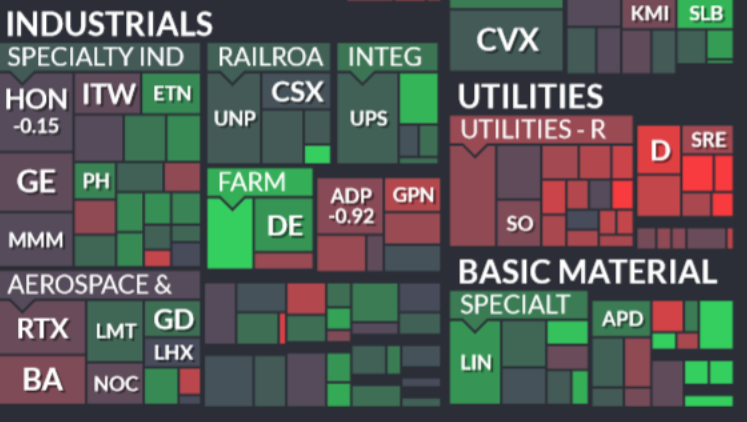

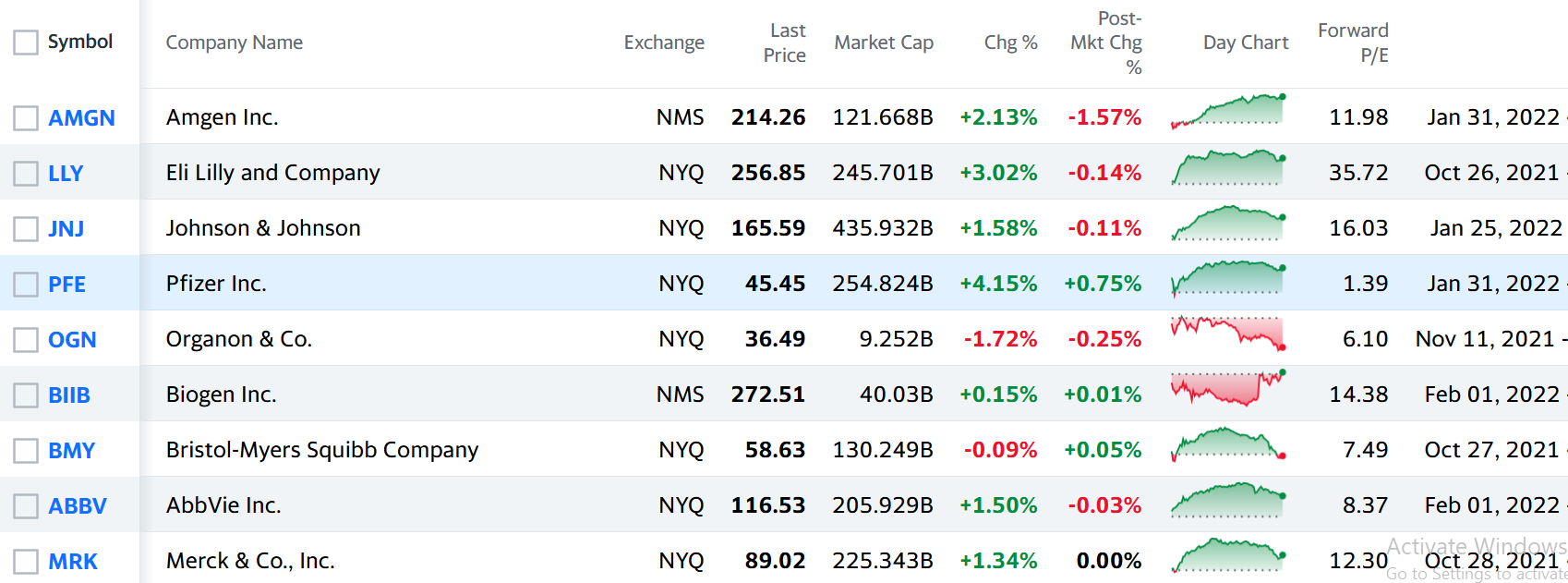

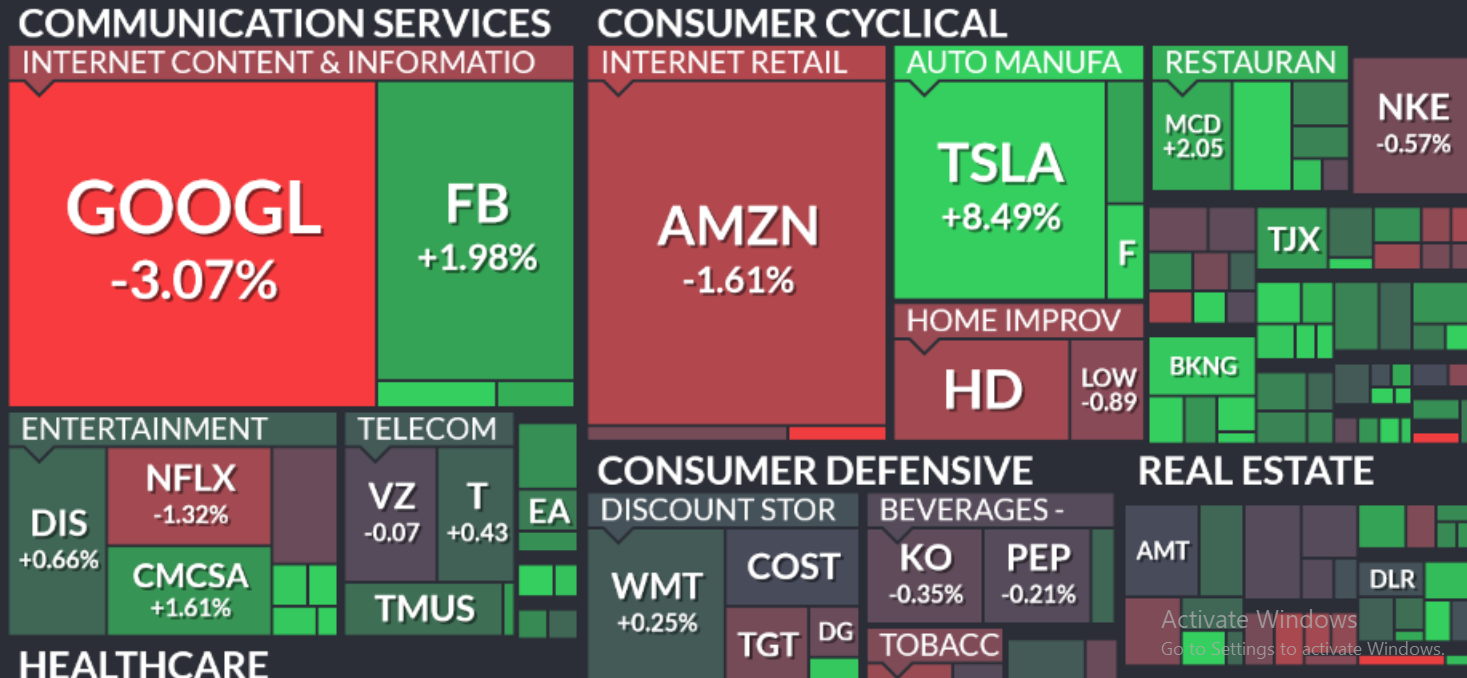

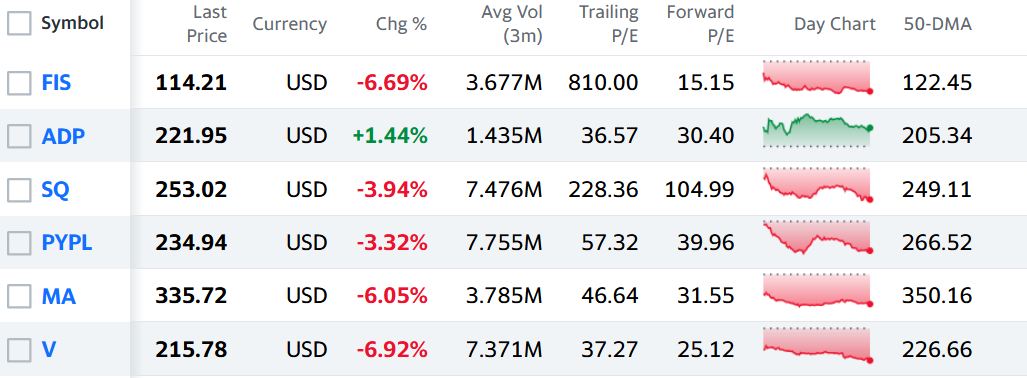

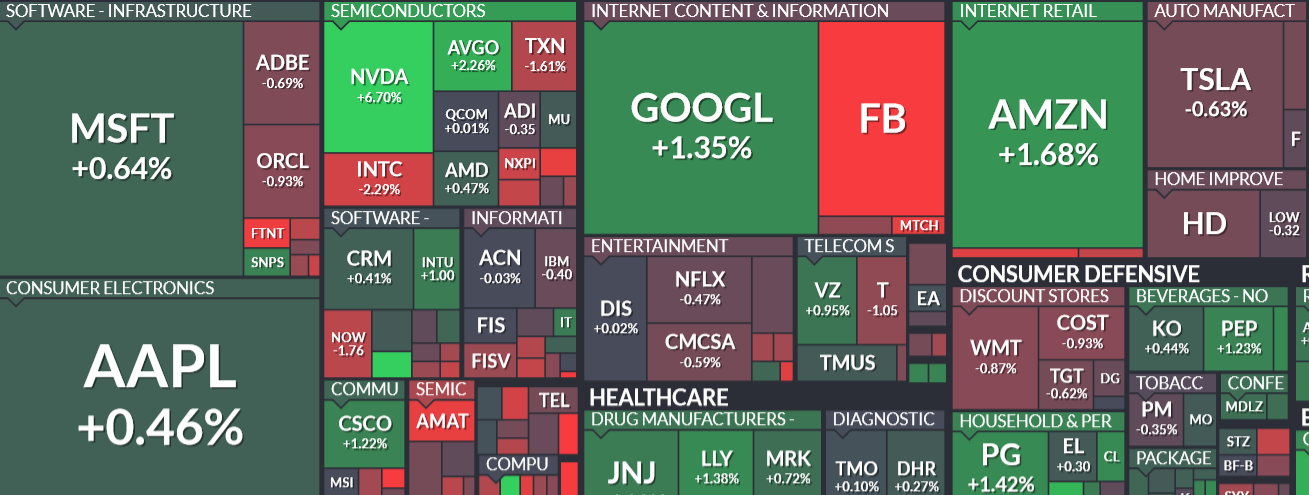

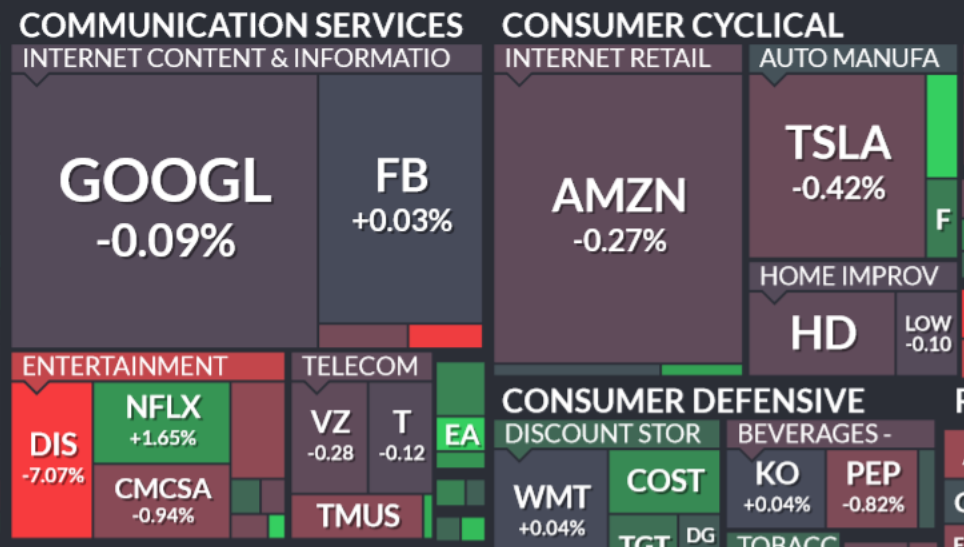

Market observations for November 12th, Stocks to watch

November 12, 2021 8:08 am

The US indices finished the session on Thursday sideways, with persisting confusion on the rising consumer and producer prices. The blue chips recovered a major downfall on Wednesday, as fears arose on the sooner than expected rising of the base interest rate and larger-scaled than expected tapering of the USD150B monthly QE by the Fed. […] Read more