On Friday, March 5, Nasdaq (ticker: NDX) sold of hard at the beginning of the session only to rebound and close the day higher.

The NDX correction found a support level near 12,200 before beginning the rebound. Continued rallies above 13,000 would indicate that NDX may retest the all-time highs. A breakdown below Friday’s 12,200 low would suggest that deeper losses may be on the horizon to 10,500.

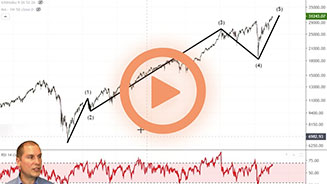

NDX Price Chart and Key Levels

The rally from Friday is a clue that the 12,200 support level is quite strong. Zooming in to an intraday price chart, if NDX is able to break above the downward sloping price channel, then Friday price action is the kick off to a trend that likely retest all-time highs. The downward sloping price channel is crossing near 13,000.

However, if NDX is unable to follow through with its rally beginning this week, then we may be in the beginning stages of a new downtrend. Should this be the case, the new downtrend will likely be contained within the downward sloping price channel.

A breakdown below the key support level of 12,200 is a big clue that the NDX price correction may continue further. Should a breakdown in Nasdaq prices take place, the next support level appears near 10,500.

Related Videos

Keep up to date with NDX and other key markets by accessing the Trading Price newsletter. With free membership to the TP newsletter, you’ll also receive trading tips and special reports.

We wrote this report as to why traders ten to miss their profitable expectations. Grab a free copy of the report when you join the Trading Price Newsletter sponsored by TradingPedia.