Yesterday’s trade saw USD/ILS within the range of 3.8220-3.8528. The pair closed at 3.8440, gaining 0.02% on a daily basis.

Yesterday’s trade saw USD/ILS within the range of 3.8220-3.8528. The pair closed at 3.8440, gaining 0.02% on a daily basis.

At 8:44 GMT today USD/ILS was up 0.08% for the day to trade at 3.8470. The pair broke the first key weekly resistance level and touched a daily high at 3.8486 at 8:35 GMT.

Fundamentals

United States

Consumer inflation

The annualized consumer inflation in the United States probably decelerated to 1.6% in October, according to market expectations, from 1.7%, registered in September and August. In monthly terms, the Consumer Price Index (CPI) probably dipped 0.1% in October, following a 0.1% gain in the prior month. In September increases in shelter and food prices outweighed declines in energy costs. The food index rose 0.3%, as five of the six major grocery store food group indexes increased. The energy index, at the same time, lost 0.7%, as the indexes for gasoline, electricity and fuel oil all decreased, according to the report by the Bureau of Labor Statistics.

The annualized Core CPI, which excludes prices of food and energy, probably remained unchanged at 1.7% in October. It is usually reported as a seasonally adjusted figure, because consumer patterns are widely fluctuating in dependence on the time of the year. The Core CPI is a key measure, because this is the gauge, which the Federal Reserve Bank takes into account in order to adjust its monetary policy. The Fed uses the core CPI, because prices of food, oil and gas are highly volatile and central bank’s tools are slow-acting. In case, for example, prices of oil surge considerably, this could lead to a high rate of inflation, but the central bank will not take action until this increase affects prices of other goods and services.

If the CPI tends to approach or comes in line with the inflation objective, set by the Federal Reserve and considered as providing price stability, or 2%, this will usually support demand for the US dollar. However, quite high rates of inflation (well above central bank’s inflation target) can be harmful to economy and as a result, this may lead to the loss of confidence in the local currency.

The Bureau of Labor Statistics is to release the official CPI report at 13:30 GMT.

Manufacturing data by Markit – preliminary release

Manufacturing activity in the United States probably expanded in November, with the corresponding preliminary Purchasing Managers Index coming in at a reading of 56.4, or the highest since September. In October the final seasonally adjusted PMI stood at 55.9. Output and new business growth moderated in October, job creation remained robust, while input cost inflation was the weakest since April, according to Markit Economics. Values above the key level of 50.0 indicate optimism (increasing activity). Higher-than-expected PMI readings would certainly support the US dollar. The preliminary data by Markit is due out at 14:45 GMT.

Leading Economic index by the CB

The Conference Board Leading Economic Index for the United States probably increased 0.6% in October compared to a month ago, according to the median forecast by experts. In September compared to August the index gained 0.8%. Better-than-expected performance of the index is usually dollar positive. The Conference Board research group is to release the official data at 15:00 GMT.

Philadelphia Fed Manufacturing Index

The Philadelphia Fed Manufacturing Index probably fell to a reading of 18.3 in November from 20.7 index points during the previous month. If so, this would be the lowest value since May, when the index was reported at 17.8. A level above zero is indicative of improving conditions, while a level below zero is indicative of worsening conditions. Lower-than-anticipated index readings would have a bearish effect on the greenback. The Federal Reserve Bank of Philadelphia is expected to release the official results from the survey at 15:00 GMT.

Existing Home Sales

The index of existing home sales in the United States probably remained flat in October compared to September at a level of 5.16 million. In September compared to August existing home sales rose 2.4% to 5.17 million, or the highest level since September 2013. The sample of data encompasses condos, co-ops and single-family houses.

In case the index showed a better-than-projected performance, this would usually have a bullish effect on the US dollar. The National Association of Realtors (NAR) is to release the official figure at 15:00 GMT.

Israel

Israeli industrial production probably increased 0.1% in September on a monthly basis, according to expectations, after in August compared to July output dropped at a pace of 1.99%. Annualized production expanded 7.38% in August, following four months of contraction, while this has been the fastest annual rate of increase since December 2013, when output climbed 11.33%. The index reflects the change in overall inflation-adjusted value of output in sectors such as manufacturing, mining and utilities. In case the index of output increased more than anticipated, this would have a bullish effect on the shekel. Israels Central Bureau of Statistics is to release the official numbers at 11:00 GMT.

Pivot Points

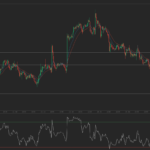

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 3.8396. In case USD/ILS manages to breach the first resistance level at 3.8572, it will probably continue up to test 3.8704. In case the second key resistance is broken, the pair will probably attempt to advance to 3.8880.

If USD/ILS manages to breach the first key support at 3.8264, it will probably continue to slide and test 3.8088. With this second key support broken, the movement to the downside will probably continue to 3.7956.

The mid-Pivot levels for today are as follows: M1 – 3.8022, M2 – 3.8176, M3 – 3.8330, M4 – 3.8484, M5 – 3.8638, M6 – 3.8792.

In weekly terms, the central pivot point is at 3.8024. The three key resistance levels are as follows: R1 – 3.8406, R2 – 3.8685, R3 – 3.9067. The three key support levels are: S1 – 3.7745, S2 – 3.7363, S3 – 3.7084.