Key moments

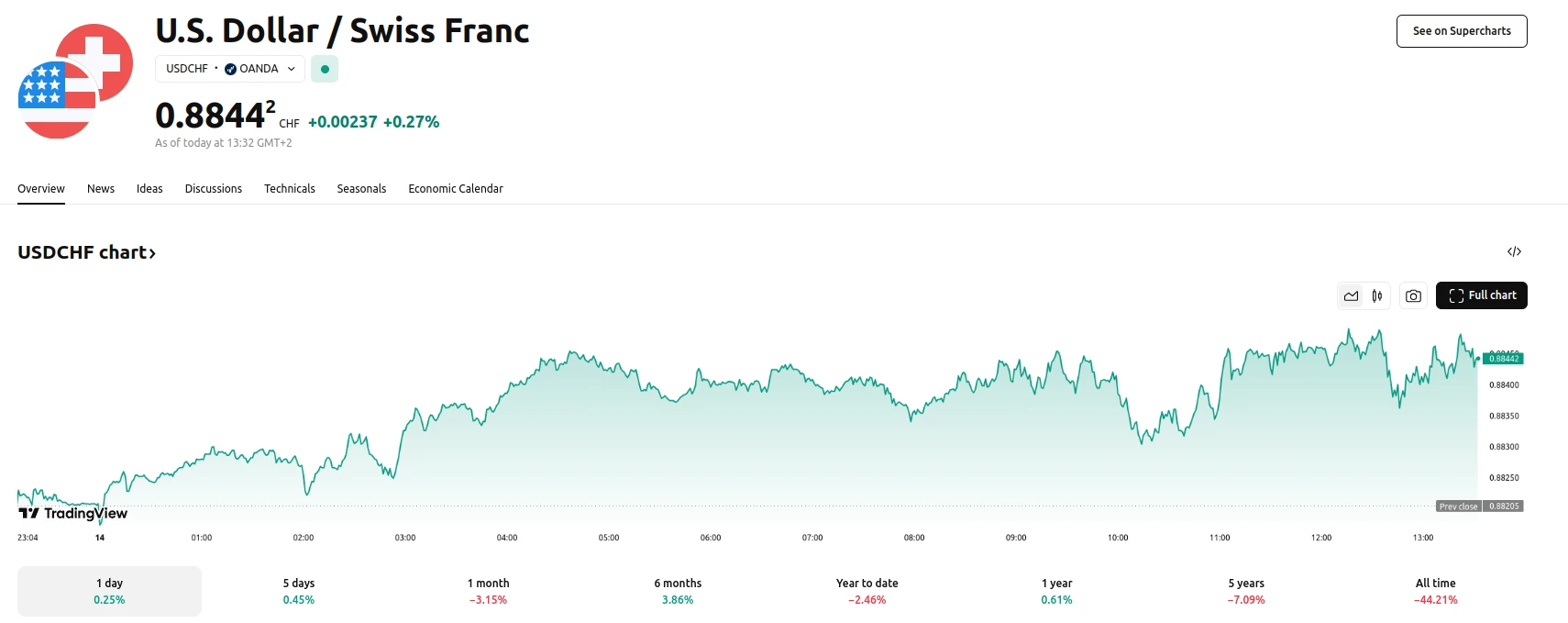

- USD/CHF pair experiences a rise to approximately 0.8844 during Asian trading, fueled by a resurgence in US Dollar demand.

- US Producer Price Index data and tariff implications contribute to fluctuating Greenback strength.

- Geopolitical tensions and potential trade wars elevate safe-asset demand, potentially bolstering the Swiss Franc.

Currency Pair Sees Uptick as US Dollar Strengthens, but Geopolitical Uncertainties Present Potential Headwinds

The USDCHF currency pair has seen an upward trend, reaching levels near 0.8844 during Friday’s Asian trading session. This movement is primarily attributed to a resurgence in demand for the US Dollar. The US Dollar has seen some support after the latest producer price index information was released. However, the potential for escalating global trade tensions and geopolitical uncertainties in the Middle East present a counterforce, potentially strengthening the Swiss Franc (CHF), a traditional safe asset.

The release of US Producer Price Index (PPI) data revealed a month-over-month figure that remained unchanged in February. While this data point might suggest a temporary stabilization of prices, concerns remain regarding the long-term impact of tariffs on inflation. There’s growing concern among economists regarding future inflation trends, particularly as tariffs start impacting consumer costs. This sentiment has contributed to the current dynamics of the dollar.

Conversely, the prospect of increased tariffs on trade with Europe, China, and other trading partners raises concerns about potential harm to the US economy and could prompt a move towards safety. This possibility, along with escalating geopolitical tensions, has the potential to boost demand for safe-haven currencies like the CHF, thus creating possible pressure on the USD/CHF pair.