising the inflation expectations in the future, and they will have a hard time implementing the monetary policy.

Oil is sometimes used as a particular asset in a portfolio. For instance, a portfolio consisting of stocks, bonds, and so on, that receives an asset that is not correlated to the general portfolio, diversification benefits are obtained.

Being a commodity, supply and demand influence the price – the more the reserves and supply, the lower the price of oil. As a response to the April 2020 drop below the zero level, the OPEC got all the members to agree to limit production levels. As such, the price recovered well above the zero level.

Oil discoveries are also important for the price of oil. Some are expensive to extract now, but they do exist. Stay tunned for the next video part of this series. Bye, bye.