The stock markets stepped back from their recent his yesterday, with corrections of .74% and .51% for the DJIA and S&P500 respectively. Nasdaq was spared with the bearish market wave, namely due to the stellar performance of its tech-giants, MSFT and GOOGL, both of which had posted favorable corporate results in the previous day’s after-hours market time. The extremely positive inertia in the current corporate season started to weaken out as the market has already priced in the 36% q/q growth rate in total corporate earnings. So far 38% of the stocks listed have reported, with 83% surpassing earnings estimates and 79% surpassing revenues estimates. The strong US-consumer sentiment, the better than expected conditions in the labor market and the general strength of the economy proved that higher prices induced by the supply side and energy-related items could be easily transferred to the consumer.

Another worthy point of attention from the yesterday session is the dramatic fall in 10year yields – reaching 1.548%, as they traded above 1.68% just last week. Reminding that yields move inversely to Treasuries’ prices, the price appreciation of the government bonds could be attributed to sooner than expected tapering. Policy changes in world central banks start to contrast too much with the Fed’s mild tone, and yesterday the Bank of Canada surprisingly ended its bond-buying program and accelerated the potential time of rate increases. The Gold reaped the gains from the falling yields, consolidating near a critical USD1800 level. The Brent and WTI also endure some dramatic corrections, closing at USD83.42 and USD81.55 respectively.

The biggest mcap-weighted market movers were MSFT and GOOGL, adding 4.21 and 4.96% respectively, after posting corporate results. In the previous article, I strongly recommended trading MSFT during yesterday’s session, as the data in its fin statements was undoubtedly positive, with no drawbacks, and furthermore, it was released in after-hours time, i.e. still had to be traded out on the next day’s session. In spite of some question marks in its Q3 financial reporting, GOOGL was also an investor’s favorite yesterday.

Some big market draggers from yesterday include GM/-5.42%/ and F/-2.7%/, although both of the carmakers surpassed expectations on revenues and profit. Moreover, F also boosted its full-year earnings outlook, thanks to a let-up in the semiconductor shortage, a problem that GM still has to solve. Considering that the general market index is a leading indicator in day-trading stocks, and sometimes the specific company sentiment is fully neglected, I would expect some bullish recovery in the price of F in the next following days, surpassing broad indices’ gains and making up for yesterday’s non-fundamentally-based losses.

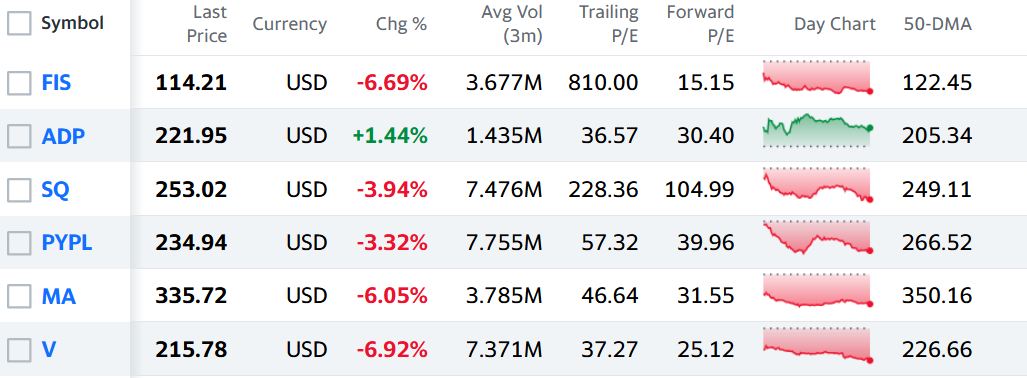

Visa’s /V/ shares lost a whole 6.92% after the company posted conservative estimates for its future revenues. This fact was not neglected at all for the whole Data Processing and Outsourced Services Industry. Provided below is the yesterday’s performance for Visa’s fellow companies in the industry and their easy-to-trade short moves, backed up also by the broad index performance. Furthermore, these companies face a lot of regulatory challenges, considering relationships with fin-tech partners in different projects.

Today at 8:30 am EST we have the GDP q/q release, which is not considered of big market importance, since this is a trailing indicator.