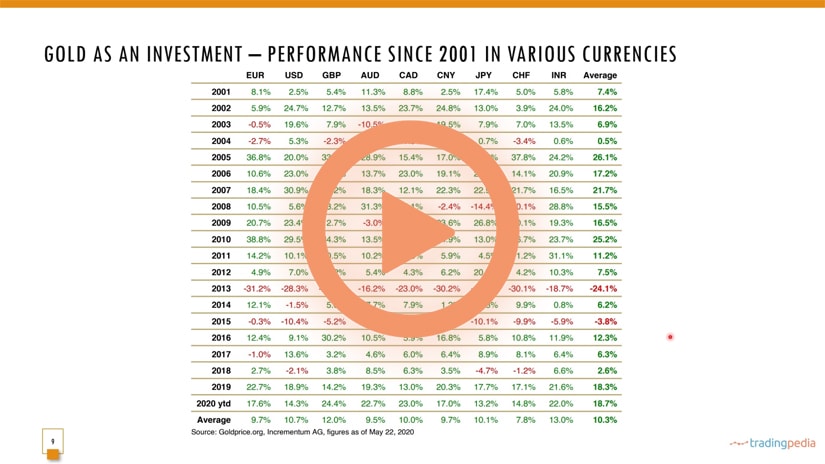

Hello there, this is tradingpedia.com and we continue our series dedicated to trading gold. In the previous video we stressed out the importance of understanding the value of historical data.

Now that we are in the 21st century, some things happened. The gold standard ended in 1970s, and so the financial system as we know it today began, with the USD its backbone.

Trading With Contracts for Difference (CFD)

We move on to another way to gain exposure to gold – by trading CFDs or Contracts for Difference. Trading with a CFD is using a currency broker and the broker offers access to other markets as well. Because of the stiff competition between brokerage houses, despite the fact that more and more people gain access to the Internet.

Most clients, as you can read in the brokers’ disclaimer, have a difficult time making a profit. Therefore, brokers add other products in order to put pressure on traditional brokers. At this point in time, a regular FX broker gives access to markets beyond the traditional FX market – stock market indices, commodities, silver, oil, platinum, grains, soybean, and so on.

When you trade gold with an FX broker, you trade a CFD. You do not own the actual gold. Instead, you speculate on the gold price. Can we also obtain diversification benefits by adding a gold position to a portfolio in a trading account? Yes, we can.

However, when we do so, we should be very careful on the costs of doing so. For instance, if you add gold to a currency portfolio, the next thing you want to know are the costs. If you are bullish, you want to buy gold, but what are the swaps – positive or negative? If you end up receiving swap, it reinforces the reason for owning gold on the long term.

How to Sell Gold using CFD

Also, a CFD allows you to sell gold, just like you sell the EURUSD, for example. But it depends a lot on what your aim is when you trade gold. If you trade gold from a scalping or swing trading perspective, then inflation does not matter. But if you have a day job and little time to spend trading and you want to sell the EURUSD, to hedge against it, you may want to buy gold a smaller position than being short EURUSD. This way, you are hedging your portfolio.

On the same portfolio, it means to have a long gold position on XAUUSD of, say, 0.05 lots against 1 lot EURUSD short, or something along the lines. So what if you are wrong and the EURUSD moves to the upside? That is when the gold hedge kicks in and the position is hedged. This is one way to speculate. However, when investing one must consider all the other aspects of owning gold.

Related Videos

Conclusion

The next video deals with CFDs and we will have a close look at this chart to see what happened to gold before and during the pandemic. Stay tuned for the next part – bye bye.