Key moments

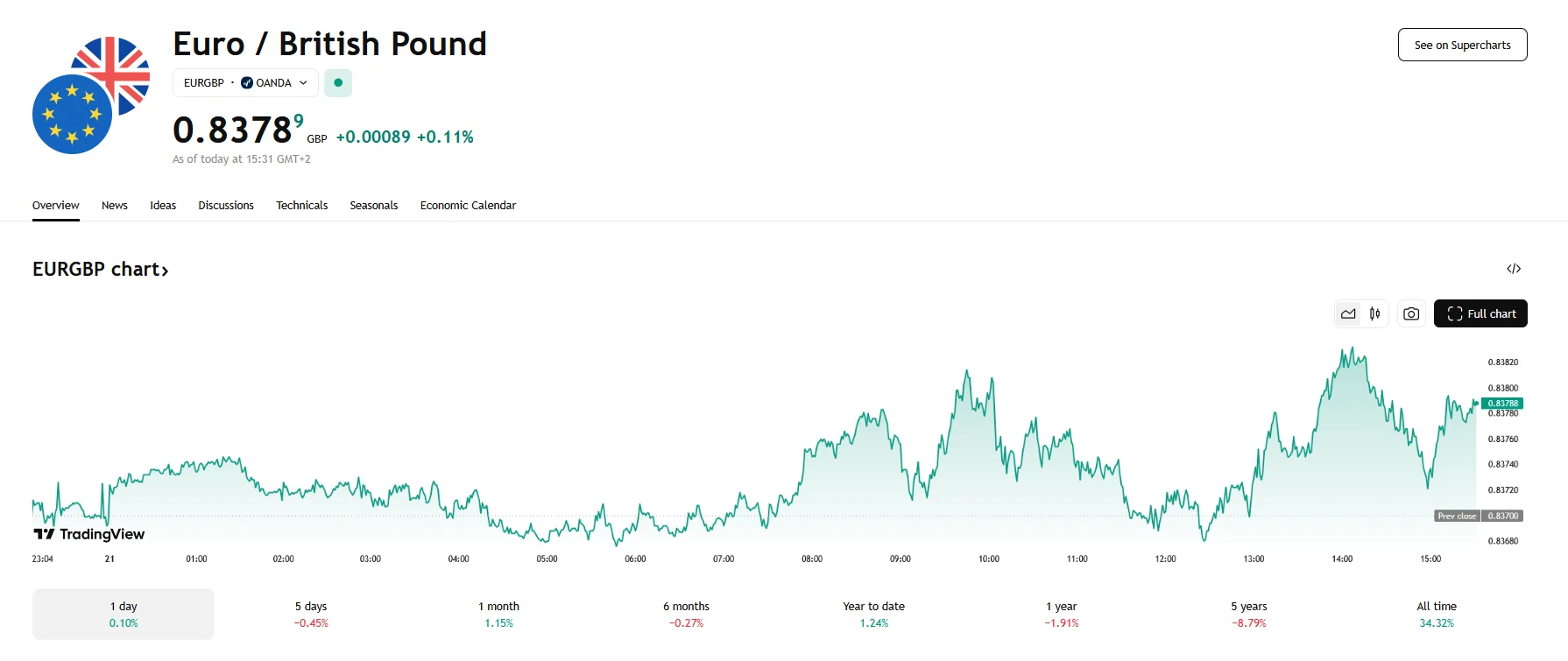

- The EUR/GBP exchange rate saw a slight increase, rising by 0.11% to 0.8378.

- The Bank of England’s recent decisions have significantly influenced the pound’s movements.

- UK government borrowing rose to £10.7 billion in February, marking a £100 million increase compared to February 2024.

Euro Gains Against Pound Amidst Economic Uncertainty

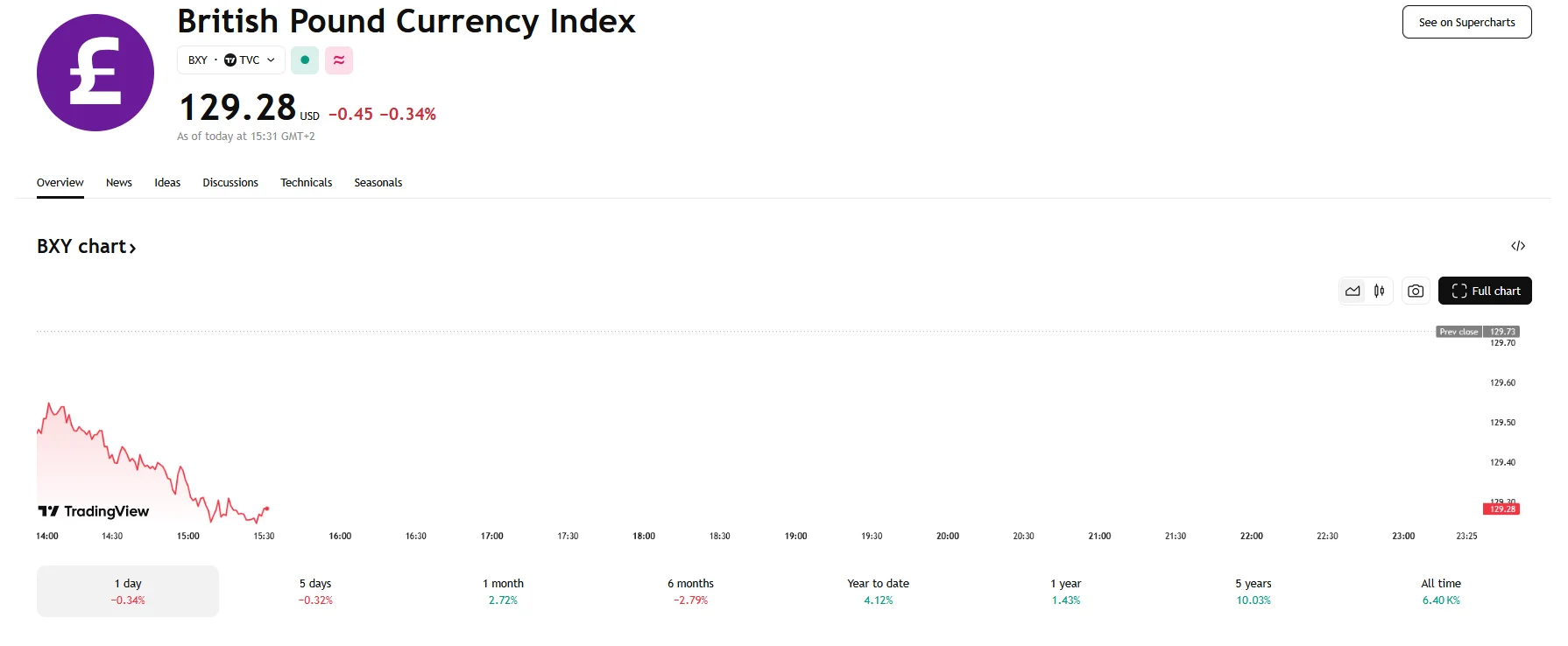

On Friday, the EUR/GBP pair’s exchange rate edged 0.11% higher to approach the 0.8400 mark. This movement occurred within a broader context of the pound sterling weakening, as evidenced by a 0.34% decline in the British pound currency index. As previously reported by TradingPedia, Friday also saw GBP/USD fall near the 1.2920 mark.

The recent movements of the pound can be largely traced to the Bank of England, which kept interest rates unchanged but indicated economic uncertainty due to global trade tension. Specifically relating to comments from US President Donald Trump.

Of notable concern are the increasing uncertainties surrounding global trade dynamics, particularly those instigated by U.S. tariff policies. Although the United Kingdom has, thus far, remained relatively unscathed by direct tariff actions, the potential for spillover effects from forthcoming U.S. reciprocal tariffs in early April looms large.

In addition, recent data reveals a substantial increase in government borrowing. Figures released by the Office for National Statistics indicate that UK borrowing reached £10.7 billion in February, considerably exceeding earlier projections. This level of borrowing underscores the fiscal challenges confronting UK economic policymakers.

Simultaneously, the Euro (EUR) has experienced its own pressures. European Central Bank (ECB) President Christine Lagarde has expressed worries about the potential for U.S. tariffs to negatively impact the Eurozone economy. Projections indicate a possible 0.3% reduction in Eurozone growth within the first year of a 25% tariff implementation. Furthermore, there are current indicators that the ECB may be considering rate cuts in 2025, driven in part by increases in global trade tensions. These developments have, thus far, prevented the EUR/GBP pair from rising a significant amount.

The UK’s economic outlook is further complicated by rising inflation risks, compounded by an upcoming tax hike for employers. Forecasts from the Bank of England (BoE) point to a peak inflation rate of 3.75% in the third quarter of 2025.