Gold retreated from nine-week highs on expectation Federal Reserve will scale back its stimulus at the upcoming FOMCs meeting. Reduced physical demand from China weighed on prices, while assets in the SPDR Gold Trust, the biggest bullion-backed ETF remained close to a 5-year low, adding to bearish sentiment.

Gold retreated from nine-week highs on expectation Federal Reserve will scale back its stimulus at the upcoming FOMCs meeting. Reduced physical demand from China weighed on prices, while assets in the SPDR Gold Trust, the biggest bullion-backed ETF remained close to a 5-year low, adding to bearish sentiment.

On the Comex division of the New York Mercantile Exchange, gold futures for settlement in April traded at $1 256.50 per troy ounce by 07:47 GMT, losing 0.55% for the day. Prices touched a session high at $1 260.80, while day’s low was touched at $1 255.70 an ounce. Yesterday prices touched $1 276.70, the strongest level since November 19th.

Gold futures settled last 5-day period 1.3% higher, capping a fifth consecutive week of gains, the longest rally since September 2012. However, the precious metal settled last year 28% lower, the steepest annual decline since 1981 as investors lost faith in the metal as a store of value and amid speculation Fed will continue scaling back its monetary stimulus throughout 2014.

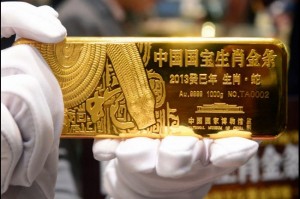

Chinese demand

Even though on the Shanghai Gold Exchange, trading volumes for bullion of 99.99 percent purity exceeded the daily average of the fourth quarter, which was about 11 525 kilograms, every day since January 6th, data revealed that they declined for a second day yesterday.

According to data by the World Gold Council, China probably overtook India as the largest global consumer in the previous year.

Fed stimulus outlook

“Gold could be under pressure in the wake of the Fed move,” said Edward Meir, an analyst at INTL FCStone in New York, cited by Bloomberg. “Although an additional taper of $10 billion is widely expected, much will ride on the statement’s policy wording and tone.”

A batch of downbeat US reports did little to change the overall market consensus that Fed will continue tapering throughout 2014.

Data released on Thursday, showed the Chicago Federal National Activity Index unexpectedly declined to 0.16 in January, defying analysts’ estimates of an increase to 0.90. In December the index stood at 0.69.

A separate report by the US Department of Labor revealed the number of continuing jobless claims unexpectedly increased to 3.056 million from 3.022 million in the previous week. Analysts had expected the number of Americans who continue to receive unemployment benefits will decrease to 2.930 million.

The National Association of Realtors reported that the number of existing home sales increased to annualized 4.87 million in December after a downward revision of November’s sales to 4.82 million. However, analysts had projected that the sales of existing homes in the US will reach 4.94 million.

Central bank’s policy makers said on December 18th that they will reduce monthly asset purchases to $75 billion from $85 billion, underscoring improving labor market conditions.

The central bank will probably continue to pare stimulus by $10 billion at each policy meeting before exiting the program in December, according to a Bloomberg News survey of 41 economists, conducted on January 10th. The Federal Open Market Committee is scheduled to meet next on January 28-29.

Assets in the SPDR Gold Trust, the biggest bullion-backed ETP, remained at 790.46 tons, after being reduced by 0.7% on Wednesday, the biggest one-day drop since December 23rd. The fund has lost 41% of its holdings in 2013. A total of 553 tons has been withdrawn in 2013. Billionaire hedge-fund manager John Paulson who holds the biggest stake in the SPDR Gold Trust told clients on November 20 that he wouldn’t invest more money in his gold fund because it isn’t clear when inflation will accelerate.