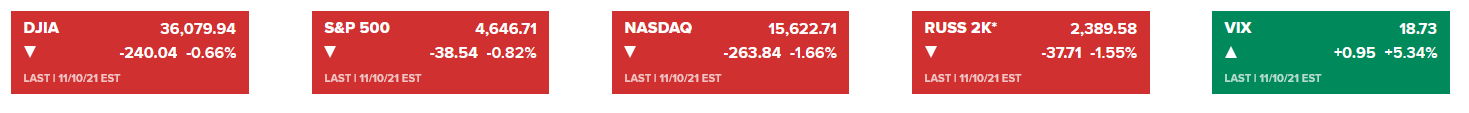

The long expected correction from the week-lasting market record streak occurred on Wednesday, triggered by much higher than expected inflation. US consumer prices jumped with 6.2% y/y, surpassing the Fed pre-defined bearable level, exceeding the 5.9% analysts’ expectations, and with the fastest annual pace since 1990. The major components triggering the inflation were Energy, Shelter, Food and Vehicles, broadening the areas, which could be explained by supply shocks post covid economic reopening. Furthermore, the jobless claims also disappointed, served with the news that almost a quarter of financial services firms are planning to reduce their workforces in NYC in the next five years. Overall, 13% of employers expect to cut staff, a third plan to reduce their demand for office space, while just about 28% of workers are visiting the office on the average weekday. This is the first week since the start of the reporting season, when macroeconomic news prevail over the corporate results-related investor sentiment. If inflation does not cool down in the near future, a barely plausible scenario, the Fed would certainly use its flexibility statement in the terms of the monthly quantity of tapering. The danger of intolerably higher prices is almost out of control and the energy sector is the only one, with very partial control from the US Administration, considering decisions on the release of state oil barrel reserves. Having all that in mind, investors and traders colored the markets in red yesterday, with the VIX indicative of the higher uncertainty and stress on markets:

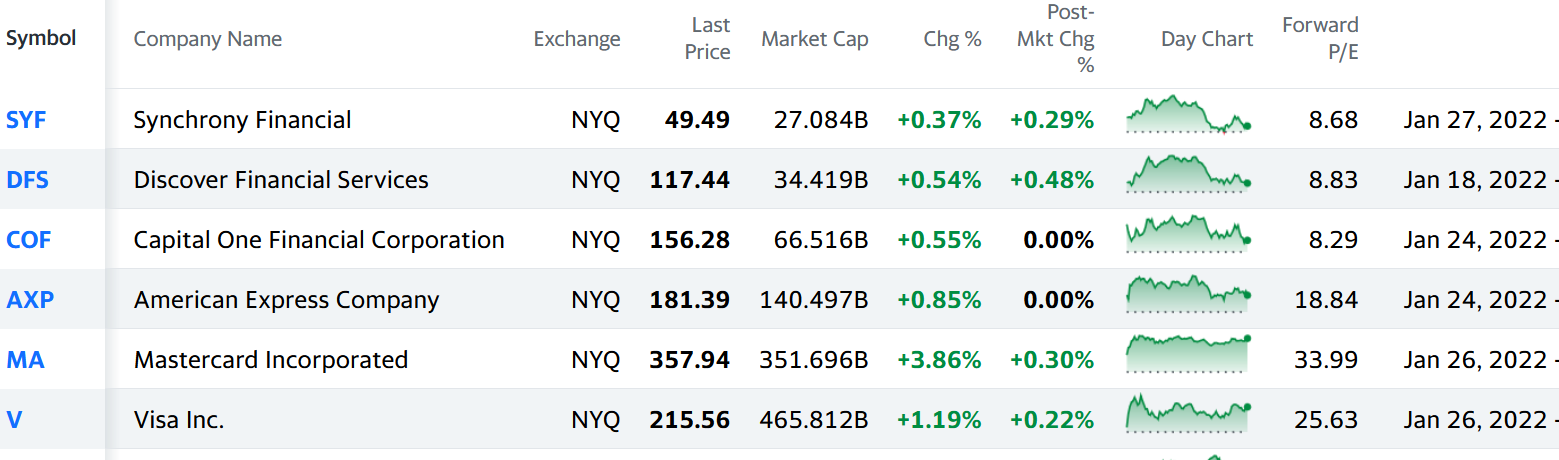

The 10 year Treasuries, whose yields just cooled down in the recent favorable weeks, regained their advance, climbing with 11bts to 1.568%. 30 year Treasuries reached 1.925%. The only sector, which gains from the yield advance is the financial one, and more specifically, the credit-service oriented. The biggest losers are the blue chips, with large future cash-flows from investments discounted at higher rates. Companies with high Debt/Equity ratios would certainly suffer.

Presented below is a list of large-cap credit service institutions, which advanced most yesterday. By contrast of the blue chips, they have pretty favorable forward P/Es, positioned in a mature industry, and are set to gain form the higher interest rate margins in the near future. All of them have reported.

Today there is a bank holiday in the US and Canada.