Hello there, this is tradingpedia.com and this video shows what inflation is, or what the Consumer Price Index is, and why it matters for the market, for all these currency pairs as it affects the market’s volatility.

Inflation Definition

Inflation, or the Consumer Price Index, is released by any economy, usually monthly, but also the yearly data is interpreted. In some countries, if you check the economic calendar, there are two measures of inflation – one is the headline inflation and another one is the core inflation. Typically, the core inflation does not take into account the energy prices, or the oil prices, because they are considered to be too volatile.

Inflation sits on every central bank’s mandate. Every central bank in the world, including the Fed, that has a dual mandate, has a mandate or part of it that refers to price stability. But price stability does not refer to the market not traveling to the downside or to the upside as, for example, here. Price stability refers to inflation not exceeding certain levels. The 2% level is perceived as the one not affecting the zero, deflationary level, and not high enough to affect the value of money. Therefore, central banks try to calibrate inflation in such a way that it will not affect price stability.

Hence, higher inflation leads to central banks raising interest rates, and that is positive for a currency as long as inflation does not exceed the 2% level – the threshold of most central banks. Below, but close to 2% in the case of the ECB, the Fed also signaled that 2% inflation is in line with its view of price stability.

So, high inflation, higher interest rates, are positive for a currency as long as the inflation does not exceed by much the 2% threshold. But what causes higher inflation? What is inflation? Inflation refers to the change in the price of goods and services from one period to another – for instance, from one month to another. What goods are considered?

There is the consumer basket, and in this basket, there are many items monitored by statistical institutions and then price changes illustrate if inflation moves to the downside or to the upside. Rampant inflation, or much higher inflation than the two percent level leads to hyperinflation. This is something that you have heard probably from Venezuela where the local currency means nothing anymore or usually some frontier or emerging markets also had episodes in the past with higher inflation.

When inflation falls, for instance if it reaches 5% and then falls to 2%, that is called a disinflationary process – you still have inflation, but positive one. The threat and the reason why central banks consider inflation at the 2% appropriate is the threat that the inflation will move to the zero level and when that happens, that is called deflation – much more difficult to fight by central banks by using conventional monetary policy tools, as we have seen in Japan that fights deflation for more than two decades.

Oil Market and Inflation

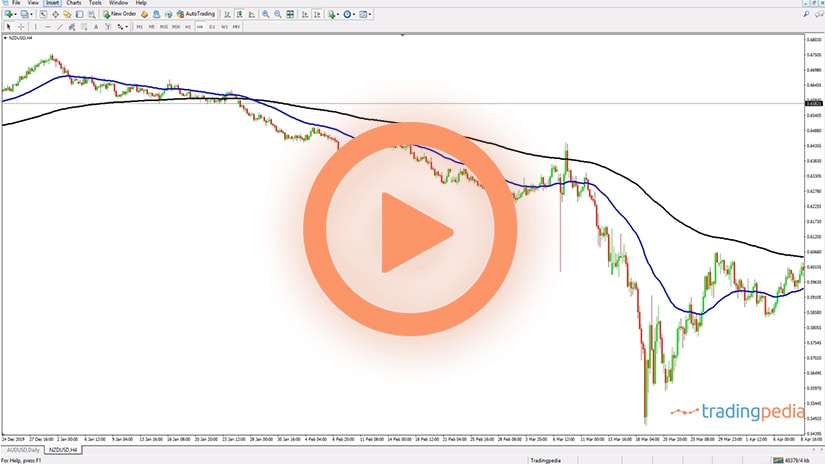

Another thing to consider here is what drives the change in prices higher or lower. A major driver is the oil market or the oil prices. Why oil prices? There is not only one price for oil, but many – WTI, Brent, OPEC, and so on. Oil prices drive inflation higher or lower.

The higher the price of oil, the higher inflation is. Central banks will raise interest rates and the currency will appreciate, as long as the interest rates remain around the threshold. What happens if the price of oil moves much higher and inflation does the same, but the central bank raises the interest rate in order to push inflation lower? What happens if the price of oil keeps pushing higher and higher?

This is why central banks look at inflation from a different perspective. They are ignoring the changes in transportation as the oil market proves to be extremely volatile. Nevertheless, oil is a major driver of inflation.

Look at this ratio as influencing the value of all currencies. For instance, in April 2020, oil futures closed below zero, as there were no buyers for the futures contracts. It closed -$40. Producers had no space to store the oil anymore and they were willing to pay for someone to come and pick the oil up. Such a move lower in oil prices means that there is no demand. No demand means slowing global economy. Slowing global economy means that the central banks will lower interest rates. Lower interest rates are negative for a currency, and so on. This is the logic behind inflation.

From this moment on, when you look at inflation, consider the price of oil, or the changes on the price of oil and what it means for a central bank when it analyzes the latest inflation report. High inflation is positive for a currency as long as the inflation rate does not exceed by much the 2% threshold.

Related Videos

Check the oil prices, higher inflation leads to higher interest rates, positive for a currency; lower inflation leads to lower interest rates, which is negative for a currency; if inflation drops below zero, this is deflation, even worse for a currency; if inflation falls into positive territory, that is a disinflationary process.

Finally, keep your attention on central banks on the core CPI, and not necessarily on the headline inflation.

Different Types of Inflation

Inflation is measured by monitoring the price changes of a basket of goods and services over a period, usually monthly. Yearly data is also observed, but the monthly releases provide more insights into what actually caused prices to rise and fall.

We all think of inflation as a period when prices rise, but, in fact, inflation refers to any change in the prices of goods and services. Inflation may rise, remain constant, or fall. Depending on the rate of growth or decline, central banks have different tools to tackle inflation.

Economic studies in time have led to the idea of price stability surrounding a certain inflation level. As mentioned earlier in this article, inflation around the 2% level represents the price stability for most central banks in the developed world.

However, inflationary targets change in time. The best example comes from the most influential central bank in the world – the Federal Reserve of the United States or the Fed.

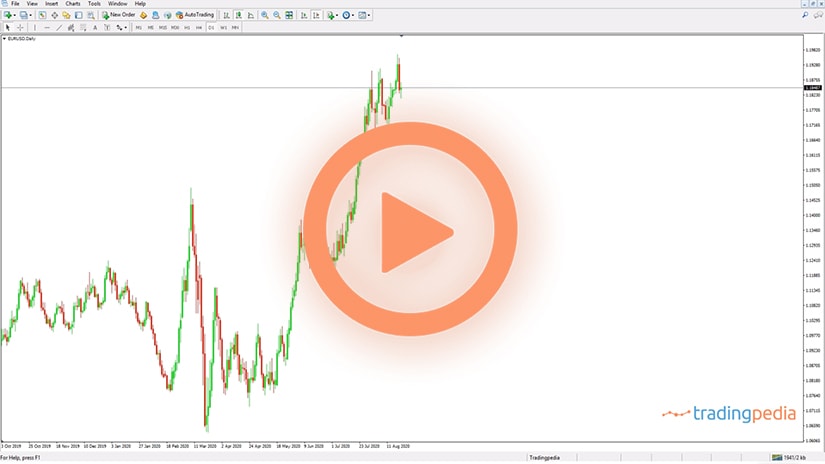

During the 2020 pandemic, the Fed used the opportunity and changed its mandate. From August 2020, it now considers inflation averaging 2% over a period, and not only reaching the 2% target.

This had a tremendous impact on market participants that suddenly did not know what is the metric the Fed uses to measure inflation. More precisely, how high and for how long is the Fed willing to let inflation rise so that it averages 2%.

When an analysis excludes inflation, it is said that it uses “real” prices. Think of it for a minute – if your capital gain in one year is 10%, and inflation over the year was 2.5%, the real gain is 7.5%. Therefore, inflation affects everything, from the income a household gets from the day-to-day jobs of its members to the capital gain or any other gain over a period.

Hyperinflation

When money loses its value literally overnight, it is said that a period of hyperinflation started. As the name suggests, hyperinflation refers to periods of extremely high levels of inflation. Or, inflation is rising too fast – so fast that the population and businesses cannot cope with the frequent change in prices.

Throughout history, many episodes of hyperinflation appeared in different parts of the world. The Weimar Republic’s inflation in Germany is the classic example, but other ones, closer to our time, exist. For instance, Venezuela, Argentina, or other countries in South America have experienced episodes of hyperinflation.

While many traders live under the impression that hyperinflation is an isolated case, we have Turkey in the last decade that contradicts the statement. The chart below shows the USDTRY over the last decade or so, and reflects how much ground the Turkish lira has lost against the U.S. dollar – it fell from 1.13 to 8.5 in a little over a decade, showing what happens when the government chooses to debase its currency.

During periods of hyperinflation, households dump the local currency because they lose faith and trust in it. As such, foreign currencies are favored (e.g., the U.S. dollar, the euro, the Swiss franc), perceived as more stable.

Also, gold and other commodities are traditionally viewed as offering a hedge against inflation. Finally, collectibles, such as fine art, rare wine, etc., offer another alternative to seek protection against periods of hyperinflation.

Disinflation

Periods with rising inflation, but at slower paces, are known as disinflationary periods. Imagine inflation rising to 1.1% from 0.9% in one month, then to 1.6% in the second month, followed by 1.8% in the third month, and so on.

While the overall inflation rate is rising, it does so at a diminishing rate. Thus, disinflation resembles the slowdown in economic activity right before the peak of the business cycle.

Deflation

The real problem for central bankers (and for traders alike) comes from periods of deflation. When inflation turns negative, or when prices decline from one period to another, that is the moment when everybody has a problem.

First, the population postpones purchases. It does so in the hope that prices are going to fall some more in the period ahead, and thus, the economy starts contracting faster than it usually does so in economic recessions.

Second, central banks have a hard time bringing inflation back to the target and usually are impotent when a deflationary spiral grips the economy. It takes a long time for the economy to recover and prices to start rising again.

Finally, traders are confused because during deflationary periods, the market reacts differently to economic data than it usually does. Also, because a central bank uses unconventional monetary policies during deflation, currencies act in an unusual way.

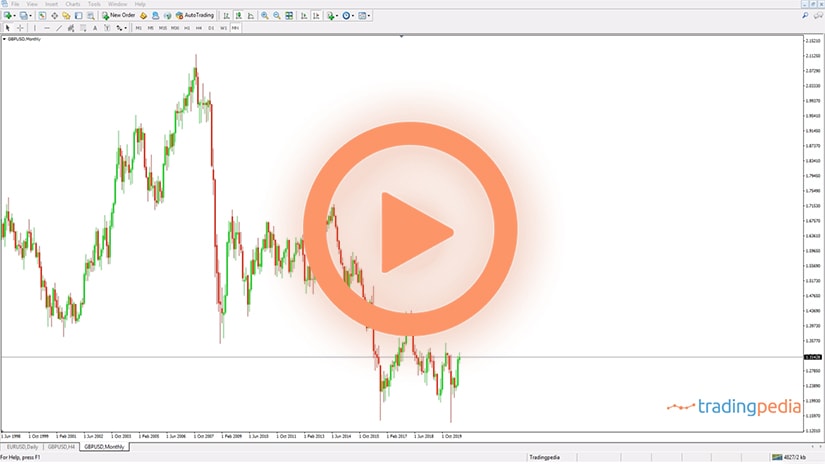

Here is the USDJPY monthly chart, showing the excessive Japanese yen strength during the deflationary spiral in Japan that gripped the economy for more than a decade. At some point, the Bank of Japan intervened with extreme quantitative easing and other unconventional monetary policy, to weaken the yen and to bring inflation back to the target. To this day, it failed to reach the 2% target.

Why Do Currency Traders Care?

Traders care about inflation because central banks adapt the monetary policy based on how inflation fluctuates. Higher inflation toward the inflation target is bullish for the currency. However, inflation in excess of the target is not so bullish anymore, as investors start pricing in the possibility of hyperinflation kicking in.

The Basket of Goods and Services

One of the main things to consider when interpreting inflation is the basket of goods and services it refers to. The typical CPI in most advanced economies only considers items in categories such as food, transportation, shelter, and so on. Sometimes even food and transportation are left aside because they are considered too volatile.

But the day-to-day life is impacted by other goods and services. Think of education, for instance, or healthcare – while their prices rose year after year, they are not part of the services considered in the CPI basket, hence they are not accounted for when calculating inflation.