Gold rose to the highest level in August as assets in the SPDR Gold Trust, the biggest bullion-backed ETP, expanded for the first time since June. Meanwhile increased demand for the precious metal in China has put the country back on track to becoming the worlds biggest consumer India, current top consumer, curbed imports to handle a record-high current account deficit. Market players remained wary ahead of this weeks upcoming U.S. economic data, which should provide them a base for speculations when Fed will start tapering its Quantitative Easing program. Silver and platinum rose to the highest since June.

Gold rose to the highest level in August as assets in the SPDR Gold Trust, the biggest bullion-backed ETP, expanded for the first time since June. Meanwhile increased demand for the precious metal in China has put the country back on track to becoming the worlds biggest consumer India, current top consumer, curbed imports to handle a record-high current account deficit. Market players remained wary ahead of this weeks upcoming U.S. economic data, which should provide them a base for speculations when Fed will start tapering its Quantitative Easing program. Silver and platinum rose to the highest since June.

On the Comex division of the New York Mercantile Exchange, gold futures for December delivery traded at $1 327.50 per troy ounce at 8:13 GMT, up 1.17% on the day. Futures held in range between days low at $1 314.30 and high at $1 332.90 an ounce, the highest since the beginning of August. The precious metal rose 0.12% on Friday and settled the week 0.19% higher after declining 1.66% the preceding one.

Gold surged on Monday as assets in the SPDR Gold Trust advanced for the first time since June 10, according to Bloomberg data. Holdings expanded by 1.9 tons to 911.13 tons on August 9 after falling by 439.69 tons through every month this year. The precious metal tumbled 21% so far in 2013 after entering a bear market in April as many private and institutional investors lost faith in it as a storage for wealth and Fed is expected to taper its monetary easing program.

Dominic Schnider, head of commodities research at UBS AG’s wealth-management unit in Singapore, said for Bloomberg today: “What we need to maintain the current gold price level is actually inflows. What’s really saved us so far on the consumer side in emerging markets has been China.” He predicted gold will fall further in the next three to six months.

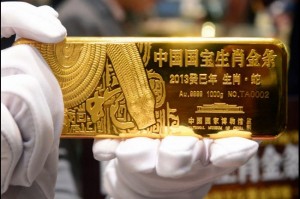

Chinese gold demand surges

Chinas gold consumption surged 54% in the first half of the year, putting the country back on track to becoming the worlds biggest bullion consumer. Current leader is India but the country is expected to curb imports to below 845 tons this year as a measure to handle its record-high current account deficit, which widened after frenzied buying of gold following Aprils steep price slump.

The China Gold Association said today that consumption rose by 54% to 706.36 tons in the first half of the year, marking a significant advance after the first quarters 26% jump. Bullion purchases rose by 87% to 278.81 tons, while jewelry surged 44% to 383.36 tons.

Zhang Wei, an analyst at Zhaojin Futures Co. in Zhaoyuan, said for Bloomberg: “China may overtake India as the biggest consumer as early as this year. Demand in China has great potential to improve further as the country encourages private sector holdings.”

QE outlook

Gold gains however remain limited as many analysts expect Fed to start tapering its bond purchasing program as early as September. Gold has lost 21% this year amid expectation for an earlier-than-expected deceleration of Quantitative Easing. The metal is used mainly as a hedge against inflation, which accelerates when a central bank eases money supply. An exit from a program such as Quantitative Easing would deliver a heavy blow to gold’s price as its demand will crumble. According to a Bloomberg survey of analysts last month, fifty percent of the 54 economists expect Fed to taper its Quantitative Easing program in September.

Market players will be closely watching for the upcoming U.S. data to gauge the economy’s recovery pace and speculate whether the Federal Reserve will begin winding down its massive bond purchasing program. July’s Retail Sales are due on Tuesday and are expected to have advanced by 0.3%, compared to a 0.4% jump in the preceding month. Import prices are projected to have outdone the previous period both on annual and monthly basis. On Wednesday, producer prices (Producer Price Index) will likely show a slower advance than the preceding period both year-on-year and month-on-month. Thursday’s consumer inflation (CPI) should have advanced by 0.2% compared to June and 2.0% from a year earlier. Industrial Production is expected to have surged 0.3%, marking the same advance as in June. Both of Friday’s Building Permits and Housing Starts are projected to have advanced last month.

Elsewhere on the precious metals market, silver and platinum touched their highest levels since June, while palladium advanced to the highest since the last week of July. Silver for September delivery rose to $20.845 an ounce at 8:09 GMT, up 2.15% on the day. Futures held in range between days low at $20.625 and high of $21.245 per ounce, the highest since June 19. Meanwhile, platinum October futures retreated to $1 498.70 an ounce at 8:11 GMT, down 0.13% on the day. The metal rose to $1 510.65 earlier in the day, the strongest level since June 6, while days low stood at $1 498.05. Palladium for September delivery traded at $743.10 an ounce at 8:12 GMT, marking a 0.28% daily advance. Prices held in range between days low at $740.50 and high of $747.00, the highest since July 24.