Relative Strength Index

This lesson will cover the following

- What is the Relative Strength Index

- How is it calculated and visualised

- What does it tell us

- How can it be of benefit

The Relative Strength Index is one of the most widely used tools in a trader’s toolkit. The RSI is an oscillating indicator that shows when an asset might be overbought or oversold by comparing the magnitude of the asset’s recent gains with its recent losses. A common misconception is that the RSI draws a comparison between one security and another, but, in fact, it measures the asset’s strength relative to its own price history rather than to that of the broader market.

The Relative Strength Index is useful for generating signals that help time entry and exit points by determining when a trend might be coming to an end or a new trend may be forming. It weighs the price’s upward and downward momentum over a given period of time, most often 14 periods, thus showing whether the asset has moved unsustainably high or low.

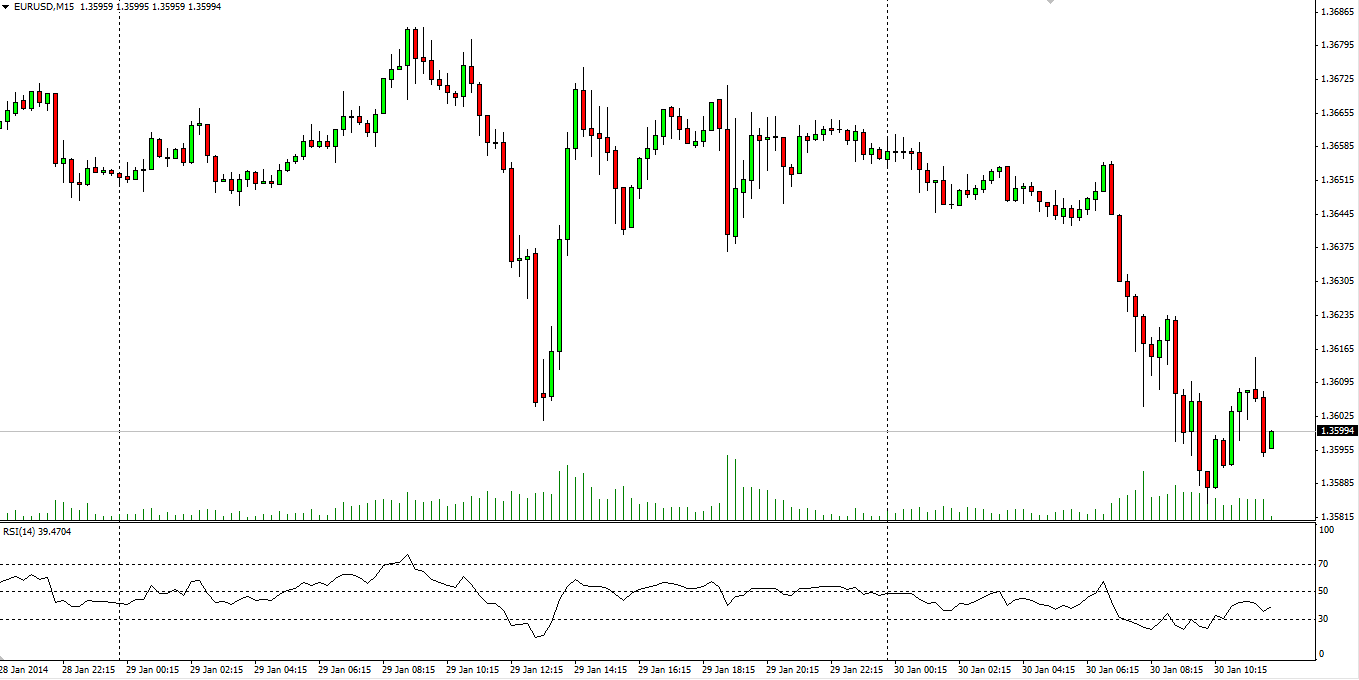

The RSI is visualised with a single line and is bounded between 0 and 100, with the level of 50 considered a key point distinguishing an uptrend from a downtrend. You can see how the RSI is plotted in the following screenshot.

J. Welles Wilder, the inventor of the Relative Strength Index, also identified two other fundamental points of interest. He considered that an RSI above 70 indicates that the asset is overbought, while an RSI below 30 suggests an oversold situation. These levels, however, are not strictly fixed and can be adjusted to suit each trader’s unique trading system. Trading platforms allow you to choose any other value as the overbought/oversold boundary apart from the conventional levels.

- Trade Forex

- Trade Crypto

- Trade Stocks

- Regulation: NFA

- Leverage: Day Margin

- Min Deposit: $100

How is RSI calculated?

Constructing the RSI requires several calculations to be made. The formula is as follows:

RSI = 100 – [100 / (1 + RS)]

Where the RS (Relative Strength) is the division between the upward movement and the downward movement, which means that:

RS = UPS / DOWNS

UPS = (Sum of gains over N periods) / N

DOWNS = (Sum of losses over N periods) / N

As for the period used for tracking back data, Wilder’s original calculations included a 14-day period, which continues to be used most often even today. However, it can also be subject to change according to each trader’s unique preferences.

After calculating the first period (in our case the default 14 days), further calculations must be made to determine the RSI once a new closing price is available. This involves one of two possible averaging methods: Wilder’s original – and still most widely used – exponential averaging method, or a simple averaging method. We will stick to the most popular approach and use exponential smoothing. The UPS and DOWNS for a 14-day period will then look as follows:

UPSday n = [(UPSday n-1 x 13) + Gainday n] / 14

DOWNSday n = [(DOWNSday n-1 x 13) + Lossday n] / 14

What does the RSI tell us?

There are several signals that the movement of the Relative Strength Index generates. As noted earlier, this indicator is used to determine the type of trend we have and when it might come to an end. If the RSI moves above 50, it indicates that more market players are buying the asset than selling, thus pushing the price up. When the movement crosses below 50, it suggests the opposite – more traders are selling than buying and the price is likely to decrease. You can see an example of an uptrend below where the RSI remains above 50 for the duration of the move.

However, keep in mind that the RSI should be used as a trend-confirmation tool rather than for determining trend direction on its own. If your analysis shows that a new trend is forming, you should check the RSI for additional confirmation of the current market movement – if the RSI is rising above 50, then you have confirmation at hand. Conversely, a downtrend exhibits the opposite characteristics.

Overbought and oversold levels

Although trend confirmation is an important feature, one of the most closely watched events is when the RSI reaches the overbought and oversold levels. They indicate whether a price movement has been overdone or is sustainable, thereby signalling whether a price reversal is likely or whether the market might at least move sideways and undergo some correction.

An overbought condition suggests that there are insufficient buyers left in the market to push the asset further up, thus leading to a stall in price movement. The reverse – an oversold level – indicates that there are not enough sellers remaining to drive prices lower.

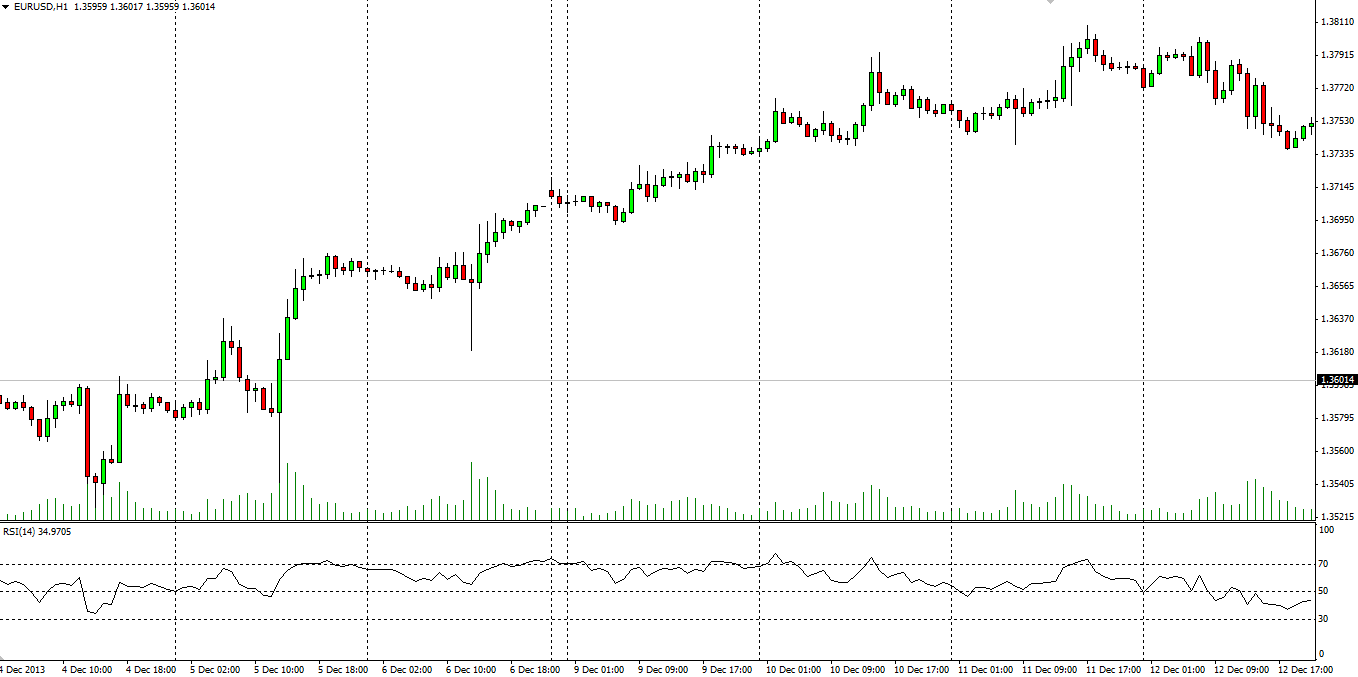

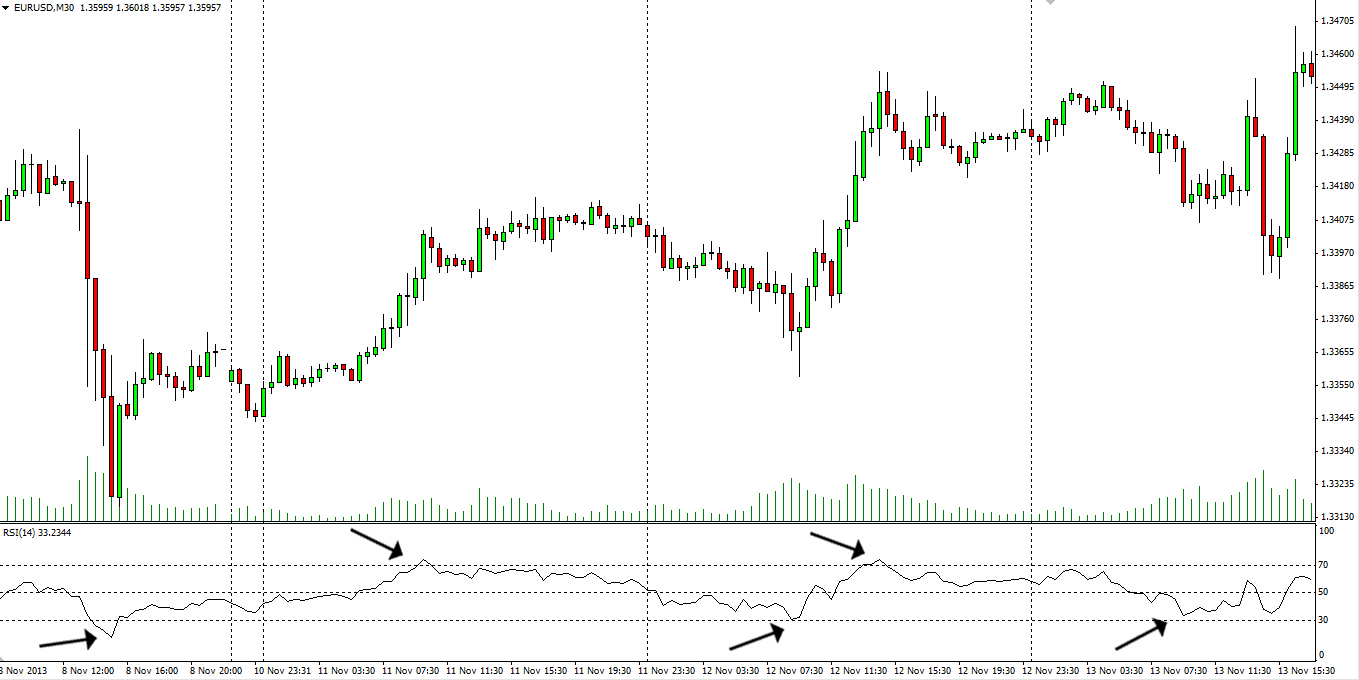

This means that when the RSI hits the overbought area (in our case 70 and above), it is very likely that price movement may decelerate and potentially reverse downward. Such a situation is pictured in the screenshot below. You can see two rebounds from the overbought level, with the first move being extraordinarily strong and bound to end in a price reversal, or at least a correction.

Conversely, when the RSI nears the oversold level, it often signals that the downward movement is coming to an end. Such a scenario is visualised below.

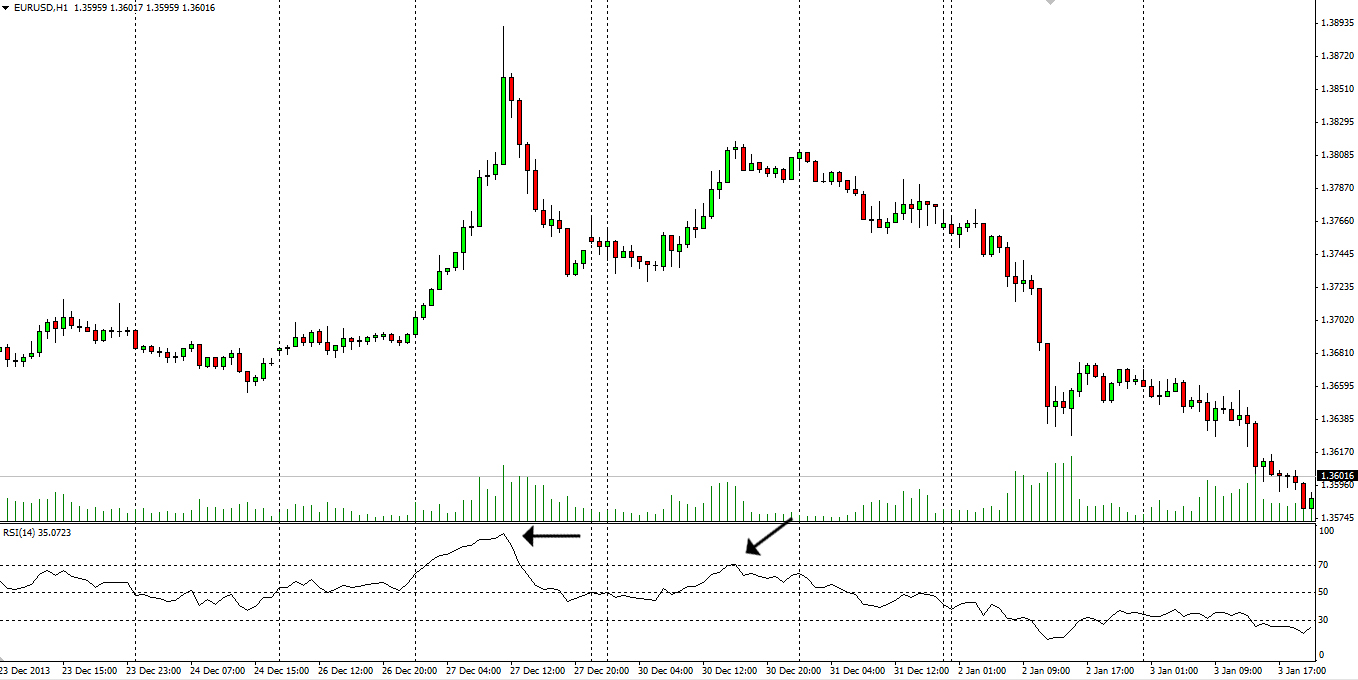

Having noted that prices tend to rebound from overbought and oversold levels, we can therefore conclude that they tend to act as support/resistance zones. This means that we can use those levels to generate entry and exit points for our trading session. As soon as the price hits one of the two extremes, we can use the Relative Strength Index to confirm a probable price reversal and enter an opposite position, hoping that prices will reverse in our favour. We can then set the opposite extreme level as a profit target. See the following screenshot, where you can see how the RSI line tends to bounce between the two extreme levels.

Changing the RSI settings

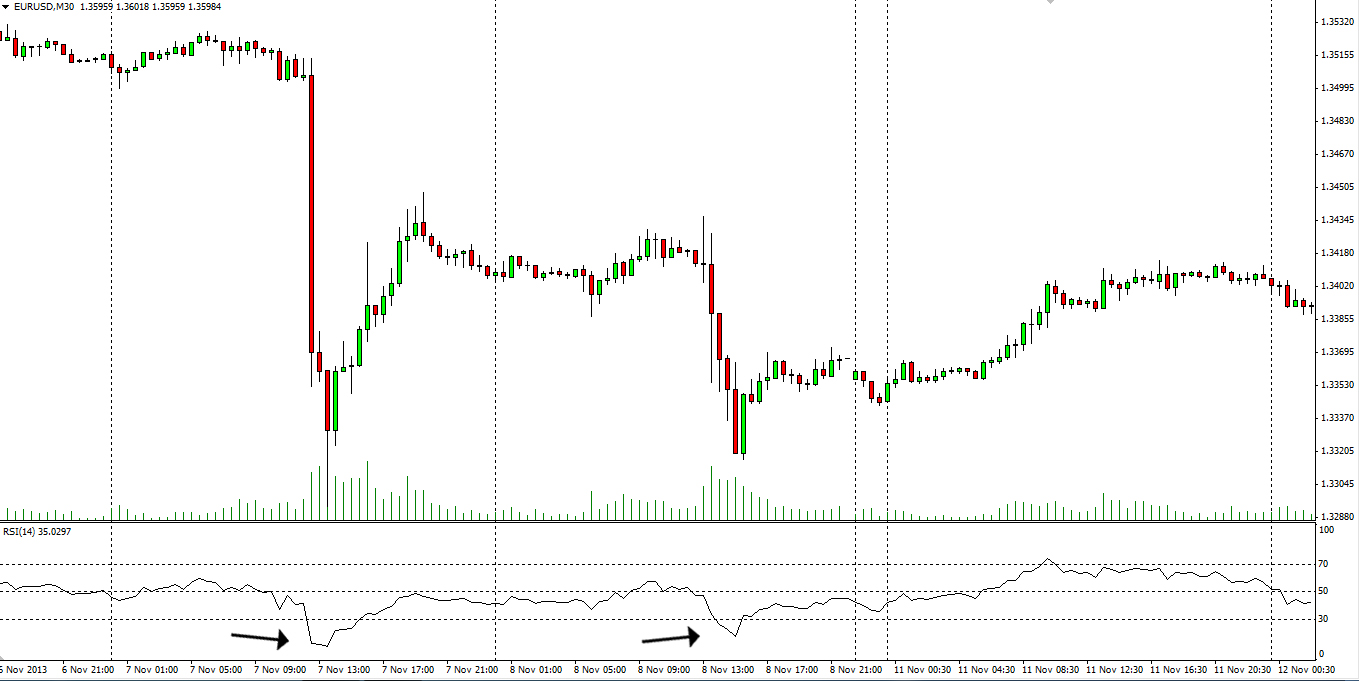

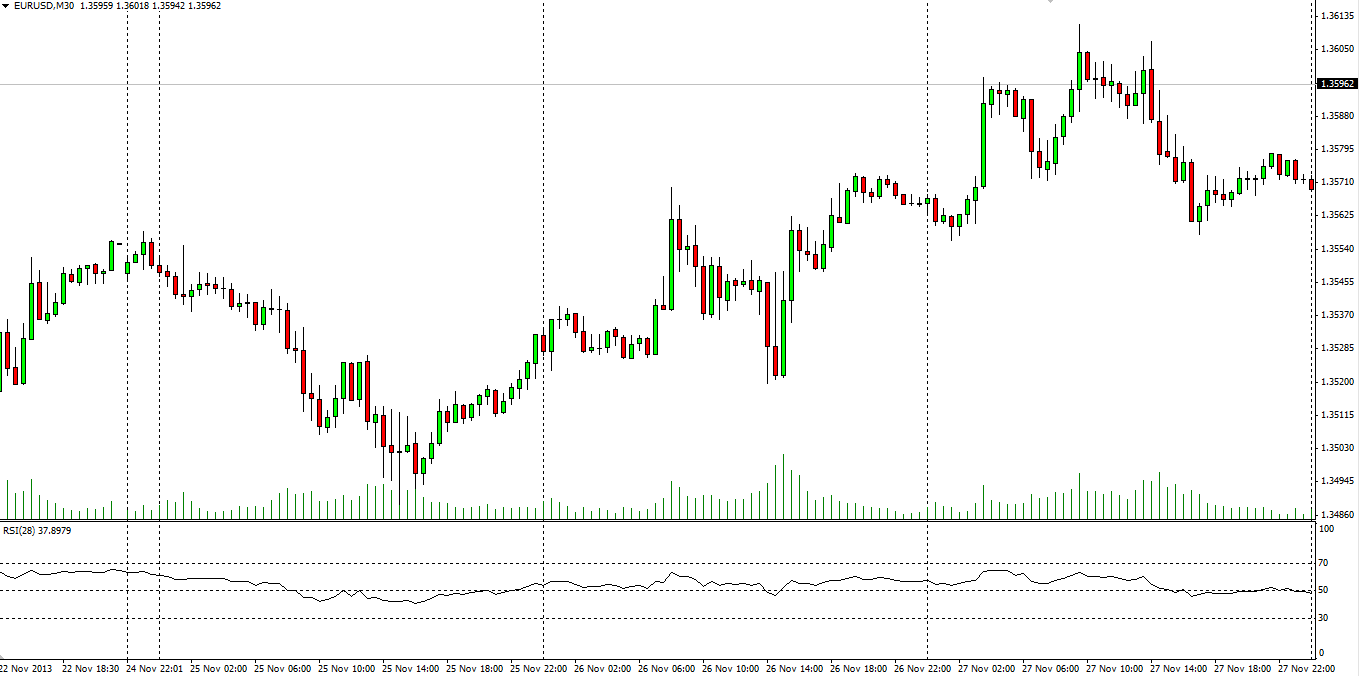

We mentioned earlier that the most commonly used period to calculate the RSI is 14 periods, as suggested by its inventor. This setting, however, is subject to change according to each trader’s uniquely tuned trading system. As with any other indicator, however, the larger the period of data included, the smoother the line visualising the indicator will be. Therefore, it will produce fewer false signals, but the ones it does generate will most likely lag behind the price action. In the screenshot below we have illustrated what an RSI calculated on the basis of 28 periods (twice the usual) looks like.

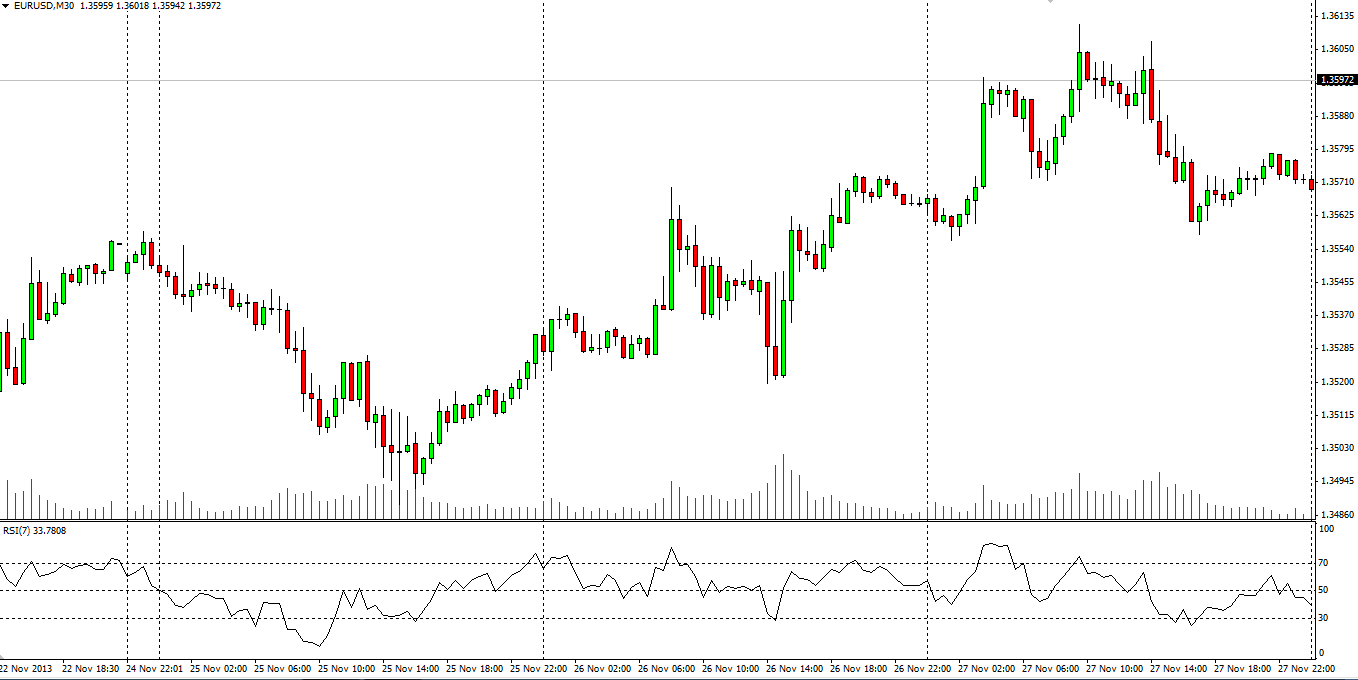

Logically, the RSI line will fluctuate much more each time we reduce the number of periods considered. The fewer the periods, the more closely the RSI will track price movement, allowing you to identify overbought and oversold situations much earlier, but at the cost of many more false signals. The same price action is pictured below, but with the RSI period reduced so that you can compare the two extremes.

As you can see, both of these period settings deviating from the default setting do not seem particularly suitable, especially for novice traders. We suggest that you first carry out extensive testing using the conventional 14-period time frame and then, if you are not satisfied, try out a setting that suits you best. But do not forget to scrutinise the new setting as well before incorporating it into your live-account trading strategy.