Hello there, this is tradingpedia.com and on this part on how to trade gold we have discussed the CFDs or Contracts for Difference. The idea there is to speculate on the gold’s price direction and, if right, you earn the difference. We also looked at various costs of trading CFDs.

Overview

But there are also other ways of trading gold. This is the TradingView platform and on it you can find numerous gold-related market. Another way to gain exposure on gold without actually owning the physical stuff, is to trade ETFs or Exchange Traded Funds that have exposure on the price of gold.

This is one of the most famous of them all – the GDX. This is the most quoted when traders look to increase their exposure to paper gold or the demand from the investment community to gold. Exposure to paper gold comes from owning an ETF.

What is GDX

Therefore, if you think that the price of gold will make a new all-time high above $2,000 and more, you want to own shares in a gold miner. But how about owning or trading an ETF that tracks the moves of the gold mining sector? This is what the GDX does.

This gold mining segment is a trading powerhouse with both secondary and deep primary markets, but also with derivative markets. After 2013, this ETF is no longer limited only to US companies and at this point has companies from Canada, Australia, and so on.

On the GDX ETF you will gain exposure on three segments part of the mining industry. Over 91% of it is made out of gold mining companies, 4.4% out of integrated mining companies and the rest belongs to other previous metal companies.

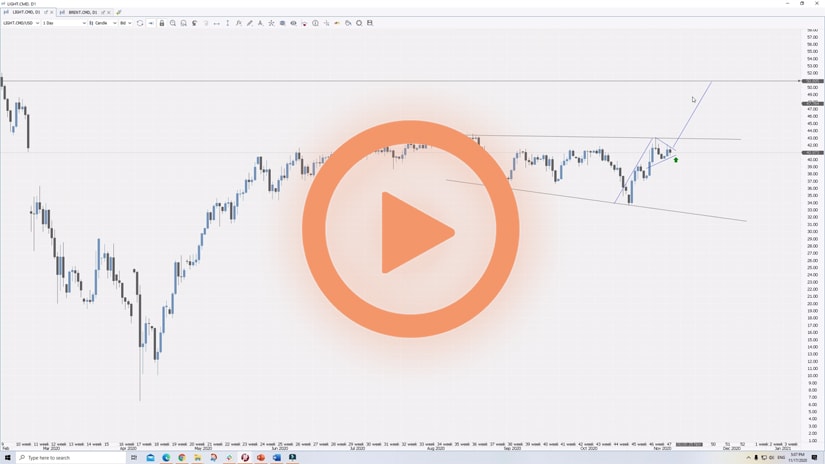

If we compare the GDX with gold, the XAUUSD on the same chart, we see a direct, positive correlation between the two assets. This is the deep in the price of gold in March, with the pandemic, and then the GDX dipped even more.

Related Videos

How to Use the ETFs

An ETF tracks the moves of the underlying market by a factor of magnitude bigger than the underlying market. It may track only a fraction of the market, the entire market, or more. In a way, it is similar with how the returns deviate from the mean. As the chart shows, the ETF outperforms to the upside and underperforms to the downside, when compared to the price of gold.

At this point we see that the price of gold collapsed today. This is November 23rd, 2020, and the price of gold broke the support level and so did the ETF.

Once again, why would anyone want to own an ETF rather than the actual product? Well, if you own the actual product, you cannot speculate on the decline on price – but you can do so with the ETF.

Some traders use ETFs to hedge against the actual long positions on gold in the portfolio. While most investors own gold to obtain diversification benefits, from time to time they may choose to hedge the long gold position via shorting an ETF with exposure on the gold market.

The difference between the two, if we consider this particular ETF, is that to the downside, if you are right, you will make more on the declining move. Stay tuned for the next part – bye, bye.