Key Moments:

- The Dow Jones slipped 0.25% after markets opened on June 5th, with other major US indices also suffering declines.

- Thursday witnessed a phone call between US President Trump and Chinese President Xi, as reported by the state-run news agency Xinhua.

- In the US, Initial jobless claims rose to 247,000 last week, beating expectations and fueling job market concerns.

Stocks Turn Lower Amid Trade Headlines and Labor Market Pressure

US equities fell on Thursday following reports that Donald Trump and Chinese President Xi Jinping spoke by phone, an event described by Chinese state media and later confirmed by China’s Ministry of Foreign Affairs. The call initially boosted investor sentiment, particularly as new labor data added complexity to the economic picture.

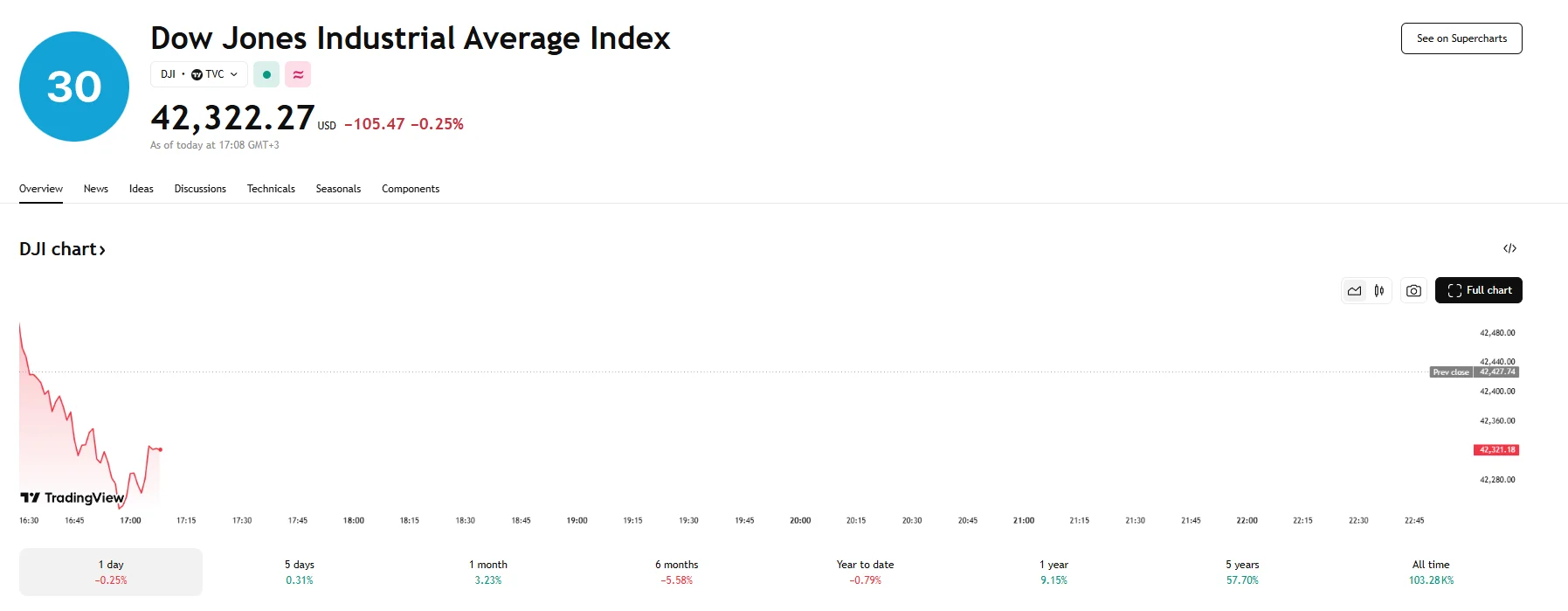

However, major indices have since ticked downward, with the Dow Jones Industrial Average losing around 105 basis points to reach 42,322.27. The Nasdaq Composite also fell by 0.2% and hit 21,698.15, while the S&P 500 dropped by 0.2% and slipped below 5,960.

Labor Market Signals Trouble as Jobless Claims Climb, Trade Deficit Narrows Sharply in May

The Labor Department reported that initial jobless claims increased to a seasonally adjusted 247,000 for the week that ended on May 31st, higher than what Dow Jones analysts had been expecting. This marked an increase from the 239,000 reported for the previous week. Continuing claims also ticked higher, pushing the four-week average to its highest level in over three years.

Additionally, recent data showed a 6.6% climb when it came to unit labor costs during 2025’s Q1, while productivity declined 1.5%. These figures fell below expectations and raised fresh questions about cost inflation and the efficiency of the American workforce.

Other data that rocked markets pertained to the US trade deficit, which contracted sharply in May as companies reduced imports following tariff-related inventory buildups from earlier in the year. The trade gap narrowed to $61.6 billion, significantly below April’s $76.7 billion and under the $66.3 billion consensus estimate. A 3% climb saw exports advance by $8.3 billion. Imports, on the other hand, sank by $68.4 billion (16.3%), according to Commerce Department data.