Hello there, this is tradingpedia.com and this video covers the last category of flat patterns – actually there is one flat pattern that doesn’t fit any of the categories mentioned here. We already mentioned two categories – flats with weak and normal b-waves. This time we will look at flats with strong b-waves.

Overview

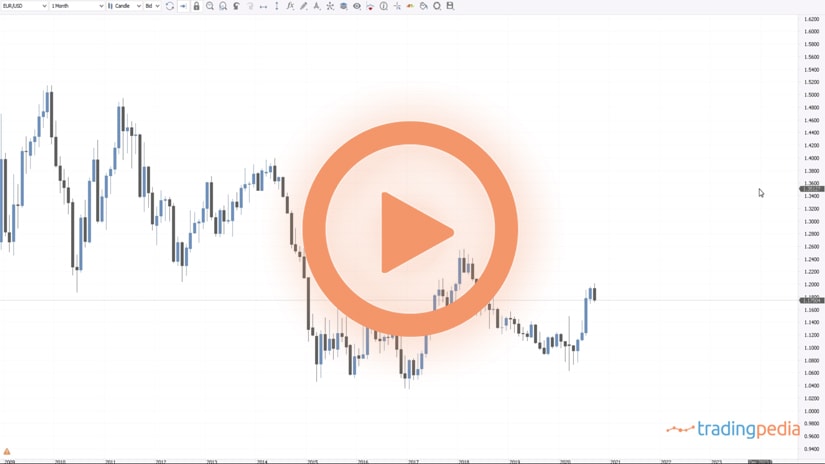

The flats here are very common in the currency market, but not so common in other markets. A flat pattern is a three-wave structure. Wave a is corrective, the b-wave fully retraces the start of wave a and then the market goes with the c-wave’s length that gives us the type of the flat.

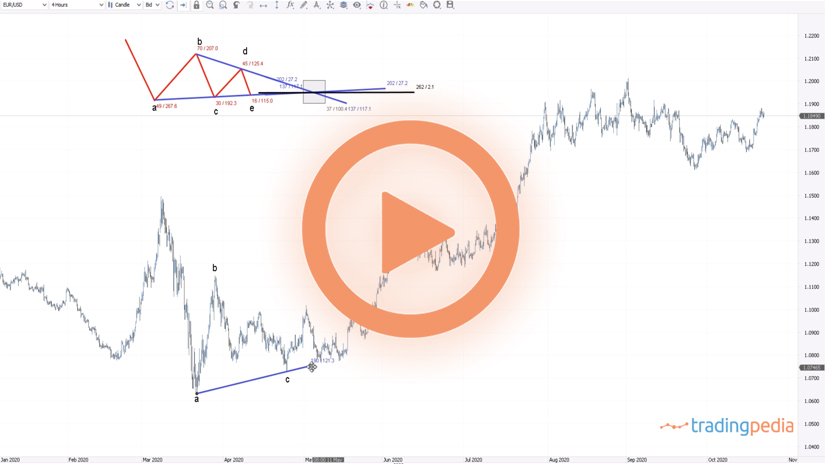

Therefore, the mandatory conditions are that the b-wave fully retraces the a-wave in the case of a flat with a strong b-wave. Usually, it ends between 100% and 123.6% of wave a. And then, based on the length of the c-wave, we have various types of flat patterns.

If the c-wave does not fully reverse the b-wave, the market forms a flat with an irregular failure. Another possibility is that the c-wave fully retraces the b-wave and ends between 100% and 123.6% when compared to the length of the b-wave. In this case, this is called an irregular flat. This is one of the trickiest patterns of them all because it will stop traders often. It is tricky because if you go short based on the retracement of the b-wave, the tendency is to place the stop-loss order at the previous high. Next, when the market declines, traders will try to buy it again, placing a stop-loss at the previous swing lower.

Elongated Flats

The third possibility is an elongated flat. Elongated flats appear in all the flat categories. The c-wave is still an impulsive wave and the chances are that all these three c-waves that form the three flat patterns are classic impulsive waves and not terminal impulsive ones.

Whenever you hear that term of an elongated flat, you should think of a contracting triangle as elongated flats are quite rare. Therefore, this is the category of flats with a strong b-wave. Next, based on the length of the c-wave, we have three types of flats – irregular failure (when the c-wave is shorter than the b-wave), irregular flat (when the c-wave is longer than the b-wave but not much longer than 123.6%) and an elongated flat (when the c-wave is longer than 123.6%, often longer than 138.2%, and even longer than 161.8%).

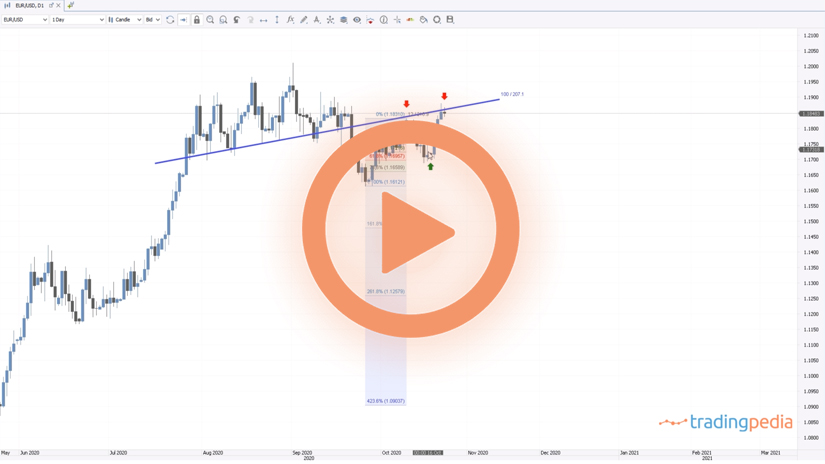

These are the three types of flats in this category. This is the EURUSD in October 2020. The marked advanced all the way to almost 1.20 before forming a horizontal consolidation. Have a look here – this is no impulsive wave because there is no extension, and the moves are identical. Hence, this is a three-wave structure, a corrective wave.

The move that follows is still not impulsive, but corrective. Why? Because, in an impulsive wave you need an extension – there is no extension here. Moreover, the length of this move is equal with the one here, which is not possible in an impulsive wave.

And then the market forms the c-wave. If we look at this arrangement, the c-wave fails to fully retrace the b-wave. Whenever you hear the word failure with the Elliott Waves Analysis, it means that the market signals a countertrend strength. By the time the c-wave fails to take these lows, it shows a bullish reversal. What’s important here is that the market only marginally took the highs.

With this category, we have covered all the three categories of flats. In each category there are three types of flats based on the length of the c-wave.

Related Videos

Running Flats

The only flat that remains to be covered is a running flat. We will cover that later in the trading academy and keep in mind that the flat patterns are the most numerous ones during the Elliott Waves Theory and the b-wave is critical.

The minimum retracement level into the territory of wave a is 61.8%. Next, the 61.8%, 80% and 100% give you the categories of flats, while the length of the c-wave gives the types of the flats.

Thank you for being here and have a great day – bye, bye.