Hello there, this is tradingpedia.com and this is the start of a new series we build here on tradingpedia.com. It is about gold, as you can see.

Gold has fascinated people for millennia and represents the only form of money that survived thousands of years. To this day, this being November 2020, gold offers an aura of independence when it comes to central banks, inflation, and so on.

Overview

Perhaps the best example is what happened to gold in 2020 during the COVID-19 pandemic. As the pandemic hit the Western world, investors turned to gold as safe-haven, a protection against the doomsday.

We will cover many aspects, both fundamental and technical. For instance, what is gold as a commodity and what it means as an investment. Also, the relationship between gold and inflation and the value of money – what drives the demand for gold, and we will cover the investment community, central banks the industrial production of gold, households demand for jewelry, etc.

How To Trade Gold

The focus of this series is to show the retail trader everything there is to know about gold. Moreover, how to trade it in the 21st century as there are so many options to do so. For instance, one can own the physical stuff. Well, there are numerous outlets you can find over the Internet and buy gold. After that, against a fee, the gold seller will store your gold, etc.

We will also cover paper gold or gold as an investment – ETFs that have exposure to the gold industry via the gold mining sector. This is a cheaper way to gain exposure on gold rather than buying shares in a gold mining company. When you own shares, you participate into the company’s decisions, and it is more expensive to own shares than trading ETFs. Also, an ETF has lower costs.

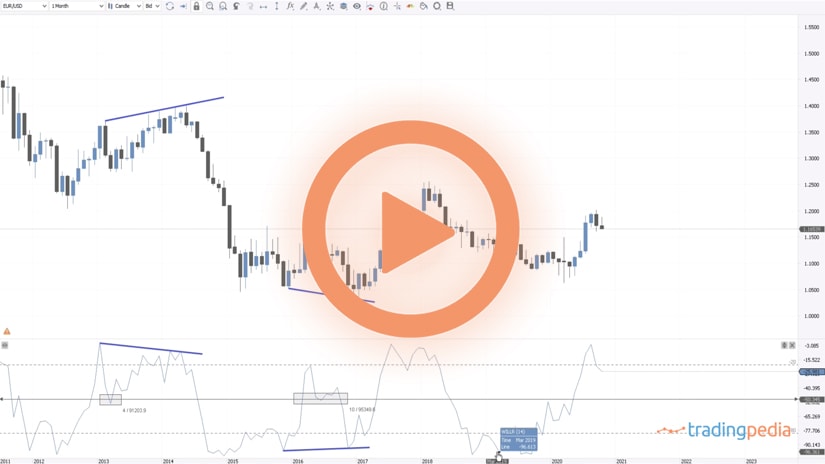

Gold can be denominated in various currencies, not only in USD. However, the XAUUSD is the most common one.

This would be the bulk of our series dedicated to gold. We will start slowly, but the main focus is on how to trade gold into the 21st century.

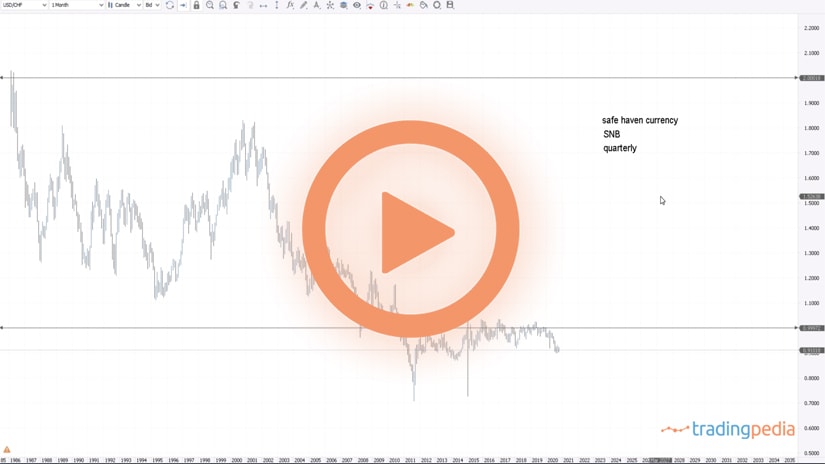

We will cover three different parts. One is what does gold mean for the retail trader, as there are various ways to gain exposure to gold and the main purpose of owning gold is to benefit from its safe-haven characteristics. What is more important, we will look at clear examples on how to trade gold, and why do we want to own this curious yellow metal? Why do we want to have exposure to such a metal and why it is viewed as a safe-haven?

Have you ever wondered why always Bitcoin is shown in the gold color? Because of the association with gold. By the time Bitcoin was presented, the idea was to suggest that something valuable was born.

I am not the one to argue for or against Bitcoin. I am just telling you that gold suggests value, and this is why Bitcoin comes with this color.

In certain countries, gold helped people mitigate government mismanagement of money. Think of what happened this year in Turkey, or in Venezuela and Argentina in the past. When money loses the buying power, people return to alternative investments, but the “father” of all alternative investments is gold.

Related Videos

Conclusion

No matter how you put it, owning gold in its various ways offers diversification benefits that investors appreciate when things go bad. And, in 2020, things did go bad. Therefore, it is no wonder that gold made a new all-time high above the $2,000 level.

Stay tuned for the second video part of this series – bye, bye.