Trend continuation factor

This lesson will cover the following

- Definition

- Interpretation

Developed by M. H. Pee, the Trend Continuation Factor helps traders identify whether the market is trending and, if so, in which direction it is heading. It can be used in any timeframe with any currency pair, and it is suitable for beginner traders.

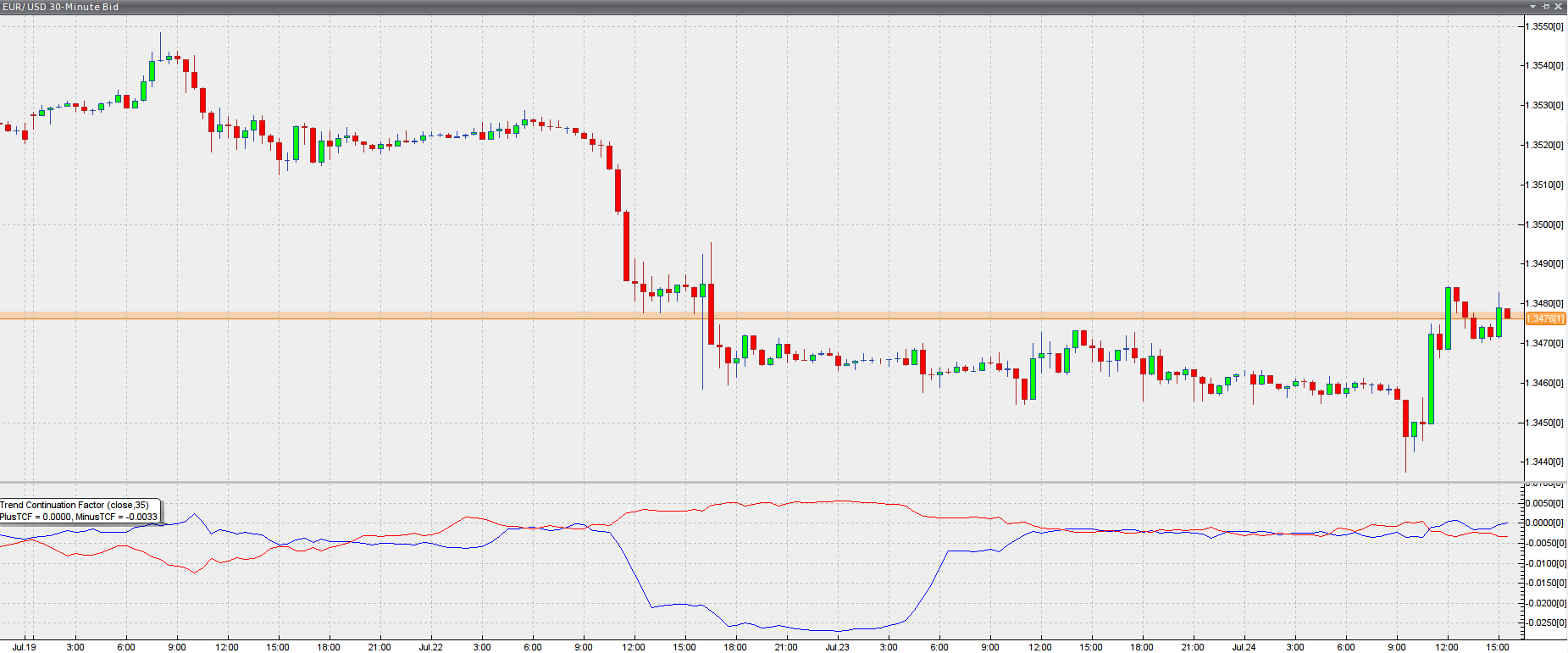

The indicator comprises two lines, namely the PlusTCF and MinusTCF, which correspond to bullish and bearish momentum, respectively.

If the PlusTCF line is positive, the prevailing trend is bullish, while a positive MinusTCF line signifies a bearish trend. Logically, both lines cannot be positive at the same time because the market cannot be in a bullish and a bearish trend simultaneously. However, they can both be negative at any given moment, implying that the market has consolidated in a trading range. Here is how the indicator is displayed on a trading platform.

Chart source: VT Trader

Regarding trading with this indicator, it is generally interpreted and acted upon in a similar way to the Average Directional Movement Index. The most basic trading strategy involving the TCF is to enter long positions when the PlusTCF line is positive and to enter short positions when the MinusTCF is positive.

Traders also tend to regard the crossovers of the PlusTCF and MinusTCF lines as entry signals in the direction of the advancing line. Thus, if the PlusTCF crosses the MinusTCF and becomes positive, you should initiate a long entry, and vice versa.

Apart from the two trading strategies listed above, more experienced traders can incorporate the Trend Continuation Factor into their trading plan by combining it with other indicators. As a reference point, you can use a number of trading strategies we have previously discussed in our “Forex Trading Strategies” guide. More particularly, you can look up strategies based on ADX (Average Directional Movement Index), as well as the combination between ADX and Parabolic SAR. Generally, replacing the ADX with the Trend Continuation Factor should yield results comparable to the original strategy.