Key Moments:

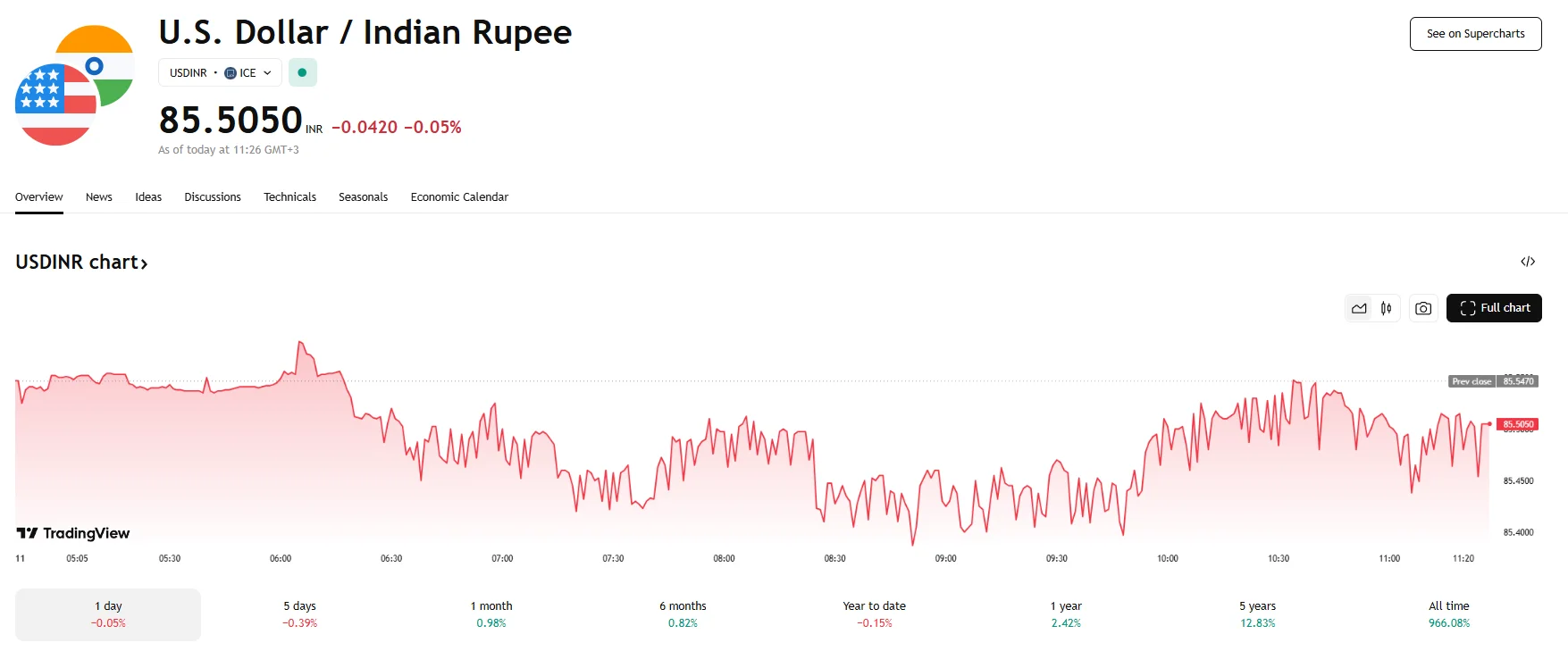

- USD/INR hit 85.5050 on Wednesday after a steep decline saw it hit a weekly drop below 85.4000.

- Trade representatives from the US and China agreed on a framework deal that awaits approval from both presidents

- Foreign Institutional Investors injected Rs 2,301.87 crore into Indian stock markets on Tuesday

Trade Deal Hopes Bolster Market Sentiment

The USD/INR hit a one-week slump of around 85.3870 during Wednesday trading. Although the pair has since attempted to trim its losses, it is still finding it difficult to remain above the 85.5000 mark as the rupee’s strength persists amid optimism surrounding US-China trade negotiations.

According to US Secretary of Commerce Howard Lutnick, a preliminary framework for the trade accord, originally made in Geneva in May, had been reached during the two-day meetings in London. China has agreed that it will ease the export restrictions on rare earth materials, while the US expected to relax constraints on semiconductors. However, the deal still requires final approval from President Donald Trump and President Xi Jinping.

Dollar Index Climbs Past 99.00

The US Dollar Index hovered above 99.00 after the trade news. Analysts from National Australia Bank noted that “the devil would be in the details,” emphasizing the crucial question of whether this could help to reestablish trust between President Xi and President Trump, given that it had evidently deteriorated since the publication of the Geneva Agreement.

Additionally, the US Federal Appeals Court maintained that tariffs imposed by President Trump concerning border policy violations and actions declared on “Liberation Day” will remain in place. These measures will stay active until evaluated in accordance with the Emergency Act. The next court session to assess this issue is scheduled for July 31st.

Indian Rupee Gains Momentum Ahead of CPI Data

Today’s forex movements mark the Indian rupee’s fifth straight session of gains as strong foreign inflows further supported the currency. On May 10th, Foreign Institutional Investors (FIIs) registered net purchases totaling Rs 2,301.87 crore in Indian equities.

Now, investors will await the release of the US Consumer Price Index (CPI) for May, expected to be published later today. The CPI headline figure is projected to increase 2.5% YoY, compared to April’s 2.3%. Core CPI is estimated to rise 0.1% to 2.9%. The monthly headline and core numbers, meanwhile, are forecast to climb 0.2% and 0.3%, respectively.