Key Moments:

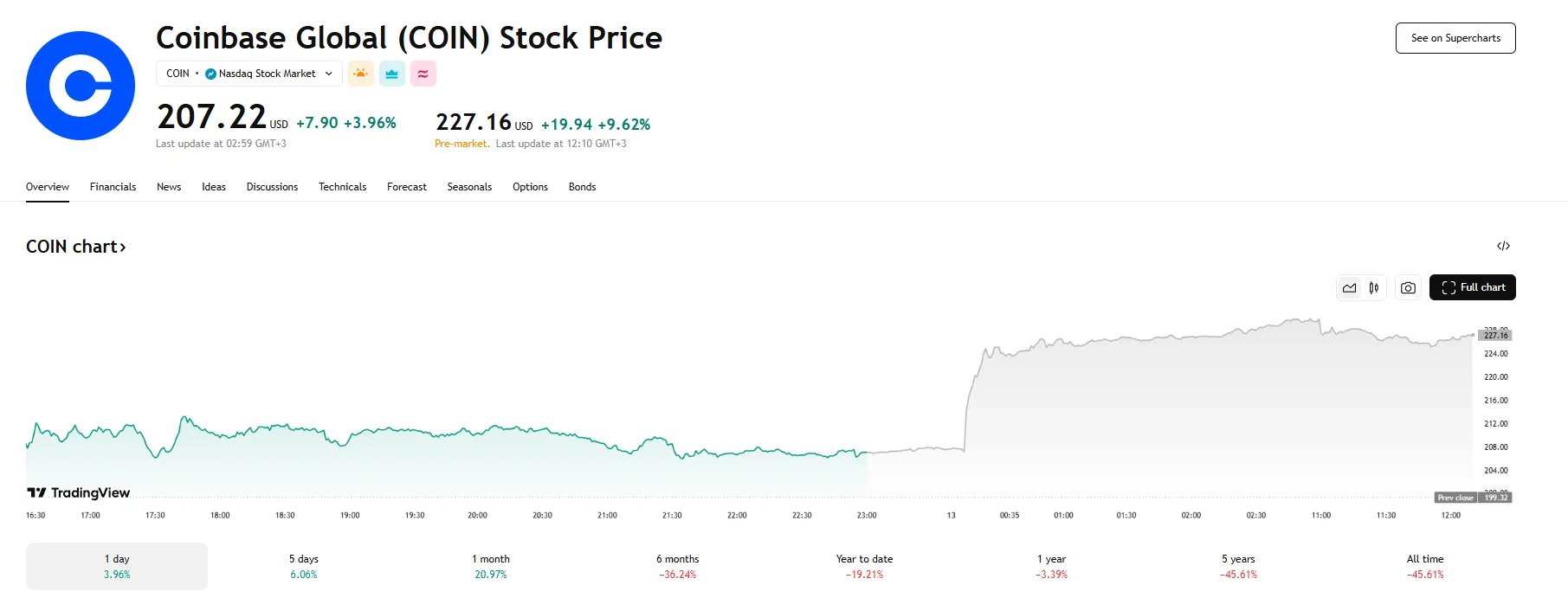

- Coinbase shares surged 9.62% in pre-market trading following the announcement that the company will have a spot on the S&P 500.

- Coinbase is set to replace Discover Financial Services on the index next Monday.

- The news follows Coinbase’s latest financial report, which disclosed a revenue increase of 24%.

Major Milestone for Digital Assets

Coinbase Global Inc. will become the first cryptocurrency-focused firm added to the S&P 500 starting May 19th. The announcement sent shares soaring during pre-market hours on Tuesday, with the stock gaining 9.62% to $227.16.

S&P Dow Jones Indices confirmed that Coinbase will take the place of Discover Financial Services on the benchmark S&P 500 index. This change follows Discover’s pending acquisition by Capital One Financial, which secured regulatory approval last month.

Index inclusions like this tend to drive increased investor interest. A number of ETFs and mutual funds will be obliged to purchase shares of Coinbase once next Monday rolls around, which commonly results in heightened demand and elevated trading volume. Furthermore, inclusion often attracts more institutional capital.

Recent Performance and Financials

Despite the after-hours jump, Coinbase shares remain down over 19% year-to-date. According to a recently issued financial report, the company’s net income stood at $65.6 million ($0.24 per share) compared to last year’s $1.18 billion ($4.40 per share). However, revenue did jump 24% to $2.03 billion, marking an increase from the prior year’s $1.64 billion.

Coinbase currently stands as the largest US-based Bitcoin exchange, and it has also continued to expand its international presence. The company recently disclosed an agreement to acquire Deribit, a crypto derivatives firm based in Dubai, for $2.9 billion.