Key moments

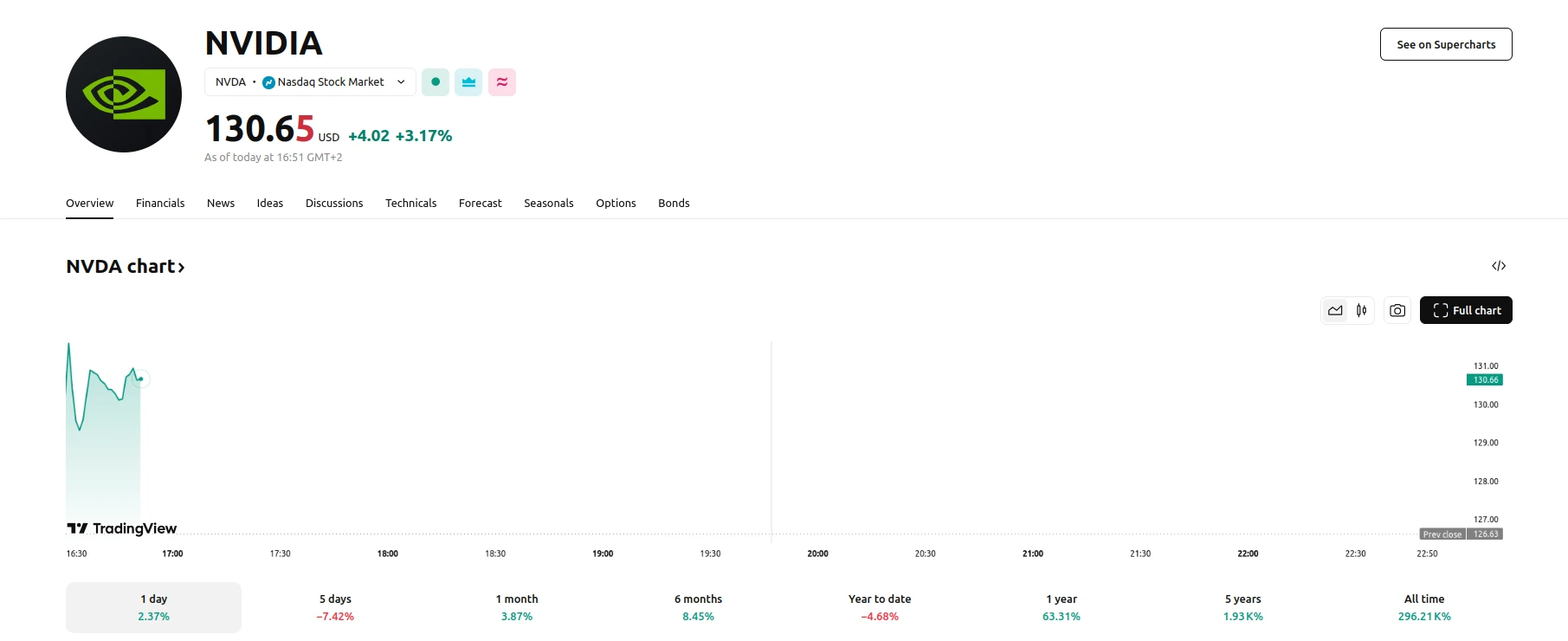

- DeepSeek’s release of its latest model, DeepSeek-R1, led to a significant decline in Nvidia’s shares, with the stock falling close to 9% thus far in 2025.

- The rise of DeepSeek has sparked a shift in the AI industry, with a growing trend towards democratization and the development of foundational models that can operate on relatively low budgets and with limited compute power.

- Nvidia’s upcoming earnings report is expected to provide insight into the company’s outlook on the AI market, particularly in light of the growing competition from companies like DeepSeek and the potential impact on its AI chip sales.

The recent rise of Chinese AI company DeepSeek has sent shockwaves through the market, with the company’s DeepSeek-R1 model temporarily displacing OpenAI’s ChatGPT as the Number 1 downloaded free app on Apple’s App Store. This sudden shift has had a significant impact on Nvidia, with the company’s shares falling close to 9% thus far in 2025. According to Mohamed Elgendy, co-founder and CEO of enterprise AI platform Kolena, the DeepSeek approach has shown that AI model development can be done on thinner margins and with lower-quality resources than anticipated, which has a negative impact on Nvidia.

Despite this, AI enablers such as Nvidia are still investing in the development of AI-specific semiconductor chips, compute power, and platforms that foundation models can use to operate. Elgendy believes that the rise of DeepSeek marks a shift in the industry towards greater democratization, with more companies and researchers able to develop foundational models using relatively low compute power and bootstrapped budgets. This trend is expected to lead to a proliferation of new AI models, with Elgendy predicting that the number of builders and users will increase significantly.

The impact of DeepSeek on the AI industry is still being felt, with Nvidia’s upcoming earnings report expected to provide insight into how the company views the market for AI chips and data centers. The report will be closely watched by Wall Street analysts and investors, who are eager to understand the potential impact of DeepSeek and other similar models on the industry. According to Amr Awadallah, CEO of enterprise AI agent company Vectara, the rise of DeepSeek and other foundational models will lead to significant margin compression for AI model builders and large AI enablers, with revenue growth expected to continue but profit margins decreasing.

As the AI industry continues to evolve, we will likely see more models like DeepSeek emerge, with companies such as Intel already providing lower-cost alternatives to high-end hardware. The rise of these models is expected to drive innovation and improve efficiency, but it also raises important considerations such as cost, energy use, and responsible deployment. Ultimately, the impact of DeepSeek on the AI industry will depend on how companies like Nvidia adapt to the changing landscape and respond to the growing trend towards democratization and the development of foundational models using relatively low compute power and bootstrapped budgets.