T3 moving average

This lesson will cover the following

- Definition

- Calculation

- Interpretation

Developed by Tim Tillson, the T3 Moving Average is regarded as superior to traditional moving averages because it is smoother and more responsive, and therefore performs better in ranging market conditions. However, it has the disadvantage of overshooting the price as it attempts to realign itself with current market conditions.

It incorporates a smoothing technique that allows it to plot curves more gradually than ordinary moving averages and with a smaller lag. Its smoothness is derived from the fact that it is a weighted sum of a single EMA, double EMA, triple EMA, and so on. When a trend is formed, the price action will stay above or below the trend during most of its progression and will hardly be touched by any swings. Thus, a confirmed penetration of the T3 MA and the absence of a subsequent reversal often indicates the end of a trend. Here is what the calculation looks like:

T3 = c1*e6 + c2*e5 + c3*e4 + c4*e3, where:

– e1 = EMA (Close, Period)

– e2 = EMA (e1, Period)

– e3 = EMA (e2, Period)

– e4 = EMA (e3, Period)

– e5 = EMA (e4, Period)

– e6 = EMA (e5, Period)

– a is the volume factor; the default value is 0.7, but 0.618 can also be used

– c1 = – a^3

– c2 = 3*a^2 + 3*a^3

– c3 = – 6*a^2 – 3*a – 3*a^3

– c4 = 1 + 3*a + a^3 + 3*a^2

The T3 Moving Average generally produces entry signals similar to those of other moving averages and is therefore traded largely in the same manner. Consider the following:

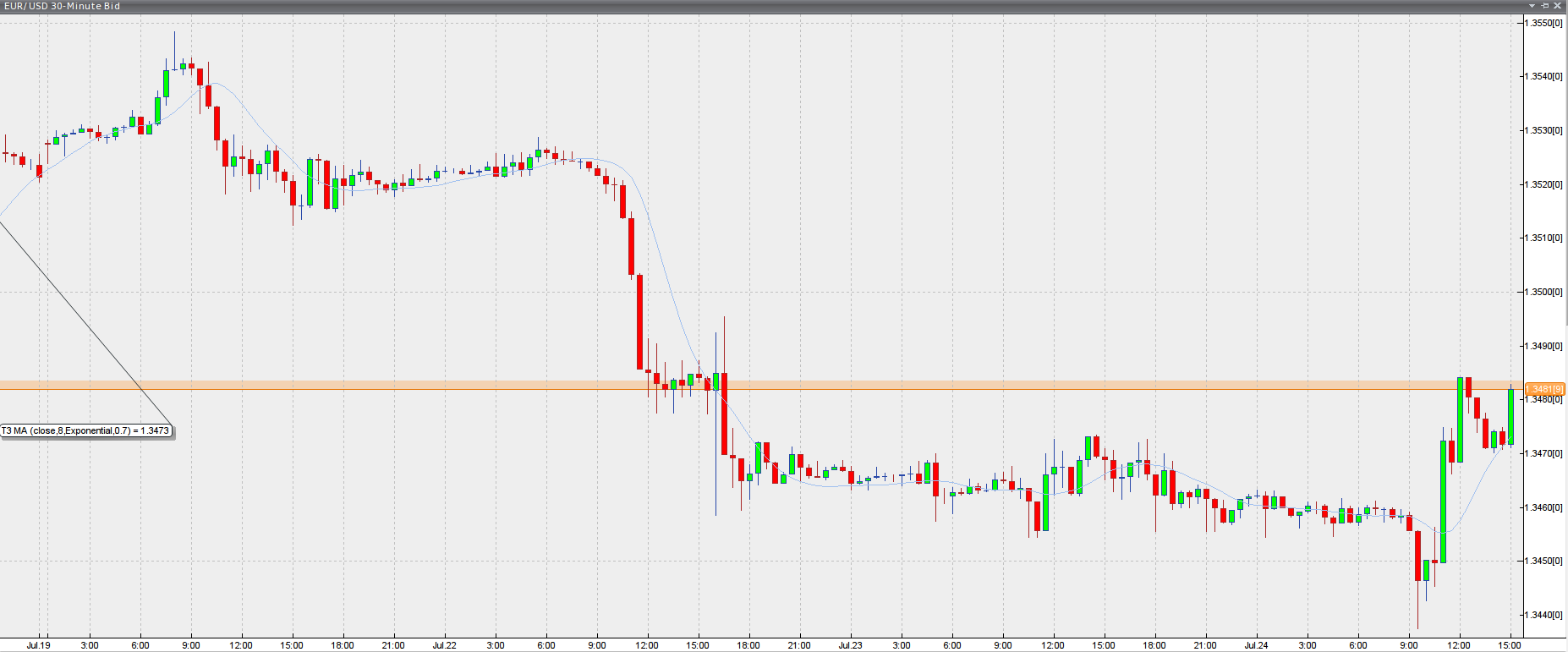

If the price action is above the T3 Moving Average and the indicator is heading upwards, we have a bullish trend and should only enter long trades (advisable for novice or intermediate traders). If the price is below the T3 Moving Average and it is edging lower, we have a bearish trend and should limit entries to short positions. See below for a visualisation on a trading platform.

Chart source: VT Trader

Although the T3 MA is regarded as one of the best swing-following indicators and can be used on all time frames and in any market, it is still not advisable for novice or intermediate traders to increase their risk level and enter the market during trading ranges (especially tight ones). Therefore, for the purposes of this article, we will limit our entry signals to those that occur in trending conditions.

Once the market is displaying trending behaviour, we can place trend-following entry orders as soon as the price pulls back to the moving average (undershooting or overshooting it will also work). As we know, moving averages act as strong resistance or support levels; thus, the price is more likely to rebound from them and resume its trend direction instead of penetrating them and reversing the trend.

In a bull trend, if the market pulls back to the moving average, we can reasonably assume that it will bounce off the T3 MA and resume upward momentum, allowing us to go long. The same logic applies during a bearish trend.

Last but not least, the T3 Moving Average can be used to generate entry signals when it crosses another T3 MA with a longer look-back period (just like any other moving-average crossover). When the fast T3 crosses the slower one from below and moves higher, this is called a Golden Cross and produces a bullish entry signal. When the fast T3 crosses the slower one from above and declines further, the scenario is called a Death Cross and signifies bearish conditions.