Hello there, this is tradingpedia.com and this video deals with trading stocks vs. trading the stock market, what are the differences between the two and what to do when the broker offers the possibility to trade both markets.

Understanding The Broker’s Offering

Let’s make a headline here – stocks vs. Forex, advantages and disadvantages. The first thing is to understand the broker’s offering. For instance, if the broker offers the possibility to trade stocks, you want to make sure what the product is. It is likely that the broker offers CFDs and not actual stocks. These are Contracts for Difference and they represent instruments that track a stock but if you trade a CFD it does not mean that you actually own that stock.

For instance, this broker offers all these CFDs from all over the world. If you choose one of those products and trade, you are not buying shares but trading a CFD and you make a profit based on a difference or a loss depending on the direction.

In this way, CFDs and currency trading work in a similar manner. You have the possibility to buy or to sell, regardless of the currency pair or CFD and you have unbounded risk if you short both markets.

But if your broker gives you access to the actual stock market, another way to trade is to actually go long or short stocks. You must consider margin trading. It comes with a cost.

You would buy stocks on margin because you want to participate more to the upside potential of a stock. For instance, let’s assume you have $10,000 and you want to buy Tesla shares. You have two options – you may buy shares worth of $10,000 or you may borrow from the broker an x amount based on your collateral. The broker will give you funds, and you will buy more as you have more funds. The positive thing is that you can participate more on the upside. The drawdown is that you have to pay interest on the borrowed funds. Therefore, the broker also acts as a lender.

If the market reverses, you will participate on the loss too, in the sense that you will receive a margin call if the collateral cannot cover for the position or the broker will close the position.

Difference Between Trading Stocks and Forex

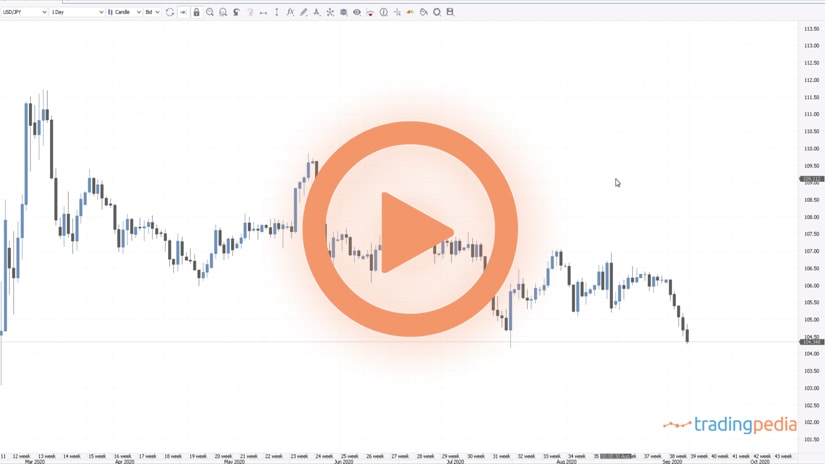

The difference between trading and individual stock and the Forex market is that when you short a stock the maximum level the stock can drop is zero. However, if you buy a stock, there is the potential for unbounded profit.

In the FX market, the maximum that a currency may drop is not limited. The EURUSD now trades 1.18 but it can go to 0.1. There is a big difference. But if you short a Tesla share at $500, the most you can make is $500.

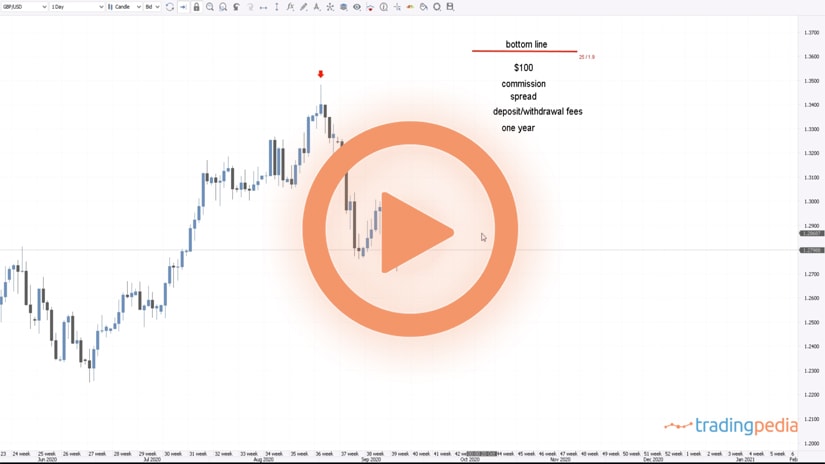

Another difference comes from the costs or commissions. Trading actual stocks comes with a cost of opening an account with a broker. Some brokers have limitations, as in the US most brokers do not accept international clients and, if they do, there is a minimum amount to fund the trading account.

Nowadays things have changed a bit, as some brokers offer fractional shares trading, but those brokers are usually in the United States and recently in Europe too.

Related Videos

Stock Indices

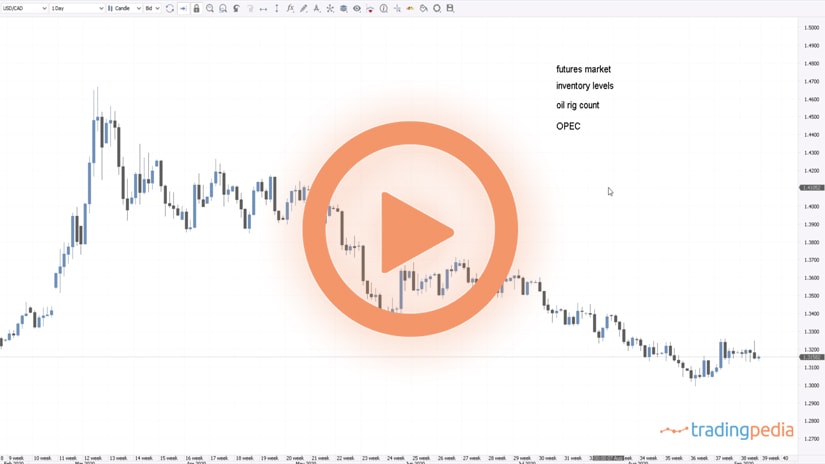

Yet another thing to consider is to trade stock indices. If you don’t know what company to buy or sell or if you are bullish on, say, the tech sector in the United States, you may want to own an entire index. Nasdaq 100 is an index tracking the biggest technological companies in the United States, like Amazon, Tesla, Microsoft, and so on. Therefore, you may not want to own shares in a particular company but inmore. If you do so, consider that indices change their composition from time to time.

Only recently, the Dow Jones kicked out from its componence a few companies, like Exxon, and introduced some other ones, like Salesforce. Therefore, an index, while it keeps the same name, it changes its composition from time to time. It also rebalances.

Luckily, most brokerage houses that offer currency trading they also offer indices using CFDs. The only difference is that trading CFDs is a bit more expensive, as commissions are bigger. Otherwise, consider margin trading and the costs associated with buying or selling on margin.

Thank you for being here, bye, bye.