Hello there, this is tradingpedia.com and this video complements the money management video that is already on the website. It refers to how to derive the proper stop-loss level when trading at market.

Overview

Trading at market is something that many retail traders are tempted to do and sometimes it is the only chance to trade when the market “runs away” from a level. For example, if you want to buy a support level, the market may come to it, missing the pending order by a thread and then runs away in the opposite direction. As such, the only thing that you can do is to trade at market.

Where to Place Sto-Loss

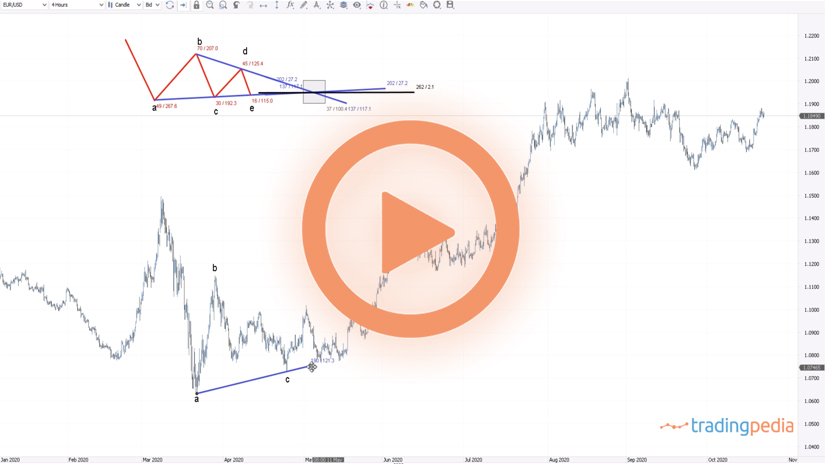

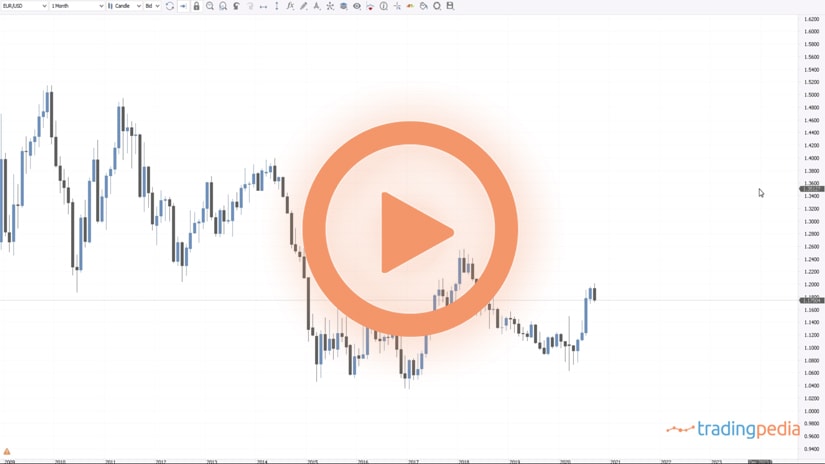

In doing so, the tendency is to place the stop-loss at the previous swing’s high or low. This is the EURUSD and the current price action is 1.1847 and the highest level on the EURUSD was 1.2010 in September.

Assuming that we are bears, we can draw a trendline like this and we see that the market broke it here, then retested it one time, two times, and even here we may be bearish too. Assuming we sold the EURUSD, what would be the next logical place to put the stop loss?

Most traders use the previous market swing high or low. If we take a Fibonacci retracement level and we measure this move, we see that the drop came exactly at the 61.8% level. Many trading strategies buy the 61.8% level so if you go long here, where would you put the stop? Naturally, at the previous low. This works well for many times, but often the market pierces those lows or highs and then reverses in the opposite direction.

Just like it happened here. Imagine you were bearish on the EURUSD for whatever the reason. But if you go short here and place a stop-loss order here, the market comes, takes your stop, and then moves lower.

You might say, well, if it was a good place to short it here, why not short it again? And then shorting it here, the market reverses, makes a new high, and comes back to the same level.

You short again. Needless to say, the market makes and a new high, and so on. Therefore, placing a stop loss at the previous higher high or lower low is not necessarily a strategy that works. It works many times, but often it doesn’t, and this is the recipe to ruin a trading account and, more importantly, to ruin your confidence.

Related Videos

Trading at Market With the Right Stop-Loss

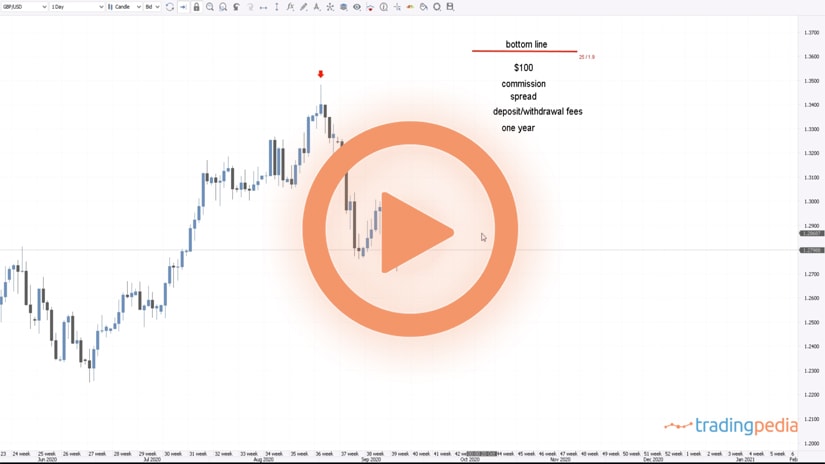

So, in order to avoid doing that, what is the way of trading at market with the right stop-loss? It all starts with the size of the trading account. Let’s say the trading account is worth of $10,000.

At this point we said we are bearish the EURUSD for whatever the reason – it doesn’t really matter. If you want to sell the EURUSD here, you have to use the risk-reward approach in relation to the amount to risk in any given trade. Usually a trader risks 1% or maximum 2% of the trading account on any trade. One percent is the ideal. Why?

If we risk one percent of the trading account on any given trade, only if you have seventy-two consecutive losing trades, then the account will drop to half. In other words, it will reach 5k after 72 consecutive loosing trades. But on the other hand, if there are so many losing trades in a row, maybe you are not ready for trading, neither from a technical, nor from a fundamental perspective.

Therefore, one percent of $10k would be $100. To use an appropriate risk-reward ratio, we must set the take profit at a minimum $200 for a risk-reward ratio of 1:2 and ideally $300 for a risk-reward ratio of 1:3. The higher the risk-reward ratio, the better for the trade.

We see that the market high here is 1.2010 but we want to trade at market at 1.1847. If we trade 0.1 lots, it means that one single pip means $1. Therefore, if the market moves against us one hundred pips it means $100 – the risk for this trade.

But one hundred pips from 1.1835 is not enough for the market to make a new higher high. Therefore, we want to avoid for the market to make a new higher high and then to move in the opposite direction, because it can do so, especially during volatile events.

Therefore, we should not trade 0.1, but half of that – 0.05. With that volume, we can set the stop-loss at two hundred pips so that would be 1.2044, higher than the previous higher-high.

If this would be the entry and this the stop, then we measure the risk and project it twice to the downside to find the take profit. If your analysis does not envision 1.1480, you do not take the trade. In order for a trade to make sense, you need a risk-reward ratio of 1:2.

If you want a 1:3 risk-reward ratio, based on, for example, an analysis on a bigger timeframe, that would be even more appropriate. This is how you adjust the entry and stop-loss using money management rules in such a way that it makes sense with the overall analysis.

Let’s assume that you wanted to sell here – the same thing applies. From here, you look at the previous market high or low if you want to buy and then you adjust the volume in such a way that you don’t risk more than one percent of the trading account.

Therefore, with the 1:2 or 1:3 risk-reward ratio you will see if the market can go, according to your analysis, to that low or to that high. If yes, then that’s your trade. If not, you simple avoid the trade.

Thank you for being here – bye, bye.