Market Observations for October 22th, Stocks to Watch

October 22, 2021 2:19 pm

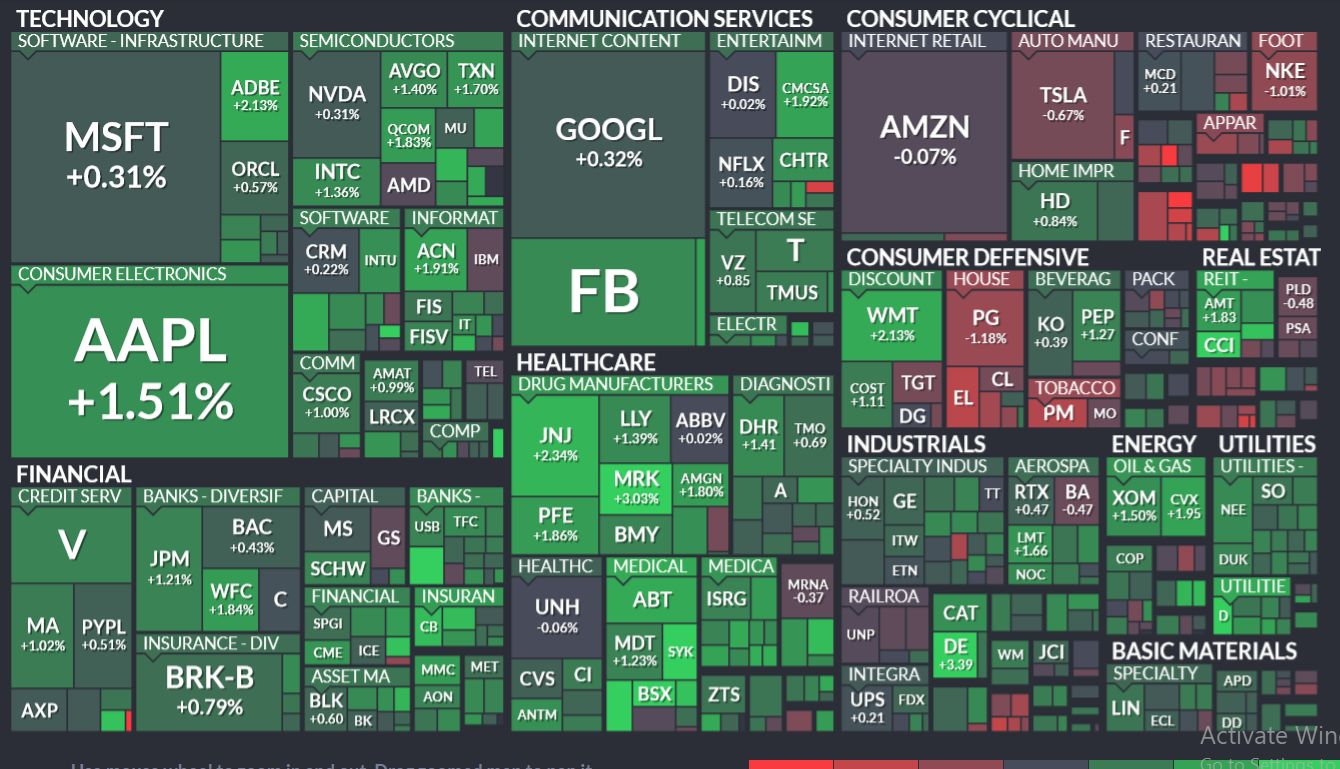

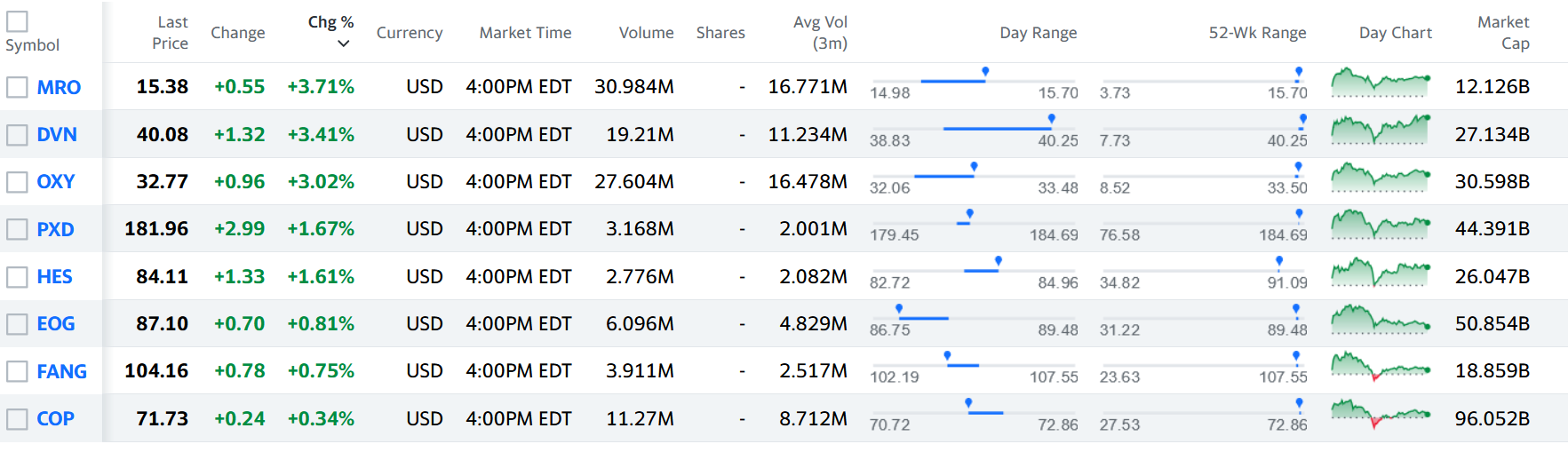

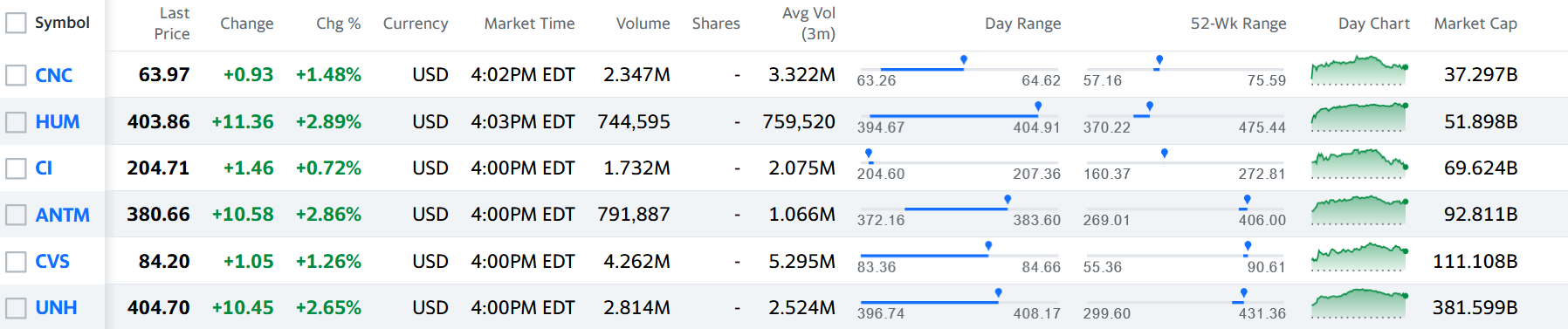

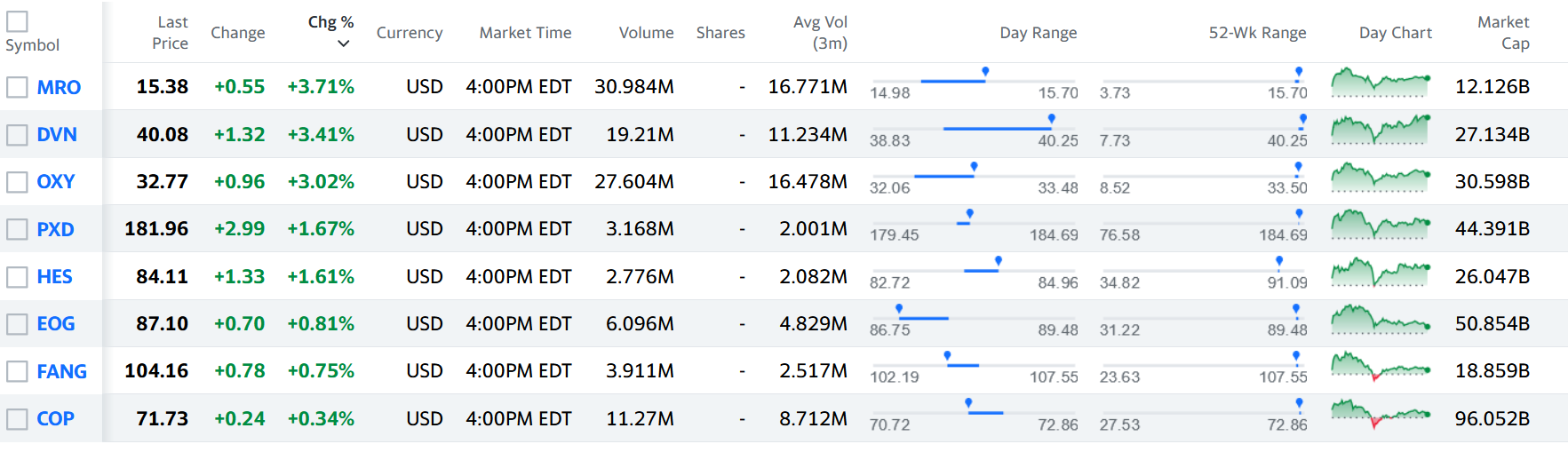

US markets closed sideways on Thursday as a little bit before the end of the session the S&P500 reached a new record hi, finishing .30% higher. The Dow was more or less flat with .02% and the Nasdaq was boosted by techs, mostly TSLA, ending with a .62% gain. Stocks rallied for a sixth straight […] Read more