Deutsche Telekom AG revealed that it plans to sacrifice earnings growth in 2014 in order to finance the expansion of the customer base of T-Mobile US after it posted a loss in the fourth quarter of 2013.

Deutsche Telekom AG revealed that it plans to sacrifice earnings growth in 2014 in order to finance the expansion of the customer base of T-Mobile US after it posted a loss in the fourth quarter of 2013.

Deutsche Telekom AG, which is the current majority owner of T-Mobile, said in a statement, which was cited by the Wall Street Journal: “Instead of aiming for potentially higher adjusted EBITDA [earnings before interest, taxes, depreciation and amortization], Deutsche Telekom is continuing to focus on investments in customer acquisition and retention in the United States.”

As reported by the Financial Times, the company also revealed that it does not expect to reach its free cash flow target for 2015, which was estimated to 6 billion euros. Meanwhile, its free cash flow for 2014 is forecast to decline from 4.6 billion euros last year to around 4.2 billion euros in 2014. The adjusted earnings of Deutsche Telekom for 2013 before interest, tax, depreciation and amortization were reported to have decreased by 3% from 18 billion euros in 2012 to 17.4 billion euros.

The Chief Financial Officer of Deutsche Telekom – Mr. Thomas Dannenfeldt said in a statement, which was cited by the Financial Times: “We could achieve our original ambition level for 2015 of around 6 billion euros if we were to slam the door in the face of the customer rush in the U.S. Thats not what we want. The market is offering us the opportunity to achieve a different ambition: value-driven customer growth in the U.S. that translates into an increase in the value of the company.”

According to people with knowledge of the matter, the company could sell some of its shares in T-Mobile US after the expiration of a lockup expected in November this year. They also explained that such a solution is not considered as preferable by the company because it would mean missing out on a premium from a straight sale.

Now Deutsche Telekom AG is considered to become more focused on new customers of T-Mobile in the U.S. in the long-term, making the unit more profitable.

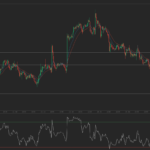

Deutsche Telekom AG plunged 4.02% in Frankfurt by 13:18 GMT to 11.71 euros, marking a one-year change of +41.43%. The company is valued at 54.30 billion euros. According to the Financial Times, the 29 analysts offering 12-month price targets for Deutsche Telekom AG have a median target of 11.70 euros, with a high estimate of 15.00 euros and a low estimate of 8.20 euros. The median estimate represents a -4.10% decrease from the previous close of 12.20 euros.