Hello there, this is tradingpedia.com and this video continues from where we ended last time with the concept of trading for a living. We have covered most aspects – what it means, what are the expectations, how to make the most of the market when it doesn’t move, like the EURUSD here, and so on.

If the EURUSD does not move, the volatility on other currency pairs is also subdued and you will have a hard time to make ends meet on a market that is less volatile by the day.

Choose Your Trading Style

The trading style plays an important role too. If you are a scalper, swing trader or investor, this has an influence on the size of the trading account, the risk taken, but also on the horizon of a trade.

Let’s assume that on the EURUSD here we are actually bearish. We believe that the EURUSD should come back to 1.08 from1.19 reached in July 2020. It doesn’t matter why, this is not the subject, but let’s say that we have a scenario that the market moves lower. Regardless, we want to sell it from here, but the pair it did not move for 43 trading days. What are you going to do? When you trade for a living, you need to make money constantly so you trade pretty much a big volume and must pay attention to all the costs associated to trading.

I am talking about commissions, for example. Make sure that you negotiate a deal with your broker for better commissions, for instance, or on a discount on commissions based on trading a higher volume, etc. These factors account for the increase in profitability.

Consider The Time Horizon

Coming back to our scenario, before going on the short side, we should always consider the time horizon. What is the possibility that the EURUSD will move like this in one single day, from 1.19 to 1.08? Literally zero, it is impossible. Therefore, we need to account for some time to give the pair room to move to the downside.

It means that possible swaps, negative or positive, will affect the account. At the end of each trading day, the broker takes or credits the account an amount, depending if the swap is negative or positive.

If we check on the EURUSD and go on Specifications to find out the swap type, we see that it is more expensive keeping a long position overnight for the EURUSD than short. It also means that you pay a negative swap in trading the EURUSD in both directions, but less if you are short.

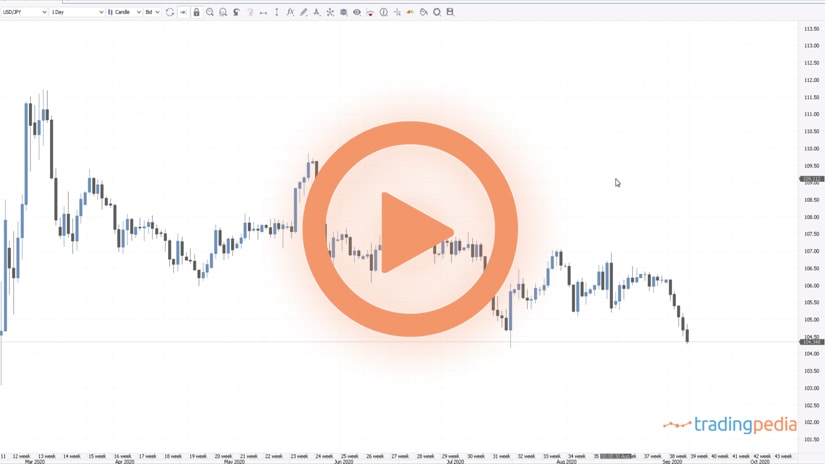

In any case, if you wait 43 days and say that the market takes another 43 days, but you should deduct what is paid on negative swap. How about trading an equivalent currency pair that trades in a correlated manner? That is the USDCHF.

The two have an inverse correlation based on the fact that the EURCHF trades in a tight range close to 1.07, with subdued volatility. The chances are that a move lower on the EURUSD will translate into a move higher in the USDCHF. If you check on the USDCHF the specifications and the swap points, there is a positive swap being long USDCHF when compared to a negative swap being short the EURUSD.

Therefore, instead of shorting the EURUSD as your analysis says, how about going long USDCHF and all this time, for 43 days, you made money even if the EURUSD did nothing. And, if you are right and the EURUSD declines and the USDCHF advances, you will still make money every day on top of the profit the market delivers.

Related Videos

Conclusion

One may wonder how this trade will fit into my calculations as these are ninety-something trading days? Well, you don’t trade only one currency pair or one market. You don’t use only one trading style. On some trades you are a swing trader, on some other trades you are an investor, on some other ones you use fundamental analysis, and so on. You also diversify the volume between different trades in such a way that everything comes together and at the end of the year you may draw a line and say that you traded your best.

Thank you for being here and bye, bye.