Advantages of Forex Over Stocks

What are the advantages of Forex over stocks?

- Liquidity, Trading Volume

- Position taking

- Easier to follow

- Lower transaction costs

- High leverage

- Speculators’ influence

- and more…

Which is the better market to trade, Forex or stocks? An experienced trader can make money in any market, provided there are enough buyers and sellers in that particular market to produce meaningful trends on a daily, weekly or monthly basis. In fact, it is always best to stick to the market, or the few markets, that you know best and have tested and, most importantly, to choose the one you feel most comfortable trading.

There are certain characteristics of the Forex market that make it superior—easier and safer to trade than other markets. Among these are liquidity, ease of access, availability of information, flexibility, time constraints and sensitivity to outside events.

Many people choose to trade Forex today because it offers numerous benefits. The following are some of the main advantages of Forex trading and the reasons for its popularity.

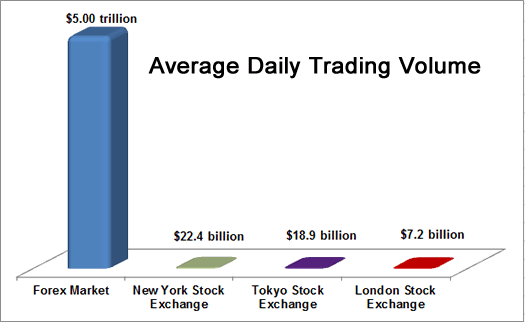

Liquidity, Trading Volume

The Forex market is the most liquid market in the world. According to the Bank for International Settlements, the preliminary global results from a survey of Foreign Exchange show that global currency market trading averaged $5.3 trillion per day in April 2013. This figure far exceeds the combined volume of all stock markets. Furthermore, liquidity remains high in the Forex market throughout the trading day. This is because as every major financial centre approaches the end of its trading day, trading begins in the next centre. For example, when there are three hours left until the London market closes, New York is just beginning its trading session. We shall discuss trading sessions at a later time.

- Trade Forex

- Trade Crypto

- Trade Stocks

- Regulation: NFA

- Leverage: Day Margin

- Min Deposit: $100

Position taking

When it comes to short-selling stocks, very few people do so, as the core of stock trading is investing for the longer term. Sometimes speculators are criticised for taking short positions. With currencies, however, it is much easier to go short. This is because short-selling a currency is psychologically more acceptable. Additionally, currencies, as we have already noted, are traded in pairs. This means that when you take a short position in one currency, you automatically take a long position in the other currency in the pair.

Easier to follow

Another major advantage of the Forex market is that there are only a handful of key pairs to trade and monitor. You are not bombarded with information as you are with the tens of thousands of stocks, each belonging to its own sector and responding to sector-specific or company-specific news. There is simply too much research involved with stocks, and following all these different news items and variables is almost impossible for a single person.

In Forex, monitoring the news becomes far more straightforward. If you trade a single currency pair, you only need to check the most important economic and political events of the two countries representing the pair.

It is also worth noting that news about a particular stock is often released before or after the market opens. In such cases, the trader must wait until the market opens in order to take a position, which is usually too late to react.

Lower transaction cost

Another benefit worth mentioning is that trading in the Forex market involves lower transaction costs than trading in the stock market. This means that if you are trading Forex, you will avoid a number of the hidden fees that are usually associated with equities. One of the fees you will avoid is the commission paid to agents when you place or exit trades in the stock market. Forex brokers, on the other hand, earn their fees from the trades you make via the bid-ask spread.

High leverage

You are able to trade currencies on a highly leveraged basis – up to 900 times your investment with some brokers. This is primarily due to the higher levels of liquidity within the currency markets. Mini FX accounts are permitted to trade with just 0.5% margin; in other words, only $50 allows you to control a 10,000-unit currency position. Futures traders, who are accustomed to margin requirements equal to 5%-8% of the contract value, will immediately recognise that the Forex market provides much greater leverage than the stock market. Stock traders usually need to ensure at least 50% margin.

Influence from speculators

In stock trading, industry and market analysts sometimes follow speculators’ movements closely. These speculators may operate with a significant amount of capital, enough to cause whipsaws in smaller and less liquid markets. However, the vast size of the Forex market and, in particular, the liquidity of the major currency pairs make it less susceptible to pressure from followers of individual analysts. The Forex market, therefore, is more resilient to manipulation.

When both sides to a transaction have equal knowledge, they are more likely to be satisfied with the outcome. Because the Forex market reacts more quickly to events, its participants have a greater chance of achieving equal knowledge than in other markets. The advantage of this characteristic is that any flawed analysis will have only a short-term effect on the market because shortcomings are quickly exposed by price action.

To sum it up

The Forex market provides you with fast and accurate execution thanks to a highly liquid environment, while allowing you to trade 24 hours per day with low spreads. This enables you to use very safe and flexible starting amounts, leverage and lot sizes. Stocks, however, offer a much more limited trading window and direction, and a far higher chance of delays in execution, slippage and price manipulation. Furthermore, share trades can bleed your account, as they can be very expensive in terms of commissions and can carry additional risks due to their fixed starting amounts, leverage and lot sizes.