Key Moments:

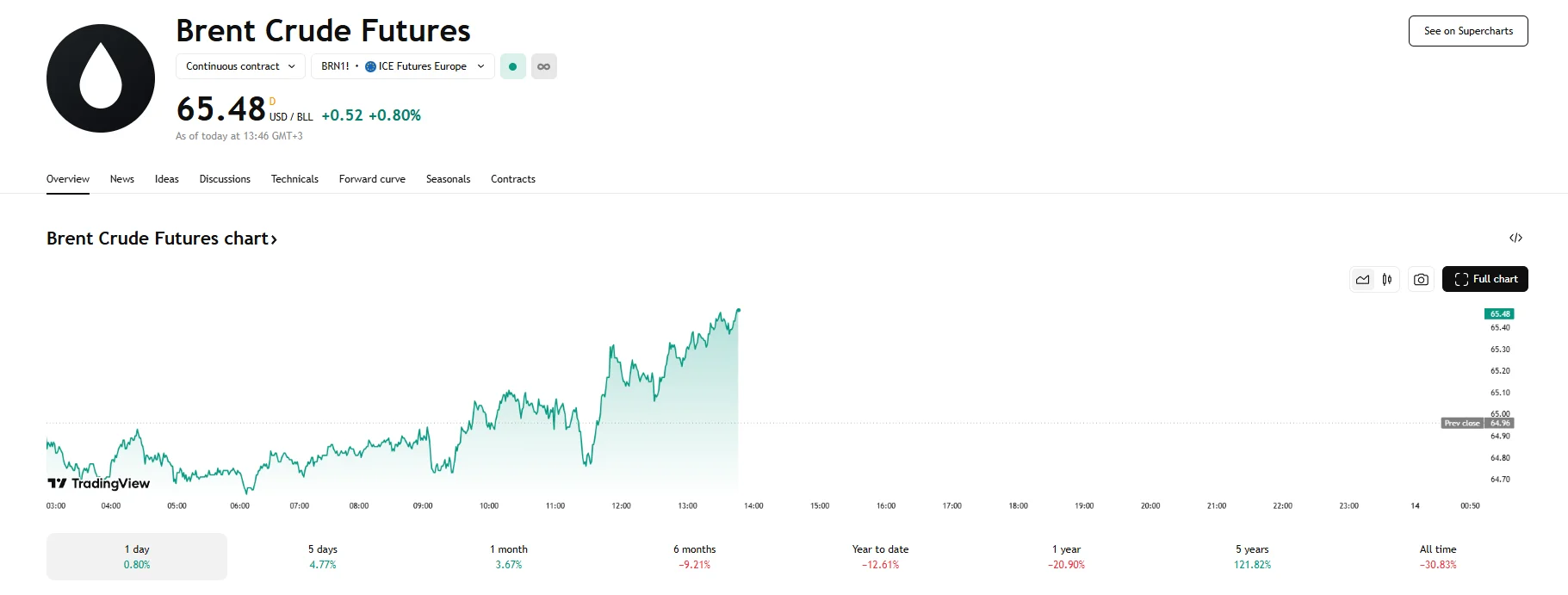

- Tuesday witnessed Brent futures climb to $65.48 per barrel, extending gains for the fourth consecutive session.

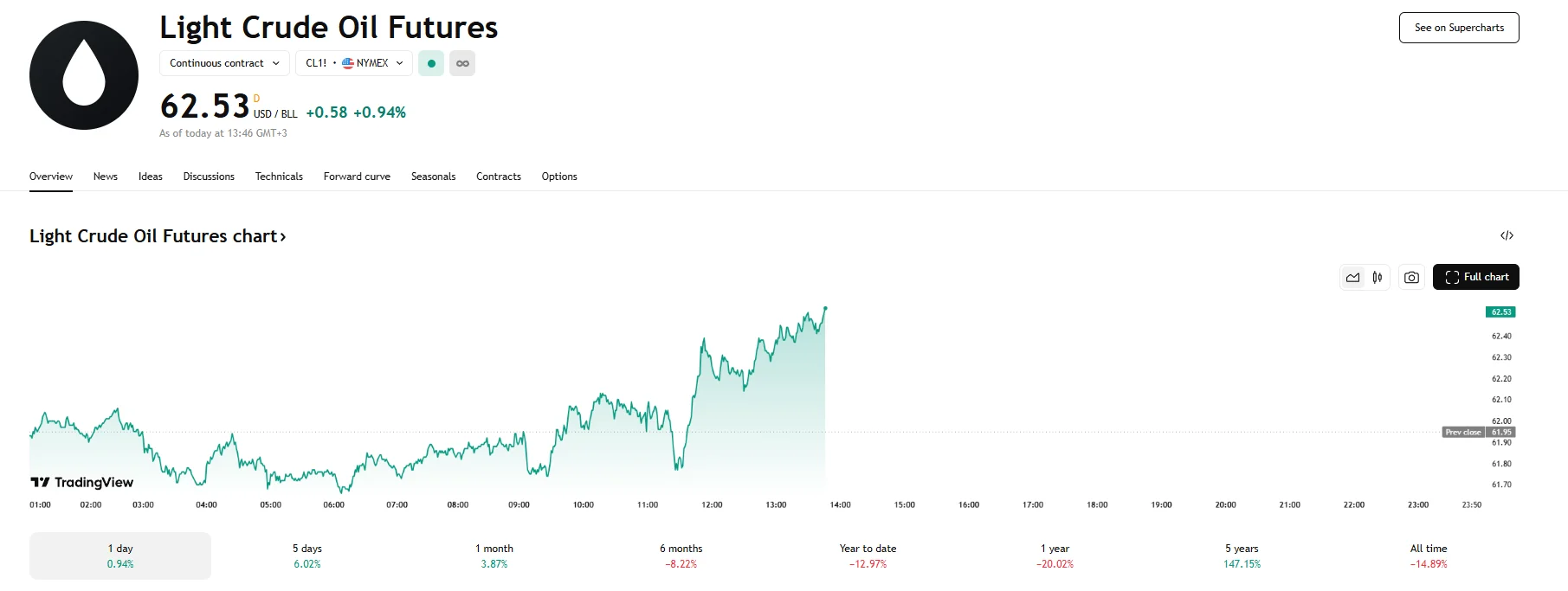

- WTI crude reached $62.53 per barrel, also logging its fourth straight rise.

- OPEC output increased by 411,000 barrels per day in May, exceeding expectations since April.

Crude Futures Extend Rally Amid Shifting Geopolitical Focus

Oil markets advanced on Tuesday as traders turned their attention from US-China trade developments to unfolding events in the Middle East. Brent crude futures rose 0.80% to $65.48 per barrel, while US West Texas Intermediate (WTI) hit $62.53 per barrel amid a 0.94% climb. Both benchmarks notched their fourth consecutive daily gains and reached two-week highs.

These increases follow a temporary easing in trade tensions between Washington and Beijing after a 90-day pause in tariff escalations. The agreement softened concerns over demand depreciation, offering a reprieve from the pressure that had weighed on oil prices since early April.

Investor focus has now turned to President Trump’s trip to Saudi Arabia, with market participants closely watching for any potential influence his discussions may have on OPEC+ production policy. Since April, the Organization of the Petroleum Exporting Countries (OPEC) has lifted output more than expected. Current estimates suggest May production has risen by 411,000 barrels per day. Saudi Arabia, a key member of the alliance, has been advocating for increased collective output as a means to enforce discipline among countries failing to adhere to quotas. This internal pressure has contributed to recent downward forces on prices despite the broader rally.

While the outlook for crude demand appears uncertain, refined fuel markets are showing relative strength. JPMorgan analysts commented that even though the outlook for crude demand was deteriorating, the positive signals from the fuel markets were significant and deserved attention.

The firm noted that international crude prices have dropped 22% since their January 15th high. However, prices for refined products and refining margins have stayed relatively consistent. The analysts also emphasized that lower refining capacity across the US and Europe is leaving gasoline and diesel balances tighter. Other consequences include heightened dependance on imports and sharp price increases during maintenance and unexpected outages.